Tether price falters following iFinex investigation, bitcoin moved from Bitfinex

Tether price falters following iFinex investigation, bitcoin moved from Bitfinex Tether price falters following iFinex investigation, bitcoin moved from Bitfinex

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Following a probe which revealed the apparent loss of $850 million in funds, the attorney general of the State of New York obtained a court order against iFinex Inc., which operates Bitfinex and owns Tether Ltd., ordering them to cease further dissipation of the US dollar assets which back the USDT stablecoin.

A $850 Million Cover Up

In a press release the Attorney General revealed that in 2018 iFinex Inc. handed almost a billion dollars without any written contract or assurance over to Crypto Capital Corp., a Panamanian payment processor. The idea was that Crypto Capital was going to handle Bitfinex customers-withdrawal requests. Later on, the Panamanian payment processor lost control of the funds and could no longer process the orders. After acknowledging this, iFinex Inc. failed to inform its investors of the potential losses and engaged in unlawful behavior.

“Our investigation has determined that the operators of the ‘Bitfinex’ trading platform, who also control the ‘tether’ virtual currency, have engaged in a cover-up to hide the apparent loss of $850 million dollars of co-mingled client and corporate funds,” said Attorney General James.

The report disclosed that executives of Bitfinex and Tether dealt with the liquidity shortage in a series of transactions whereby the cryptocurrency exchange gave itself access to up to $900 million of Tether’s cash reserves that were used to back the stablecoin. As stated in the press release:

“Bitfinex has already taken at least $700 million from Tether’s reserves. Those transactions—which also have not been disclosed to investors—treat Tether’s cash reserves as Bitfinex’s corporate slush fund, and are being used to hide Bitfinex’s massive, undisclosed losses and inability to handle customer withdrawals. The Office’s filings further detail how the companies obfuscated the extent and timing of these corporate transactions during the Office’s investigation.”

More alarmingly, the transcript revealed:

“BTC could tank to below 1k if we don’t act quickly.”

When unprocessed withdrawal requests peaked, Bitfinex stated in a Medium post on Oct. 15, 2018, that:

“All cryptocurrency and fiat withdrawals are and have been processing as usual without the slightest interference.”

Fiat deposit update – October 15th, 2018. https://t.co/F8o2ltVCN4 pic.twitter.com/ukE9JsRB0j

— Bitfinex (@bitfinex) October 15, 2018

Internally, the situation was different, as internal transcripts within the company revealed. A conversation between a Bitfinex executive (Merlin) and a Crypto Capital representative (CCC) showed signs the situation was getting out of control. This conversation happened on the same day that they were claiming that all fiat withdrawals were being processed as usual:

“Merlin [15.10.18, 09:53]: I have been telling you since a while.

Merlin [15.10.18, 09:53]: Too many withdrawals waiting for a long time.

Merlin [15.10.18, 09:54]: Is there any way we can get money from you? Tether or any other form? Apart with Crypto Capital we are running low on cash reserves.

Merlin [15.10.18, 09:54]: Please help.

CCC [15.10.18, 18:09:54]: I know. We are following the banks we post as many as we can and let them process as much as possible according to them. Everytime we push them they push back with account closure without reason.

Merlin [15.10.18, 09:55]: Dozens of people are now waiting for a withdrawal out of Crypto Capital.

Merlin [15.10.18, 10:01]: I need to provide customers with precise answers at this point, can’t just kick the can a little more.

Merlin [15.10.18, 10:02]: The international, I mean.

CCC [15.10.18, 10:02]: I will keep you posted here.

CCC [15.10.18, 10:02]: On the process of all international payments.

Merlin [15.10.18, 10:02]: Please understand this could be extremely dangerous for everybody, the entire crypto community.

Merlin [15.10.18, 10:03]: BTC could tank to below 1k if we don’t act quickly.”

Since the ultimate solution to fulfill customers’ withdrawal requests was to combine customer and company funds together and not disclose these actions, iFinex Inc. is now being sued for fraud by the Attorney General of the State of New York, Letitia James. The AG is not seeking to prevent legitimate trading on Bitfinex or redemptions by Tether. Instead, she wants the court to grant a preliminary injunction to “preserve the status quo” pending completion of the investigation, which has now required that the operators of the companies stop moving money from Tether’s reserves to Bitfinex’s bank accounts, halt any dividends or other distributions to executives, and turn over documents and information.

