Model that predicts 1,300% Bitcoin price rally after halving “fortified” by new report

Model that predicts 1,300% Bitcoin price rally after halving “fortified” by new report Model that predicts 1,300% Bitcoin price rally after halving “fortified” by new report

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

If you have followed the Bitcoin market for any stretch of time, you likely know of PlanB, a pseudonymous quantitative analyst that has garnered immense clout in the crypto-asset space. His claim to fame is an econometric model predicting a $100,000 Bitcoin price in the coming years.

While many have laughed off this predicted price as pure “hopium,” there are signs that model holds water, so to say, with a report confirming that the model is not a coincidence.

What’s PlanB’s Bitcoin price model?

First, a bit of background: in March 2019, a pseudonymous analyst named PlanB released an article entitled “Modelling Bitcoin’s Value with Scarcity.”

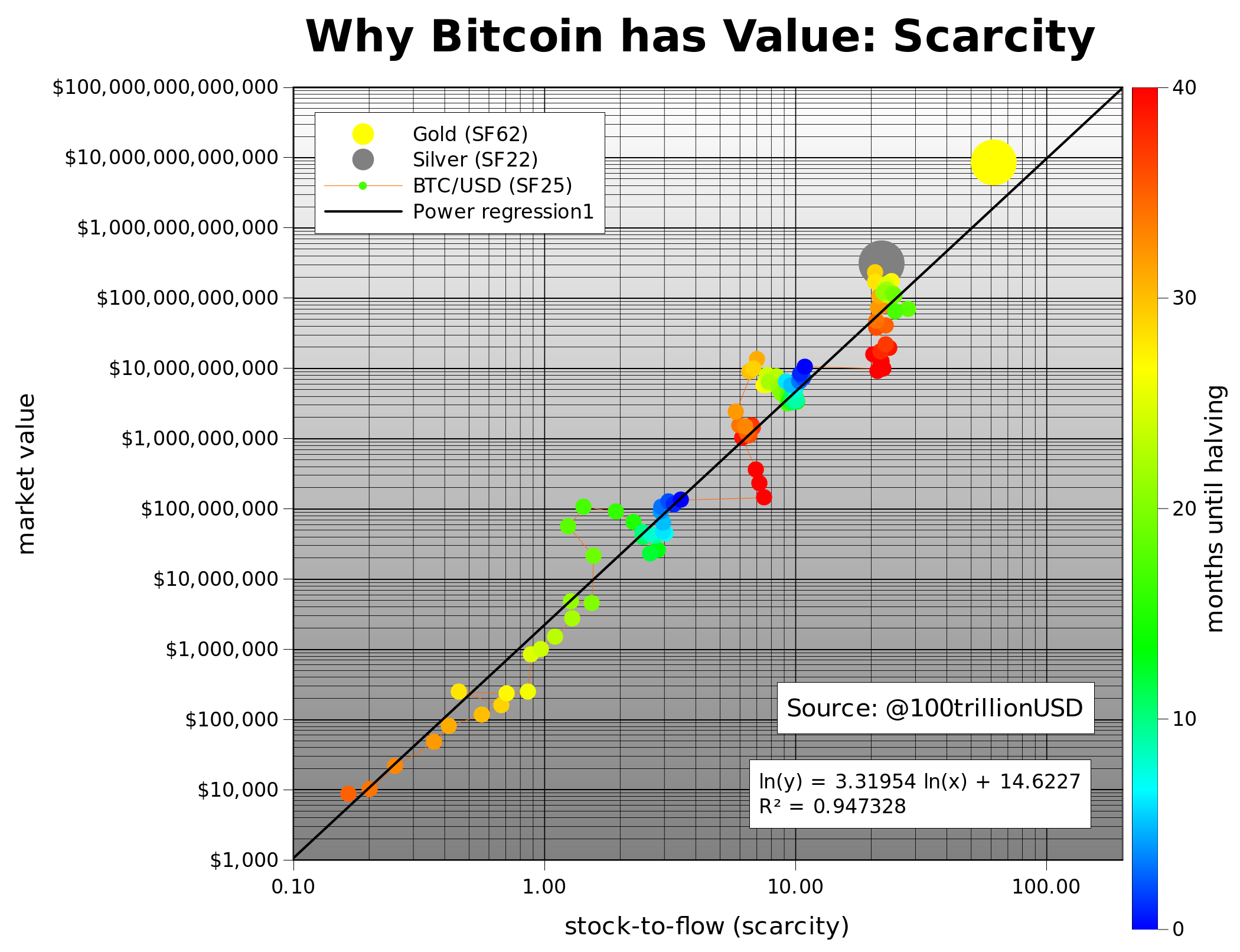

The meat of the work came down to the below image shared near the end, showing that Bitcoin’s scarcity — apparently best represented by the ratio between its above-ground supply and yearly inflation rate, the so-called stock-to-flow ratio — is correlated with the network value of the asset.

