Will Kava turn the corner after the Kava 9 upgrade?

Will Kava turn the corner after the Kava 9 upgrade? Will Kava turn the corner after the Kava 9 upgrade?

Whereas most DeFi applications are confined within one chain ecosystem, Kava gained popularity as the first major platform to offer cross-chain lending.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

On Dec. 16, Kava held a testnet event for Kava 9, which will test the carrying capacity of the new main network.

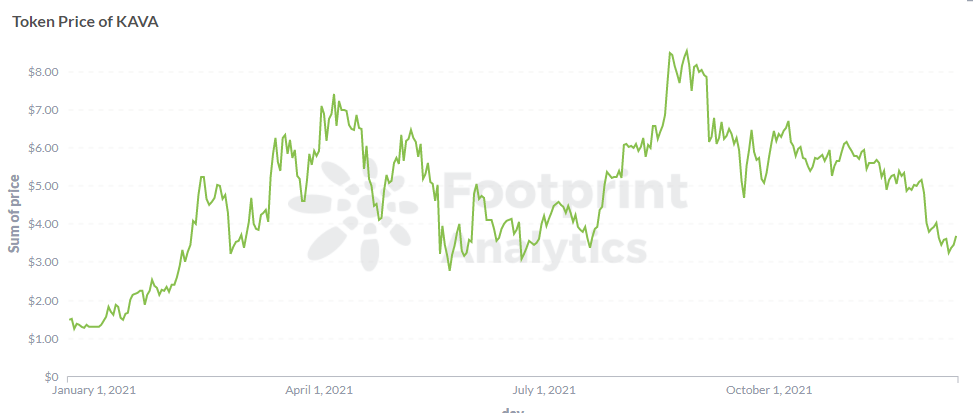

Since the Kava first previewed the mainnet upgrade a month ago, many have been holding their breath to see how it would affect the price of KAVA, as previous testnet events caused its price to rise by up to $8.

The protocol has also been generating interest in the upgrade with a series of partnerships in GameFi, cloud services, security and more.

Ultimately, Kava’s main goal is to attract more developers into its ecosystem—a sticking point for the cross-chain lending protocol whose TVL consists mostly of its own projects.

Will the upgrade succeed in generating the interest needed for Kava to regain its dwindling momentum?

A Short History of Kava

In 2019, Kava launched strongly by winning the Binance Launchpad Project of the Year Award for its potential to shake up the blockchain industry.

Whereas most DeFi applications are confined within one chain ecosystem, Kava gained popularity as the first major platform to offer cross-chain lending.

Both the Kava protocol and its lending platform, the HARD protocol, support the depositing and lending of cross-chain assets. This allows investors to lend, borrow, and deposit cross-chain assets from the Kava ecosystem.

Since 2019, Kava has become a decentralized Layer 1 hub supporting cross-chain DeFi applications and services, providing an accessible and permanent financial services infrastructure for developers.

Key milestones:

- June 11, 2020: Kava 3 mainnet upgrade was completed and the first cross-chain lending platform CDP went live, supporting BNB staking and USDX drawing.

- Oct. 15, 2020: Kava 4 gateway mainnet upgrade was completed, and the cross-chain cryptocurrency marketplace HARD Protocol went live.

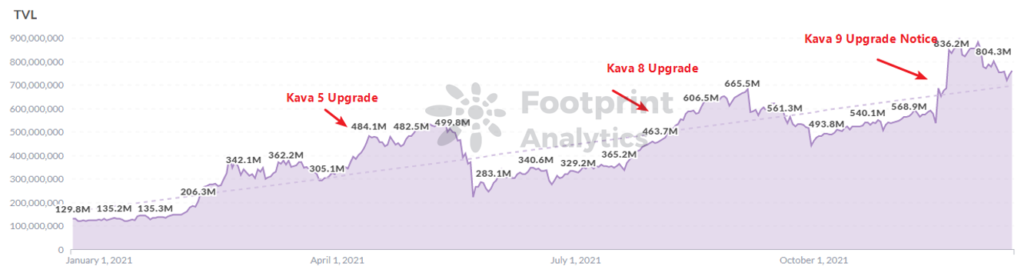

- April 9, 2021, Kava 5 mainnet officially launched.

- Aug. 30, 2021, the Kava DeFi platform completed the upgrade of the Kava 8 mainnet.

- The Kava 9 main network upgrade is expected to go live in the first quarter of 2022.

As we can see from the growth of TVL, Kava TVL grew gradually after each major iteration and upgrade, driving up its token price with it. However, its token price had not maintained the same steady upward trend as its TVL. The current KAVA token price has dropped nearly 60% from its peak since the last iteration.

The reasons become clear when we take a closer look at Kava’s ecosystem protocols and token economy.

Kava’s Ecosystem

Kava has two obvious problems:

- A weak ecosystem mainly held up by Kava’s own suite of protocols

- An unstable token economy

Lack of ecosystem breadth, with TVL supported by Kava protocols

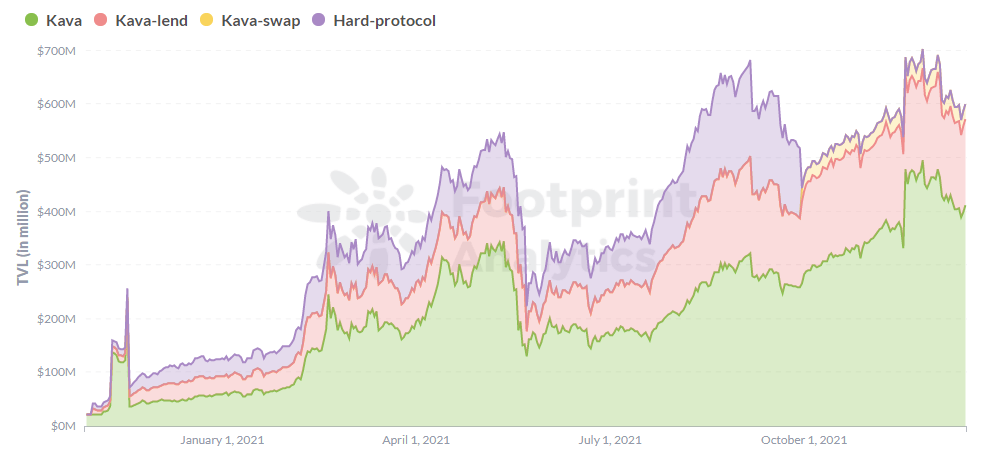

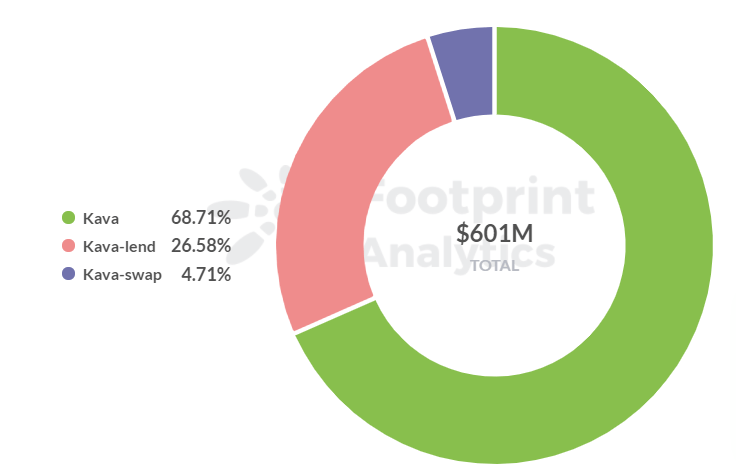

Kava currently consists of 3 main projects:

- Kava Mint, which allows users to use their assets as collateral to obtain USDX.

- Kava Lend, which allows users to earn rewards by offering and borrowing assets from the cryptocurrency market.

- Kava Swap, which allows users to buy and sell tokens on the Kava chain and earn rewards by providing liquidity to the mining pool.

Kava Mint consists of nearly 70% of Kava’s total TVL.

There are not many assets and trading pairs available for lending in the project, and there is a lack of liquidity in the ecosystem, which only revolves around lending and swapping within the Kava ecosystem. Kava Swap, for example, provides a very high APY reward, but its liquidity pool only supports USDX base trading pairs.

Kava Tokens

The price of tokens in the Kava ecosystem has been fluctuating wildly this year.

Let’s have a look at Kava’s stablecoin USDX and its governance token KAVA.