Bitfinex Fires Back

After the court order became public, Bitfinex released a statement on its website, arguing that the $850 million in question were not lost by Crypto Capital, but had been “seized and safeguarded” and it is working to get the money back. The company sustained:

“Both Bitfinex and Tether are financially strong—full stop.”

In addition, the cryptocurrency exchange suggested the attorney general’s filings were “written in bad faith and riddled with false assertions” and characterized them as an overreach. Bitfinex claimed that it had been cooperating with the investigation, and it planned to fight the order.

Notably, two things happened before and after the Attorney General’s press release was issued:

- On Aug. 2, 2016, roughly 119,756 Bitcoins (BTC) were stolen from Bitfinex wallets, just a few hours before a court order obtained against iFinex Inc. became public, 550 of those BTC were moved.

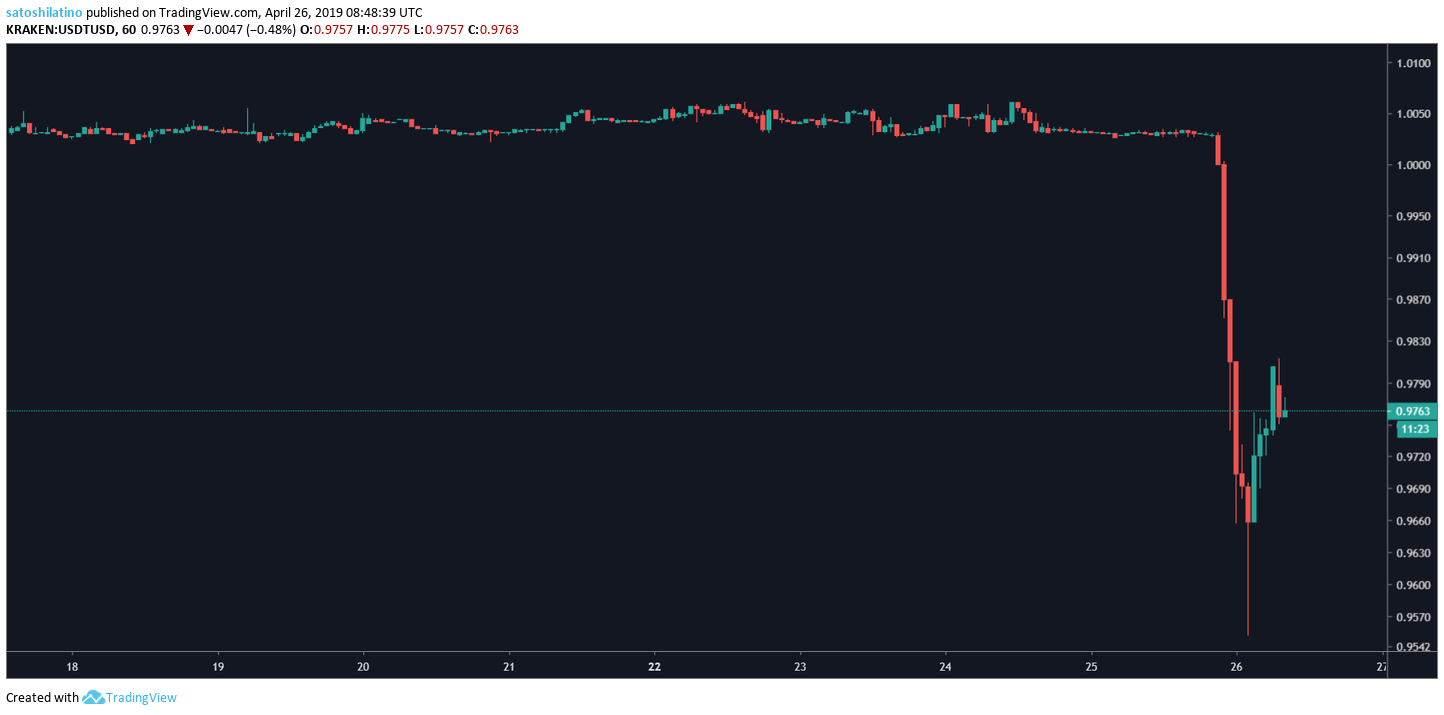

- Right after the news dropped, USDT crashed as low as $0.9551.

