Could Litecoin overtake XRP before the halving?

Could Litecoin overtake XRP before the halving? Could Litecoin overtake XRP before the halving?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Litecoin has been surging amid the upcoming block rewards reduction. LTC’s market capitalization recently increased by $2 billion leaving Bitcoin Cash behind. Now, as the bullish trend continues the question is, “will LTC flip XRP?”

The Halving Event

Fifty-five days from today, at exactly block 1,680,000, Litecoin will go through a fixed process called halving that reduces the rewards miners get for mining a block, which in turn reduces its rate of issuance. Miners, who are currently being awarded 25 new LTC for every block they solve will only be rewarded with 12.5 LTC per block after the event.

Litecoin block halving is in 56 days! https://t.co/EBWbsIUp47

Here are some stats on mining profitability. After halving, miners are still profitable with electricity under 10¢. Many are paying only 5¢ and therefore should keep mining LTC post-halving. (https://t.co/AcQPEjdNtb) pic.twitter.com/VtA9aAv7FS

— Charlie Lee [LTC⚡] (@SatoshiLite) June 10, 2019

As the date approaches, Litecoin’s market valuation has been increasing, leading investors to believe that there is a correlation between the two.

Since the low of Dec. 14, 2018, when LTC was trading at around $22, it went up 480 percent to reach a high of $130 on July 10.

The @Litecoin $LTC halvening is now approximately less than 2 months away.

In the past 6 months, coupled with a hashrate increase of over 150%, LTC has gained over 380% in USD from a low of $22.32.

Despite the nearly 4x in price, mining profitability is only up by 125%. pic.twitter.com/PbuVz6q5Sb

— Binance Research (@BinanceResearch) June 6, 2019

According to Charles Hayter, co-founder and CEO of CryptoCompare, the recent surge can be attributed to the upcoming block rewards reduction.

“The halving is acting as a price catalyst.”

Similar behavior was perceived in the previous and only halving event that Litecoin has had since it went live on Oct. 13, 2011. The block reward reduction took place on Aug. 26, 2015, at a block height of 840,000 dropping the mining reward from 50 LTC per block to 25 LTC.

Following a consolidation phase that lasted more than a month, from Apr. 13 to May 21, 2015, where LTC was trading between $1.35 and $1.5, the price finally broke out on May 22, 2015. In a matter of 48 days, Litecoin skyrocketed from $1.46 to $8.97, which represented a 513 percent move.

After reaching its peak on July 9, 2015, one and a half months prior the halving, LTC went back down 76.24 percent to trade at $2.4 just one day before the event. Litecoin more or less spent the following months staggering between $2.87 and $3.24.

Market sentiment

Even though Litecoin saw a significant correction in its market valuation after rising more than 500 percent prior to the 2015 halving, the market seems to have forgotten about it and higher highs are expected to come.

Joe DiPasquale, CEO of BitBull Capital, pointed out the $120 resistance level could have impeded Litecoin from surging higher, but now that it has surpassed that price point twice, the bullish impulse is likely to continue.

“With LTC trading around $125, we can expect a steady rise towards $150 with some normal pullbacks along the way.”

In addition, Luke Martin, a technical analyst, explained that LTC has the potential to go “higher than the recent upswing” as the halving event nears.

I was sleeping on the $LTC halvening being only 60 days away now.

Price is up 5% today breaking out of consolidation. I think it could go higher than the most recent .0182 swing high.

Props to @ThinkingUSD & @trader1sz remember seeing them on it early. pic.twitter.com/f6RyLNXj99

— Luke Martin (@VentureCoinist) June 6, 2019

Mati Greenspan, senior market analyst at eToro, and a popular Twitter analyst under the pseudonym of The Crypto Dog believe that this cryptocurrency has been leading the recent bull run in the market and will keep diverging into the bullish side.

#Litecoin is in it's own market and will deviate to the more bullish side of things on each macro $crypto move into the halvening.

This is a powerfully easy catalyst to trade, given a little patience.

