Stock futures are dropping again, suggesting Bitcoin may see another drop

Stock futures are dropping again, suggesting Bitcoin may see another drop Stock futures are dropping again, suggesting Bitcoin may see another drop

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The U.S. stock market rebounded today following yesterday’s unprecedented selloff, with all of the major indices climbing over five percent today. This led Bitcoin and the aggregated crypto market to follow suit, with BTC and most other altcoins posting decent gains over the past 24-hours.

This ongoing rebound may be short-lived, however, as the benchmark indices’ futures seem to point to tomorrow being yet another bloody day, with the massive economic impacts of the Coronavirus beginning to mount within the U.S. as most major cities go on lock-down.

This has led analysts to note that the days ahead will also likely be rough for Bitcoin and the crypto market, with one top trader noting that BTC could soon revisit its key support at $3,800.

Stock futures decline following today’s rebound, suggesting the crypto market will soon selloff

Today the major benchmark indices all were able to climb over five percent, which allowed them to erase a portion of the massive losses seen yesterday.

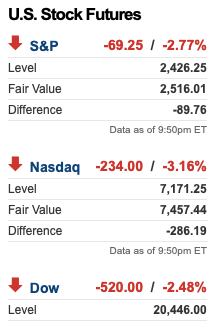

Despite this climb, it doesn’t appear that the stock market is ready to begin a sustainable reversal anytime soon, as the futures market has declined nearly three percent so far – with the Dow trading down 2.5 percent while the S&P 500 and Nasdaq have both declined roughly three percent.

This hasn’t seemed to phase the crypto market yet, as Bitcoin is still trading up two percent over a 24-hour period, while Ethereum and most other major altcoins have been able to post marginal gains.

A top trader claims Bitcoin likely to decline towards $3,800 in days ahead

Although crypto investors may be waiting to see how the stock market opens tomorrow before making any trading decisions, it is highly probable that BTC will continue tracking the traditional markets for the time being.

This has led Satoshi Flipper – a top crypto trader with a track record of accuracy – to tell his followers that he believes BTC could be positioned to make a sharp movement to $3,800 in the near-term.

“Taking this BTC short because the setup is too good and it’s a good hedge against my spot altcoin long positions. Shorting the resistance trend line of this bearish pennant that has formed now (sym triangle).”

This potential decline would cause the entire crypto market to selloff in tandem with BTC, meaning that a further extension of the market’s intense downtrend could be imminent.

Bitcoin Market Data

At the time of press 10:05 am UTC on Mar. 18, 2020, Bitcoin is ranked #1 by market cap and the price is down 2.45% over the past 24 hours. Bitcoin has a market capitalization of $94.25 billion with a 24-hour trading volume of $36.22 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 10:05 am UTC on Mar. 18, 2020, the total crypto market is valued at at $148.32 billion with a 24-hour volume of $112.72 billion. Bitcoin dominance is currently at 63.63%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass