4 reasons why analysts are still bullish on Bitcoin despite brutal 15% crash

4 reasons why analysts are still bullish on Bitcoin despite brutal 15% crash 4 reasons why analysts are still bullish on Bitcoin despite brutal 15% crash

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

To put it lightly, Bitcoin has not fared well over the past weeks. The price of the leading cryptocurrency, ever since rejecting the key $10,500 resistance as if it was a stone wall, has acted weak, losing support and support.

After two weeks of bearish price action — punctuated by a steep drawdown over the past three days that took Bitcoin from $10,000 to as low as $8,520 — it should come as no surprise that investors are once again fearing a return to a bear market.

Though, a number of analysts are still optimistic, touting an array of fundamental and technical reasons as to why they think Bitcoin has an upward trajectory in the coming months.

Reason #1: Macro support to be found around $8,500

While Bitcoin is still dramatically lower than it was just days ago, it decisively bounced off the $8,500 support (depicted below) and is now trading at $8,925 as buyers have stepped in at the eleventh hour.

This relatively strong bounce has been seen as bullish by a number of analysts; at and around $8,500 there exists a confluence of macro supports and key technical supports, meaning a reversal in this region supports the bull case.

Filb Filb, the pseudonymous crypto trader that predicted Bitcoin would bottom in the mid-$6,000s and would subsequently reverse into the $9,000s in the start of 2020, explained this further when he listed out the five key support levels around $8,500:

- 200-day simple moving average at $8789

- The point of control of the whole move at $8600

- The 50 percent Fibonacci retracement level

- The 20- and 50-week moving average at c.$8500

- The CME gap.

Reason #2: Emission shock of Bitcoin halving is just months away

Even if Bitcoin doesn’t find support at $8,500, the block reward halving — a once-every-four-years event that sees the amount of BTC issued per block get cut in half — is rapidly approaching; current estimates suggest the halving will activate at the start of May 2020.

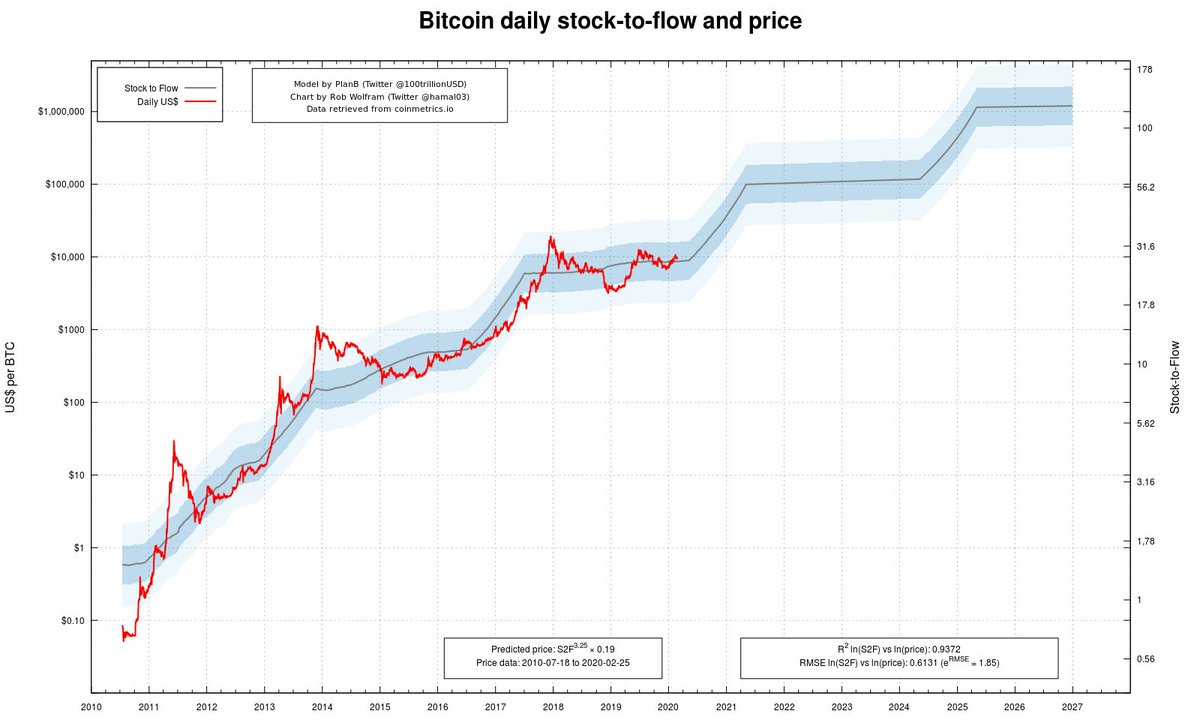

The so-called “stock-to-flow” price model made by PlanB, a pseudonymous quantitative analyst that works for a European institution, suggests that scarcity is closely linked with BTC’s market value.

The May halving, the model suggests, will imbue Bitcoin with a fair value somewhere around $100,000 — over 1,000 percent above the current market price of the asset.

As crazy as this sounds, PlanB has found that the model is accurate to an R squared of 0.9372, which suggests that the relation between Bitcoin’s scarcity and its market price is anything but a coincidence.

This makes sense from a numbers perspective; if the amount of BTC inflation decreases and the amount of demand stays the same or increases, prices should naturally trend higher.

Reason #3: Retail interest is increasing

Data shows that retail interest in cryptocurrency is on the rise — something that aided Bitcoin’s rally from $1,000 to $20,000 in 2017.

CryptoSlate compiled the four key reasons to back this assertion in a previous report, though the summary of them are as follows:

- Demand for Grayscale’s Bitcoin Trust (GBTC), a relatively easy way for the American public to get exposed to cryptocurrency, has increased, evidenced by volumes on OTC markets.

- Volume on Coinbase has increased over the past two months. Coinbase has long been seen as the home of retail crypto investors.

- Google Trends for certain terms like “Buy Bitcoin” and “halving” have started to trend higher.

- Mainstream media are starting to cover cryptocurrency once again.

Reason #4: central banks continue to prove Bitcoin’s value

From a perspective of pure macro fundamentals, central banks continue to lower their policy interest rates and participate in open market operations.

Many prominent market commentators — from CNBC “Fast Money” anchors and a chief correspondent of the Financial Times to cryptocurrency analysts and macro investors — think this trend where money is easy to come by, enabled by low-interest rates, will boost demand for provably scarce assets, like gold and Bitcoin.

CoinGlass

CoinGlass

Farside Investors

Farside Investors