To me, $LTC / $BTC is a clear buy the dip opportunity to at least .02.

— The Crypto Dog? (@TheCryptoDog) June 9, 2019

As Litecoin continues outperforming the majority of crypto assets, it has managed to climb up the market capitalization ladder and position itself at number four just below Bitcoin, Ethereum, and XRP.

Financial Survivalism, a cryptocurrency analyst, revealed that LTC could peak by doubling its price just a few days before the halvening event, which could allow it to flip over XRP. But, is a 100 percent surge from current levels possible?

$LTCBTC peaked days after $LTC halved in 2015. It proceed to selloff leading up to and following the $BTC halving. I think we will see similar price action in 19-20. If so then #LTCBTC would return to the top of the channel over the next couple months before retesting ~0.011. pic.twitter.com/vXz5KcuE2k

— Financial Survivalism (@Sawcruhteez) June 8, 2019

Litecoin Technical Analysis

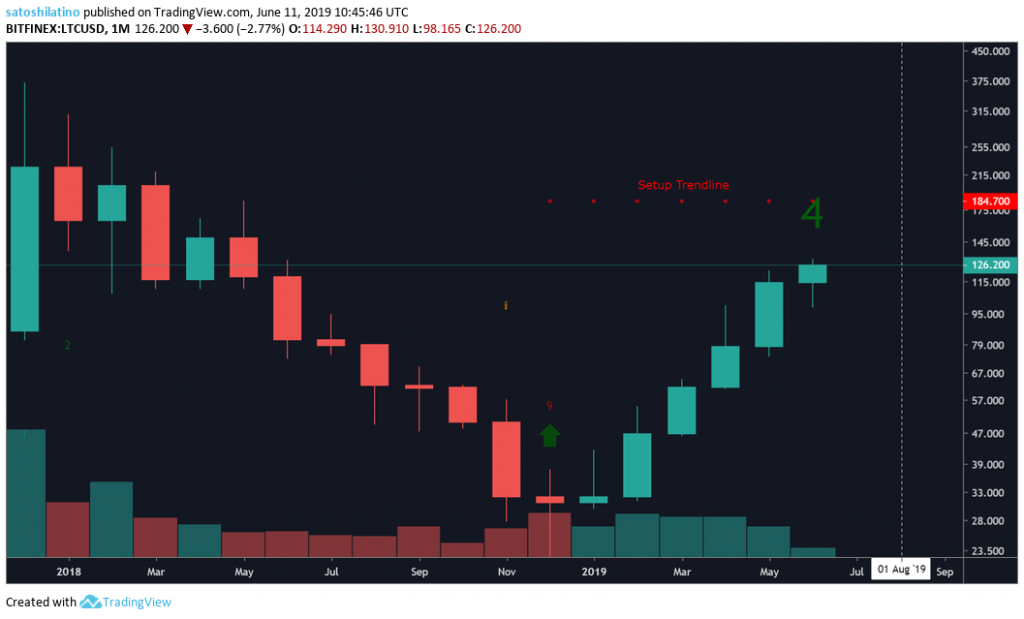

On the 1-month chart, the TD Sequential Indicator is on green four candlestick out of nine, signaling that there is potential for another five months of upward movement. If Litecoin is able to trade above the setup trendline that currently sits at $184.7, the continuation of the bullish trend will be confirmed adding credibility to the “flippening.”

A series of support and resistance levels based on historical data can be drawn on the 1-week chart. These price points have acted as barriers, preventing the price action of LTC from getting pushed up or down.

At the moment, Litecoin is trading above the $115 support level. In order to double in price, LTC will have to remain above support and break through the following levels of resistance: $147.5, $184.5 and $225.5.

Litecoin has been trading inside an ascending parallel channel on the 1-day chart that formed in mid-December 2018.

Currently, it has found strong resistance given by the middle line of the channel. A bullish impulse that allows LTC to move above current levels could take it a step closer to overtake XRP.

