Why Switzerland’s Biggest Retailer Accepting Bitcoin is Crucial For Adoption

Why Switzerland’s Biggest Retailer Accepting Bitcoin is Crucial For Adoption Why Switzerland’s Biggest Retailer Accepting Bitcoin is Crucial For Adoption

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Digitec Galaxus AG, Switzerland’s biggest online retailer with nearly a billion dollars in annual revenue, has integrated various crypto assets including bitcoin as a payment option.

The announcement, which was first reported by Watson, a major Swiss publication, was later confirmed by the Digitec team through its official blog. A roughly translated statement from Digitec Galaxus co-founder and CIO Oliver Herren read:

“Cryptocurrencies are fascinating and could become a relevant means of payment in e-commerce – we want to support this development. Of course I now count on all the Swiss crypto-millionaires to shop with us.”

Monumental for Merchant Adoption of Bitcoin

Speaking to CryptoSlate in an exclusive interview, Lucas Betschart, the President of Bitcoin Association Switzerland, said that Digitech is reportedly larger than Amazon in the region and is hopeful that other companies in the country will follow the footsteps of Digitec.

“We consider it a big step for merchant adoption in Switzerland,” Betschart told CryptoSlate, emphasizing that it could create a signal for others to accept cryptocurrencies in the near future.

Biggest online shop of Switzerland starts accepting #Bitcoin!https://t.co/MsCFXBk3FL @bitcoin_ch

— Lucas Betschart (@lucas_lclc) March 19, 2019

Betschart further explained that Digitech is a part of a larger conglomerate called Migros, which operates banks, gyms, gas stations, and other physical stores. He said:

“Having a huge local Bitcoin Community (e.g. our Bitcoin Meetup Switzerland is the 5th biggest in the world with 6,500 members) also makes it an attractive market additional to the marketing benefits. Also, Digitec is part of Migros, the biggest retail company in Switzerland, which also owns a bank, the biggest number of gyms, gas stations, etc. Hopefully those will follow.”

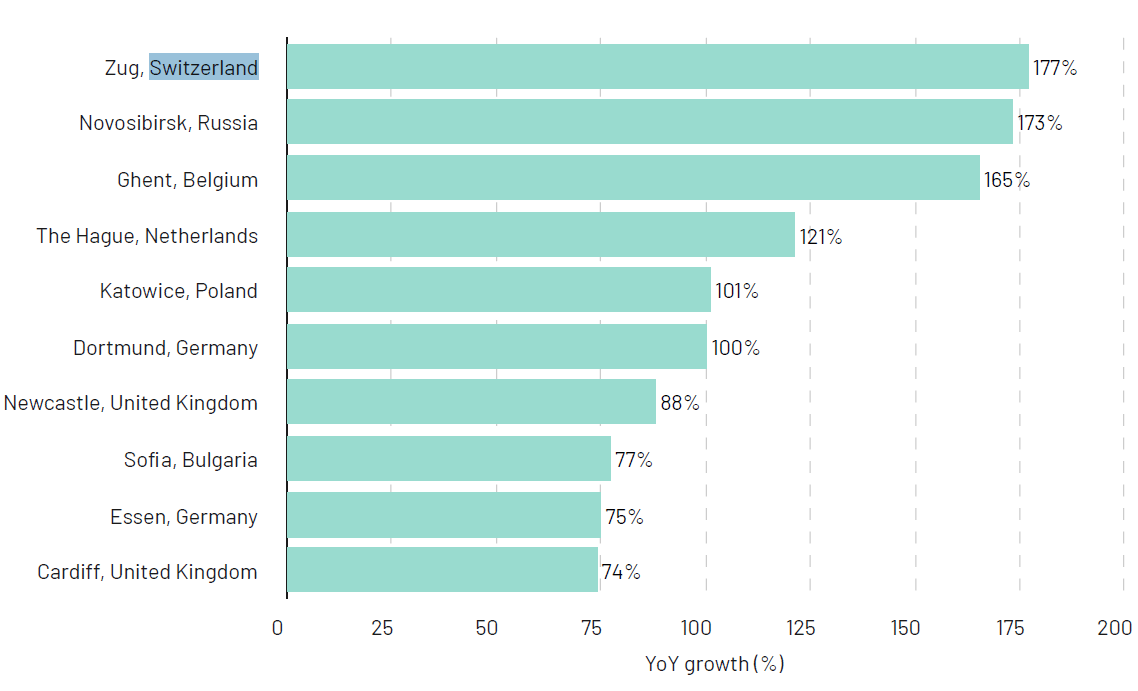

With Zug described as “Crypto Valley,” and as the fastest-growing technology hub in Europe, the initiatives of large-scale corporations who are committing to the cryptocurrency sector could positively affect the long-term growth of the Swiss economy.

Merchant Adoption is Growing Steadily Globally

In January, Rakuten, the biggest e-commerce platform in Japan, officially disclosed its official plans to overhaul the corporate structure of the company. Rakuten laid out its decision to include everybody’s bitcoin Inc., a cryptocurrency exchange it acquired in 2018 reportedly for $2 million, under Rakuten Payment, Inc.

Local analysts suggested that the move could lead the cryptocurrency division of the company to better communicate and directly cooperate with the Rakuten Payment team.

Currently, both major conglomerates and individual merchants have two choices to accept cryptocurrencies: either establish an independent infrastructure to accept crypto assets or work with a third party service provider like an exchange.

In the case of Rakuten, when the company acquired everybody’s bitcoin, strategists said that it was likely to integrate the infrastructure of the exchange to accept cryptocurrency payments in the future.

Apart from Rakuten, Bic Camera—the largest electronics retailer in Japan—has been accepting BTC for many months and in mid-2018, it revealed that it has seen an increase in sales processed by BTC with local users.

“When Bic Camera first installed the Bitcoin payment system in its stores, we expected that the customers paying in Bitcoin would mostly be foreigners. We noticed that Bitcoin was becoming very popular. Then the government announced that Bitcoin was officially legal, so we finally felt more comfortable introducing Bitcoin as a method of payment in our stores,” Masanari Matsumoto, Bic Camera’s PR and IR Chief, told Bitcoin.com.