It’s still unclear how the loss of funds will impact Tether or Bitfinex. Given the amount of USDT circulating in the cryptocurrency markets, a loss of confidence in the stablecoin could have a material impact on the price of bitcoin.

Tone Vays, a former Wall Street analysts, believes that if Tether blows up there could be short-term panic in the market, but people will then realize that the only way to get out of it will be by quickly spending their Tethers on other cryptocurrencies that they can move out of the exchange.

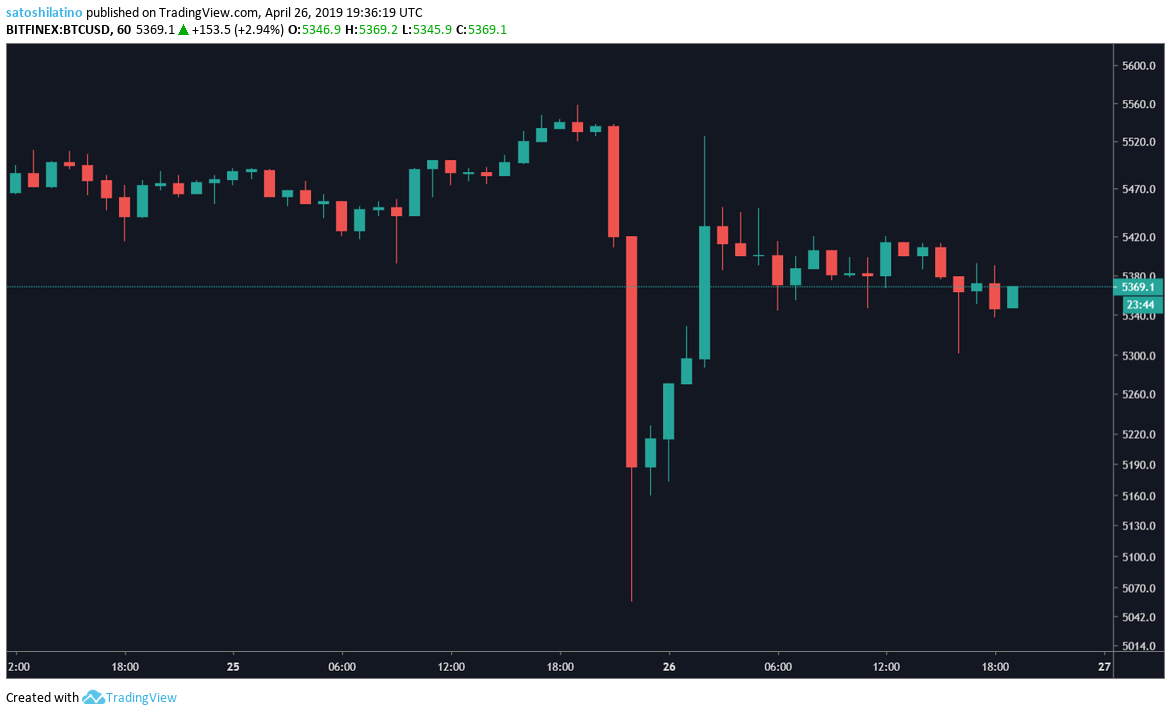

Bitcoin’s hourly chart in Bitfinex adds credibility to Vays’ idea. Around the time when the news dropped, BTC fell approximately $300 before rebounding. Moreover, Jacob Canfield, the co-founder of SignalProfits.com, tweeted that 650,000 Ethereum had been withdrawn from Bitfinex and it was reported that another 3,999 BTC had also been moved off the exchange.

While the investigation continues, the court order barred the operators of Bitfinex from further draining the cash reserves of Tether or taking dividends from the reserves of the companies. The order also compels the companies to produce documents relevant to the investigation, which they have so far “failed” to do so.

Tether USDt Market Data

At the time of press 6:02 am UTC on Nov. 7, 2019, Tether USDt is ranked #8 by market cap and the price is down 0.68% over the past 24 hours. Tether USDt has a market capitalization of $3.1 billion with a 24-hour trading volume of $27.2 billion. Learn more about Tether USDt ›

Crypto Market Summary

At the time of press 6:02 am UTC on Nov. 7, 2019, the total crypto market is valued at at $271.6 billion with a 24-hour volume of $94.7 billion. Bitcoin dominance is currently at 56.79%. Learn more about the crypto market ›

Deribit

Deribit