As long as Litecoin stays above $100, the upward momentum will continue, but a break below this level could trigger a significant correction down to $70–$60.

The “flippening”

If the bullish trend continues, Litecoin could double in prices as detailed in the previous analysis. Nonetheless, for the “flippening” to happen XRP will have to remain under the current price levels or suffer a significant drop in market valuation while LTC keeps going up.

According to a cryptocurrency analyst under the pseudonym Galaxy, there is a chance for XRP to retrace to the May 13 low of 40,250 satoshis to form a double bottom pattern before it increases in value.

A similar point was raised by another technical analyst, Sir Gordon Gecko, who compared the current timeframe to December 2017, implying that XRP could drop down to $0.33 and will be followed by a massive upswing.

@mrlevelup we got it here we go! $xrp pic.twitter.com/2YwpEKYQg3

— Sir Gordon Gekko (@gordongekko369) June 9, 2019

If XRP indeed drops to $0.33 its market capitalization will also drop to $14 billion. Under this theory, Litecoin will have to be trading above $225 in order to overtake XRP. Although there could be a “flippening” between LTC and XRP, both scenarios presented suggest that XRP could soon experience a massive upswing despite any short-lived pullbacks.

Adding to the bullishness, Ripple, the firm behind XRP, announced that it will be opening an office in Brazil that intends to bring more clients to its payment network RippleNet, targeting the entire South American region.

“We’re excited to grow our ecosystem in the region and bring additional financial institutions onto RippleNet to help provide excellent, efficient cross-border payment experiences for their customers. Brazil is a leader in fintech innovation and positioned to forge a path for the rest of South America to follow,” said Luiz Antonio Sacco, managing director at Ripple South America.

XRP Technical Analysis

XRP is on a green two candlestick, per the TD Sequential Indicator. A buy signal will be given once and if the current monthly candlestick is able to trade above the previous one at $0.44.

A bullish crossover occurred on the 1-week chart between the 7-week moving average and the 30 and 50-week moving average. A bull trend, given by the moving averages, will be confirmed when the 30-week MA is also able to move on top of the 50-week MA.

These weekly moving averages can also be used as support levels, indicating that if XRP retraces from its current market valuation the fall could be held by the 30-week MA that sits around $0.34.

On the 1-day chart, there are two major bullish patterns developing that could predict a rally on the horizon.

First, a bull flag formed forecasting a 33.5 percent upward move, if validated. The target is given by the height of the flagpole, which indicates that XRP could rise up to $0.54.

Second, there was a golden cross between the 50 and 200-day moving average signaling a potential bullish breakout. Many investors see this pattern as one of the most definitive and strong buy signals that could start a long-term bull market.

Will LTC flip XRP?

Under the current market conditions, it seems unlikely that Litecoin will overtake XRP to position itself as the number three cryptocurrency based on market capitalization.

The only way that can happen is if LTC enters an extremely speculative period of volatility as its halving approaches while XRP’s price drops.

Even though the positive sentiment around LTC seems to be increasing, the halving could actually be seen as a ‘take profit’ point for many investors, which could significantly drop its market valuation, as it happened in the last block rewards reduction.

In addition, XRP could be about to go through a rally that will increase its market capitalization making it harder for Litecoin to surpass it. The market valuation of XRP has been oppressed for an extended period of time, which is part of its characteristic behavior, increasing the probability for a strong upswing.

It will be wise to wait for confirmation of the different perspectives presented before taking a stance on the outlook of the market.

Litecoin Market Data

At the time of press 2:33 am UTC on Nov. 7, 2019, Litecoin is ranked #4 by market cap and the price is up 6.34% over the past 24 hours. Litecoin has a market capitalization of $8.5 billion with a 24-hour trading volume of $5.75 billion. Learn more about Litecoin ›

Crypto Market Summary

At the time of press 2:33 am UTC on Nov. 7, 2019, the total crypto market is valued at at $256.42 billion with a 24-hour volume of $61.74 billion. Bitcoin dominance is currently at 55.36%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass