Cryptocurrency Skeptic Jim Cramer Says Banks are Pressured by Digital Assets

Cryptocurrency Skeptic Jim Cramer Says Banks are Pressured by Digital Assets Cryptocurrency Skeptic Jim Cramer Says Banks are Pressured by Digital Assets

Photo by Jordan Andrews on Unsplash

Throughout 2017 and early 2018, former hedge fund manager and financial analyst on CNBC, Jim Cramer, expressed his skepticism towards Bitcoin and the cryptocurrency market, encouraging investors to be cautious.

This week, on CNBC Mad Money, Cramer emphasized that Bitcoin and PayPal are pressuring banks and major financial institutions already at risk of losing relevance due to the emergence of more efficient alternatives.

Cramer is Positive Cryptocurrency Market Can Challenge Banks

Cramer noted that an increasing number of young fund managers and financial analysts believe banks will eventually be overtaken by Bitcoin, the blockchain, and fintech applications such as PayPal and Twitter CEO Jack Dorsey’s “Square” payment app, as the new generation moves from traditional banking systems to digitalized networks that are cheaper, faster, and more secure.

Cramer said:

“As I wrack my brain, I come up with one plausible — and yes, existential — answer. There are plenty of younger portfolio managers who think the banks are like Sears and J.C. Penney: they’re old-line brick-and-mortar stores that are about to lose their relevance thanks to all sorts of new technologies from bitcoin, blockchain, PayPal [and] Square.”

Previously, Cramer warned investors to be cautious about Bitcoin and the blockchain space. Although Cramer has expressed support of the cryptocurrency market, he stated that the value of cryptocurrencies is questionable.

Cramer explained:

“I’m not denying the crypto world, I’m supporting the crypto world. I think that crypto is great. But I think we have to be a little more careful.”

Fast forward six months, Cramer now believes that the cryptocurrency market can challenge the traditional finance industry with more innovative and efficient systems for transaction settlement that can appeal to millennials. So what changed?

Why is Cramer Now Optimistic?

The cryptocurrency market experienced a 70% drop since its all-time high and assets like Bitcoin, Ethereum, and Bitcoin Cash have fallen by more than 65%. As a former hedge fund manager, it is possible that Cramer, similar to the vast majority of large-scale retail and institutional investors, sees an opportunity to enter the market and is now more comfortable expressing his support for the cryptocurrency market.

In 2018, the cryptocurrency market experienced the eruption of the same bubble it saw in 2014. The bubble of retail investors or individual traders led the market to drop by more than 70%. But, within 12 months, the cryptocurrency market recovered and gradually gained momentum four years ago. The market could replicate a similar trend in late 2018, especially if institutional investors finally enter the market with robust custodian solutions.

Cramer further emphasized:

“Then there are the potentially existential threats that I just mentioned: blockchain, which some people believe could possibly end the banks’ hegemony over stock clearing, and cryptocurrencies, which are the populist insurgents of the blockchain movement. I’m not saying this is the right way to look at banks, but it’s certainly how younger portfolio managers view the group, and they are winning right now judging from where the group is trading.”

The public market also began to demonstrate more optimism towards financial companies that either completed the integration of major cryptocurrencies or plan to enter the cryptocurrency market in the short-term.

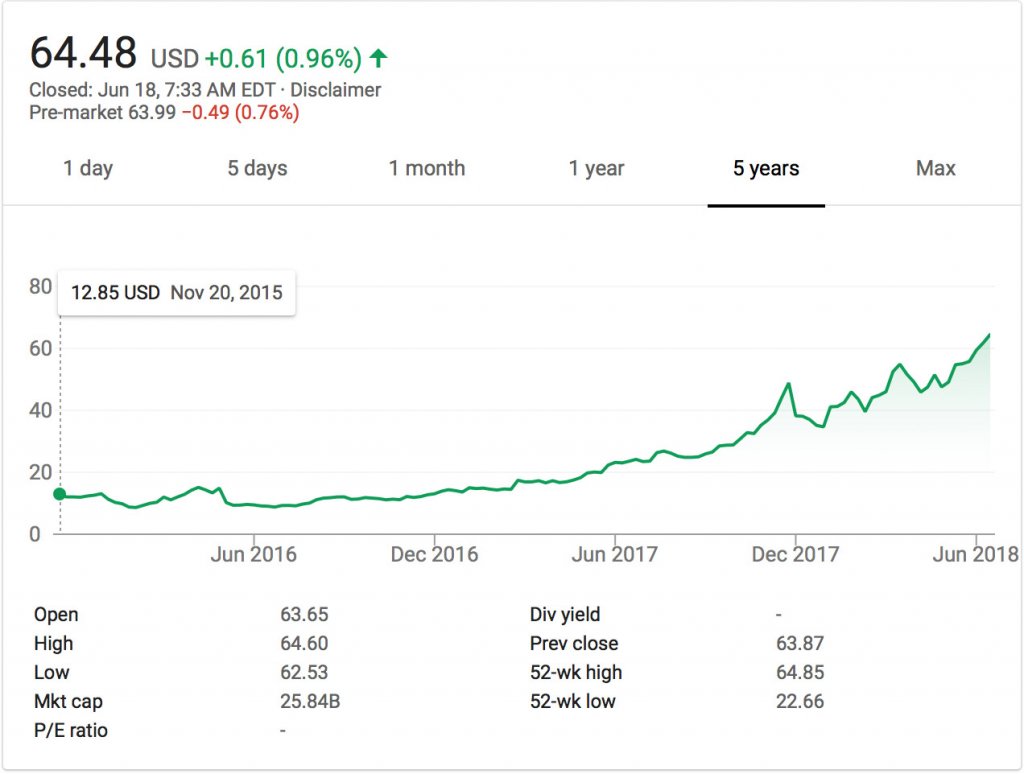

The market valuation of Square, which has been offering Bitcoin exchange services for the past year, increased by 182%, from around $9 billion to $25 billion.