True USD becomes 5th largest stablecoin after market cap surges 15%

True USD becomes 5th largest stablecoin after market cap surges 15% True USD becomes 5th largest stablecoin after market cap surges 15%

Regulatory concerns stemming from BUSD have started to support the market for lesser-known stablecoins, resulting in the surge of TUSD.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

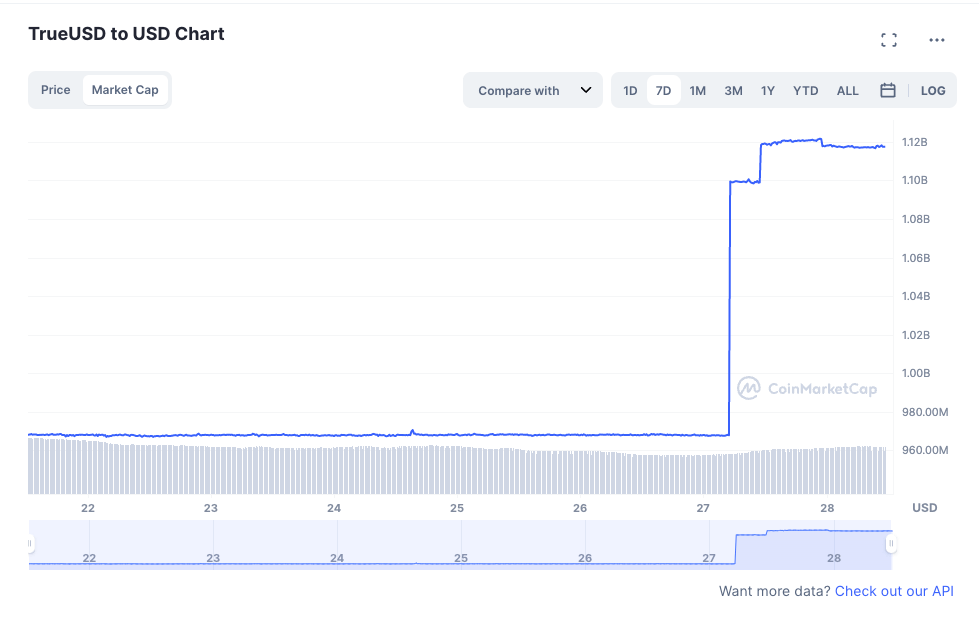

Over the last few weeks, the market value of True USD (TUSD) has surged and it is now ranked, according to Coin Market Cap, as the fifth largest stablecoin by market capitalization.

In the last 24 hours, TUSD’s market capitalization has risen by over 15%, currently at over $1.1 billion.

TUSD net outflow grows to meet demand

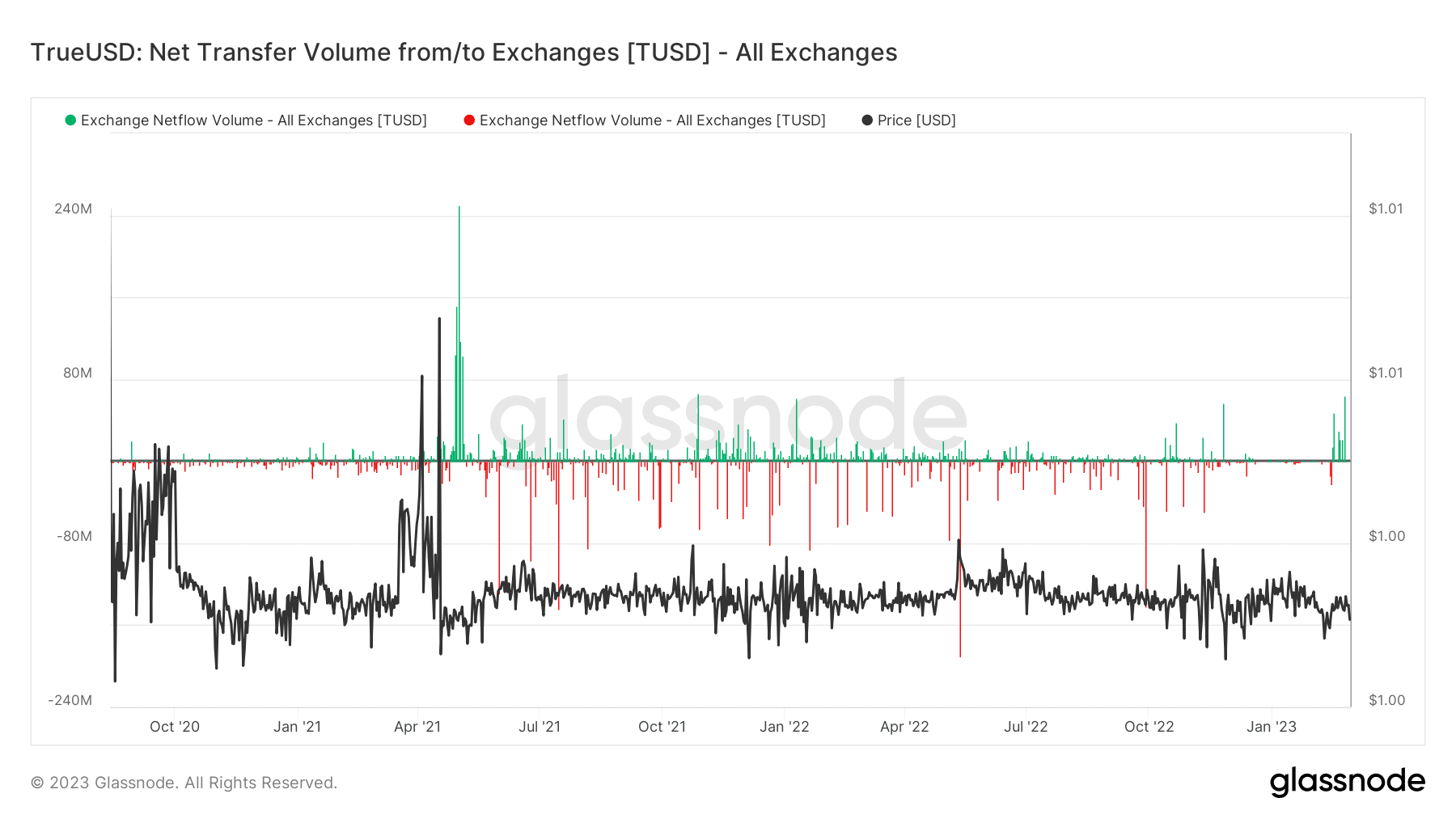

Glassnode’s Netflow measure is a useful tool for analyzing the activity of a cryptocurrency like True USD. Netflow refers to the difference between the number of coins flowing into and out of a particular exchange or mining pool. When the Netflow value is above 0, it indicates that more coins have flowed into the exchange/mining pool than have flowed out.

Using this measure, Glassnode has observed that True USD’s activity levels have recently increased. This can be seen in the significant drop in activity levels on the chart prior to February, followed by a noticeable pick-up in that month.

Additionally, the Netflow graph has shown a significant positive increase, which has not been seen since October 2021. As of the time of writing, the Netflow for True USD has surpassed 478,000 TUSD.

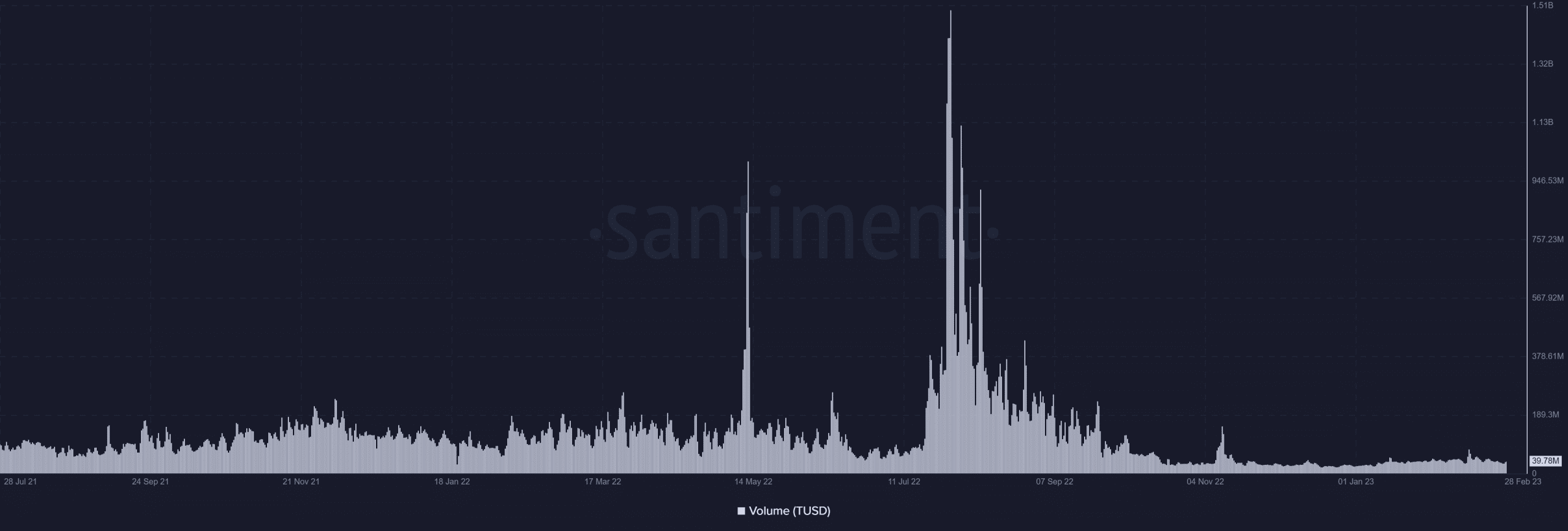

Santiment shows bullish behaviour on TUSD volume YTD

Examining Santiment’s volume metric reveals that TUSD had displayed a rather unimpressive level of activity. However, there are indications of a slight increase in engagement.