In fact, PlanB found that per his logarithmic regression, Bitcoin’s value exponentially increases the more scarce BTC gets. The model, for instance, predicts that after the May 2020 block reward halving, the fair value of the Bitcoin network will rise to $1 trillion to $2 trillion, which is about $55,000 to $110,000 per coin.

What’s especially interesting about the regression is that as of PlanB’s original iteration, it has an R squared of 94.7 percent.

Report corroborates model

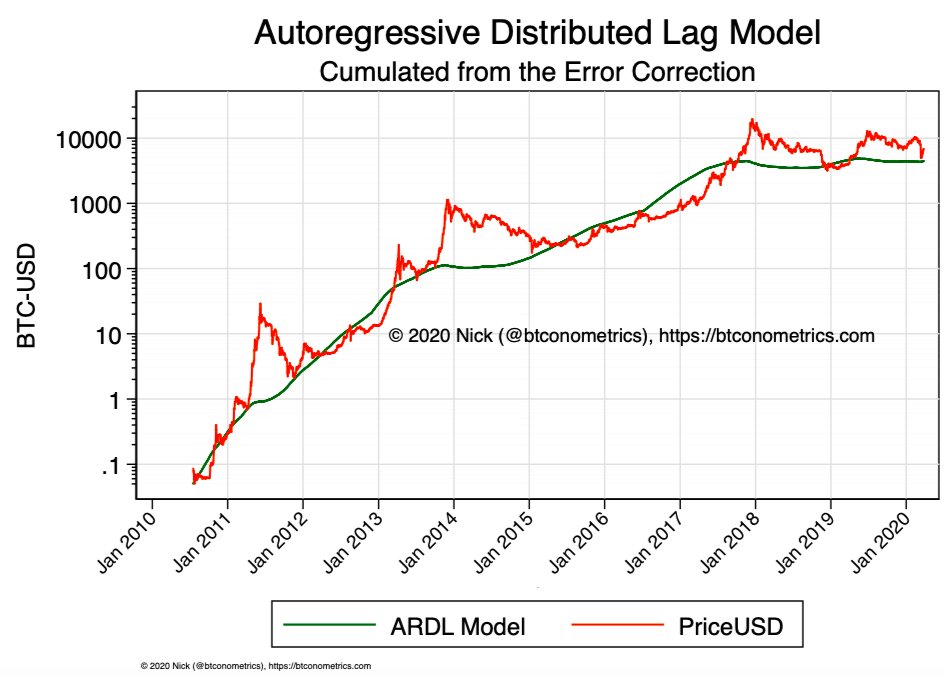

Although already proven to be historically accurate through the R squared, the model gained even more weight just recently, with reports confirming that the regression model relationship between Bitcoin’s scarcity and its price is “not spurious.”

Sharing the reports in an extensive thread, a Twitter user going by “Dilution Proof” went as far as to say the “staggering” reports “fortify” the model.

The reports, of which there are many, used multiple methods of statistical analysis to determine that the model objectively is cointegrated with the price of Bitcoin, rather than it tracing BTC by pure coincidence. As an analyst confirmed in the reports:

“All of them fail to reject the hypothesis that stock-to-flow is an important non-spurious predictor for the value of Bitcoin. […] We can see stock to flow has a significant long run influence on price.”

Importantly, the report concluded that the model has a long-term impact, meaning that BItcoin will not rally to $100,000 immediately after the halving transpires next month.

Despite the evidence corroborating the model, Dilution Proof’s thread actually sparked discourse around the model yet again, with one commentator remarking that the model still makes no sense as the halvings are a sample size of two. That comment has since been deleted.

Farside Investors

Farside Investors

CoinGlass

CoinGlass