Why Bitcoin analysts are expecting weeks of consolidation or correction

Why Bitcoin analysts are expecting weeks of consolidation or correction Why Bitcoin analysts are expecting weeks of consolidation or correction

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

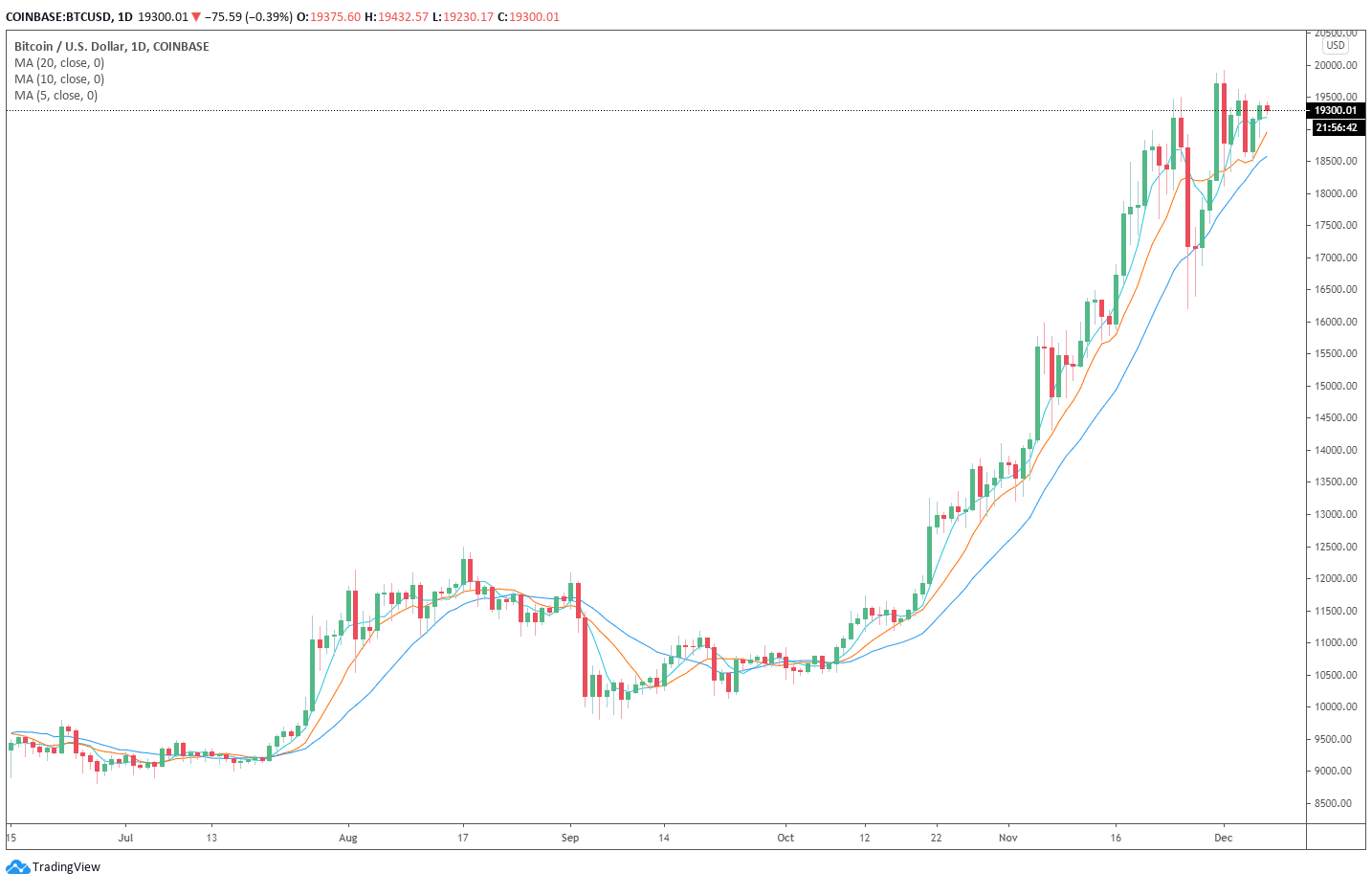

The price of Bitcoin is still hovering over $19,000, but on-chain analysts expect weeks of consolidation or a correction to occur.

Bitcoin has shown resilience in recent weeks, yet has struggled to break past the all-time high at $20,000 with strength.

With many sell orders stacked up between $19,500 and $20,000, analysts expect consolidation to occur.

Correction or consolidation?

Bitcoin could either see a prolonged consolidation between $18,500 to $19,400 or a correction. If a correction occurs, potential targets are the $16,200 support and the $14,000 macro support area.

The $14,000 level is noteworthy because it was the last top of the 2019 rally, which is the highest peak for Bitcoin other than the all-time high.

Willy Woo, an on-chain analyst and the founder of Woobull.com, said:

“Bitcoin on-chain structure saying to bulls “thou shall not pass”, not without a reset. A reset means many weeks of sideways or a decent bearish dip. Will we get a dip? There’s no impulse of coin movements that’s strongly bearish just yet. Waiting game.”

Throughout history, Bitcoin recorded 30% to 40% pullbacks. During this rally, BTC is yet to see a decent pullback, which has made analysts expect a deep correction in the near term.

The probability of a correction could increase if whale inflows start to increase once again, placing additional selling pressure on the dominant cryptocurrency.

Data from CryptoQuant suggest that a whale-induced sell-off is still a possibility, as the whale ratio on spot exchanges remains high.

The growing money supply is always a variable

However, one variable that could prevent a massive correction from occurring is the growing monetary supply. The continuous increase in central bank liquidity injections is prompting investors to invest in risk-on assets and inflation hedges.

Analysts at Glassnode found that on-chain data signifies growing confidence of Bitcoin at the $18,000 area. This trend could allow BTC to remain stable above it, enabling a broader rally to emerge.

Glassnode analysts wrote:

“Around 10% of the #Bitcoin supply was moved at a price above $18,000. Many investors are valuing BTC above this level, which may indicate their conviction for further $BTC price appreciation. In contrast: In 2017 at ATH this number was only 2%.”

In the near term, the key technical level for Bitcoin remains $18,500. It has been repeatedly defended in the past week, which suggests whales have been bidding at that level with large buy orders.

Alex Wice, one of the top traders on FTX by volume, noted that the $18,700 support level also remains a critical area in the short term.

So far, Bitcoin has been unable to convincingly surpass the $19,400 to $19,500 resistance range, which remains a concern in the foreseeable future. The dominant cryptocurrency has consistently seen a trend where it rejects strongly with a sudden dump as soon as it reaches around $19,500.

Farside Investors

Farside Investors

CoinGlass

CoinGlass