Limited application scenarios for USDX

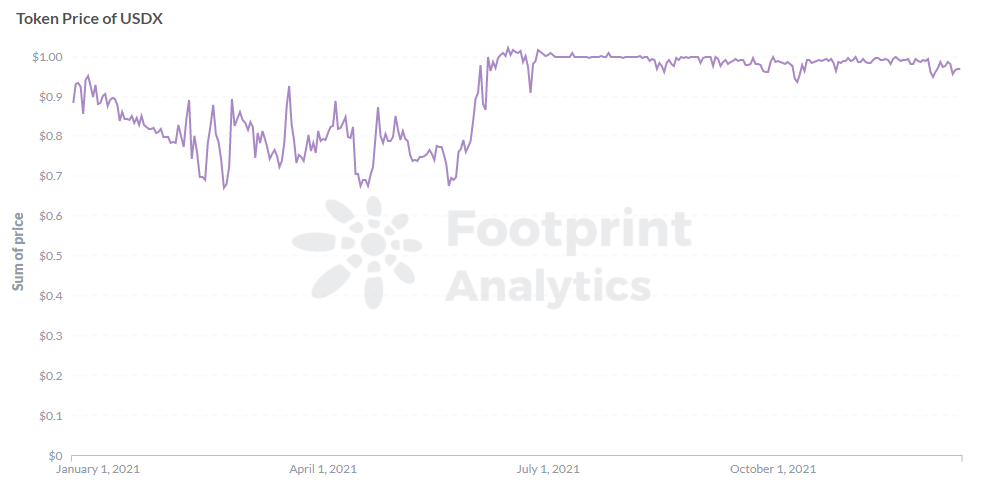

USDX is a stablecoin that’s been notably unstable, mainly due to a lack of application scenarios. Currently, its primary use is pledging on Kava Lending.

USDX’s price has stabilized after the launch of the cross-chain AMM application Kava Swap. Kava is also planning to increase its liquidity and usage scenarios by listing on more exchanges.

Governance token allocation carries sell-off risk

KAVA is the token used to govern the Kava blockchain, while KAVA also acts as the system’s lender of last resort. If there is not enough collateral for the entire system, KAVA is minted to buy back USDX until the system reaches a sufficient amount of collateral again.

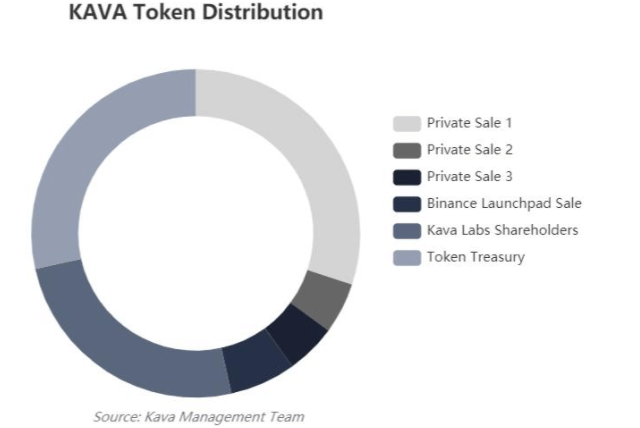

The allocation of KAVA is controversial. 40% of KAVA has been sold in 3 large private sales, making it highly consolidated in a few hands.

Will Kava 9 fix these problems?

One of the biggest highlights of the upcoming Kava 9 upgrade is it will officially enable Inter-Blockchain Communication protocol (IBC), which allows blockchains to talk to each other. This will have two major impacts:

- More inclusiveness: The upgrade will enable all IBC supporting projects and communities to integrate their products with the Kava chain. DeFi projects will have access to multiple functional scenarios in the Kava cross-chain DeFi ecosystem.

- More application scenarios: Given the cross-chain structure of IBC, USDX can be used in DeFi projects of Ether through IBC and become the settlement unit of decentralized exchange. Hence Kava’s token economy is expected to become more stable.

The Kava 9 upgrade also includes the completion of the Ethereum cross-chain bridge, Kava Launchpad, Keplr wallet support, and other infrastructure, all of which set the stage for the Kava ecosystem to grow in the years to come.

While Kava successfully launched a cross-chain solution for DeFi lending, projects in the Kava family alone are not enough to sustain a public chain.

The success of Kava’s ecosystem will subsequently depend on whether it succeeds in attracting developers to deploy projects on the protocol, which the new upgrade might do.

This report was brought to you by Footprint Analytics.

What is Footprint

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Farside Investors

Farside Investors