Market for stablecoins heating up

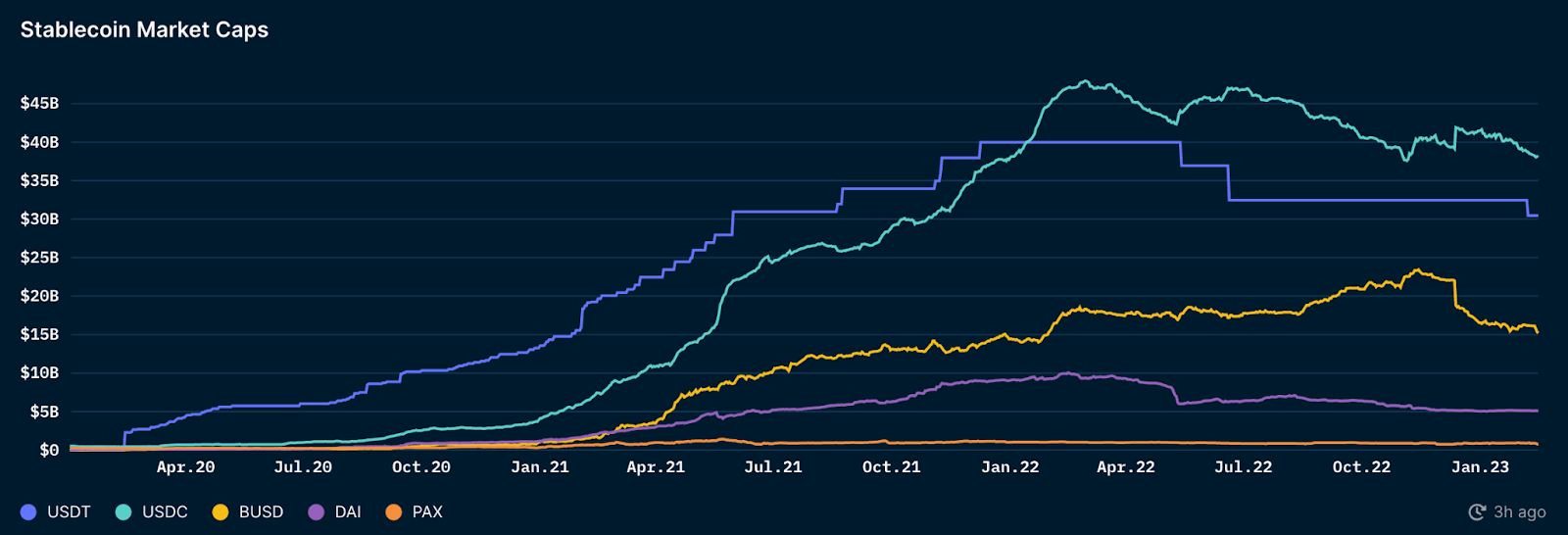

There are several popular types of stablecoins in the market, including decentralized under-collateralized algorithmic (UST), decentralized over-collateralized asset-backed (DAI), and centralized 1:1 backed versions such as USDC, USDT, and BUSD.

During the previous 24 months, BUSD and USDC have experienced remarkable growth, expanding by roughly 1409% and 912%, respectively. Stablecoins are most often available via centralized exchanges (CEXes) and bridges. An overview of the big four:

BUSD flight likely fuelling growth of other stablecoins

Recent blockchain research by Nansen reveals that Binance USD (BUSD) has been facing a decline in demand, while TUSD has been gaining popularity in the market. This shift in demand could be due to the recent news that Coinbase intends to delist BUSD because of regulatory issues.

As per the same Nansen report, Binance appears to be attempting to recover its position by minting around $130 million worth of TUSD in the past week, suggesting a growing reliance on TUSD by the exchange. This move could further contribute to the increase in TUSD’s market cap, as investors doubt the sustainability of BUSD in the market.

However, despite TUSD’s recent uptick, its market valuation is still considerably smaller than that of Dai (DAI), which is currently the fourth largest stablecoin in terms of market capitalization, worth more than $5 billion. This suggests that while TUSD may be gaining ground, it still faces stiff competition from the top players in the stablecoin market.

Farside Investors

Farside Investors