Who Is Winning The Stablecoin Race?

Who Is Winning The Stablecoin Race?

Photo by Marvin Ronsdorf on Unsplash

Before discussing specific stablecoin names, it is important to understand the three types of stablecoins that currently exist: centralized IOU stablecoins, crypto-collateralized stablecoins, and non-collateralized stablecoins.

Centralized IOU stablecoins are backed with fiat money or precious metals, such as the U.S. Dollar or other sovereign currencies. Centralized IOU stablecoins have value because it is a representation of another asset.

Crypto-collateralized stablecoins are collateralized with digital assets on-chain. In other words, this type of stable coin is collateralized with other cryptoassets, such as Ethereum or another token.

Lastly, non-collateralized stablecoins are a type of stablecoin that are uncollateralized and feature an algorithmic mechanism to achieve price stability. Seniorage shares is a concept invented in 2014 that uses a smart contract to imitate a central bank, where the monetary policy has only one duty – to issue a currency that is valued at $1.

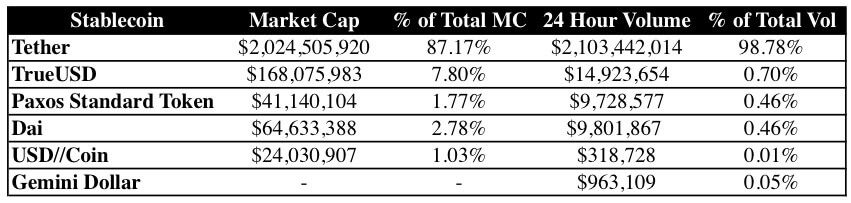

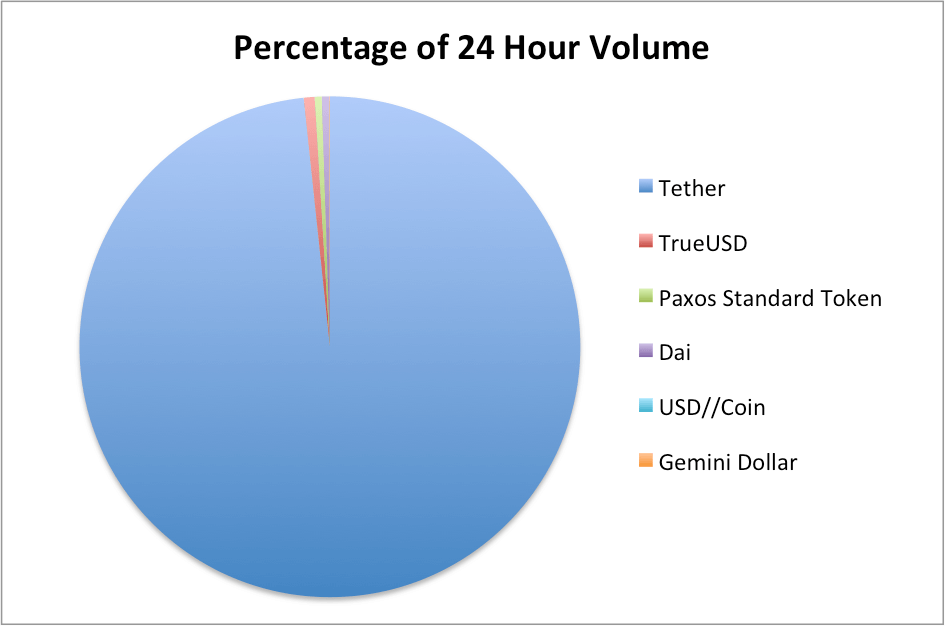

Stablecoin Market Capitalization and 24 Hour Volume

Data from CoinMarketCap indicates that Tether has over 87 percent of the total stablecoin market capitalization and nearly 99 percent of the total stablecoin volume in the past 24 hours. TrueUSD has the second highest share of stablecoin market capitalization and volume with 7.8 percent and 0.7 percent, respectively.

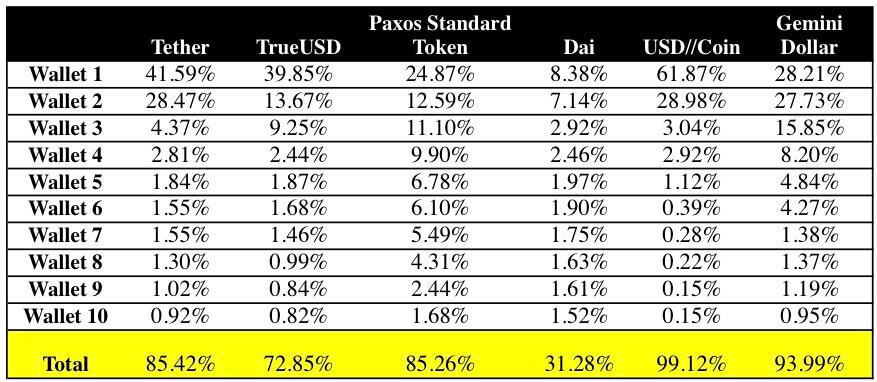

Concentration of Top Ten Addresses

According to Etherscan, the concentration of stablecoins in terms of holdings by top ten addresses are: MakerDAO’s Dai at 31.28 percent, TrueUSD at 72.85 percent, Tether at 85.42 percent, Paxos Standard at 85.26 perecent, Gemini Dollar at 93.99 percent and Circle’s USD//Coin 99.12 at percent. In terms of capitalization and trading volume however, Tether is still the stablecoin market leader. We can aniticipate an increase of activity of crypto-collateralized stablecoins as the cryptoasset market grows.

All data in this article was pulled on Oct. 20, 2018, at 9:30 PM EST.

Learn more about stablecoins:

- View CryptoSlate’s list of actively trading stablecoins

- Read about recent stablecoin news