Transaction volume up, users down – is OpenSea challenger LooksRare gmi?

Transaction volume up, users down – is OpenSea challenger LooksRare gmi? Transaction volume up, users down – is OpenSea challenger LooksRare gmi?

After a blasting start, OpenSea challenger LooksRare still boasts high transaction volumes, but are the numbers “real” and is LooksRare gonna make it in the long run?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Two weeks since launch, LooksRare, portrayed as a community driven challenger to the NFT behemoth OpenSea, is still printing high levels of transaction volumes. On the surface, it looks like LooksRare has gotten itself a foothold on the market.

OpenSea has had, and still have, an impressive journey from around $71 million in sales a year ago, to $36 billion today – that’s a 50,000 percent increase in sales, all thanks to the blow-of-top interest in NFTs manifested in the explosion of profile pictures, art, collectables and in-game items. In its latest funding round, OpenSea was valued at $13 billion.

OpenSea’s vulnerable underbelly

There are, however, a couple of things that leave OpenSea vulnerable. One is the fact, or at least a low probability, that OpenSea will ever release a token. Reasons being many, one is securities regulation in the U.S. and that OpenSea is basically synonymous with the whole NFT mania, meaning the centralized, U.S.-based, private company has regulatory eyes on it. And then, there are few incentives for the people involved in OpenSea to release a token.

Another other obvious vulnerability is that the OpenSea platform is published under an open source license, so anyone can clone it, a third being that users on OpenSea pay a two percent fee to the platform, and ultimately its owners – the latter being a nail in the eye to the more crypto-ethos leaning partition of the community.

To the surprise of few, these vulnerabilities are being exploited by challengers in the market, the most hyped at the moment being LooksRare. Launched only a couple of weeks ago, LooksRare is already making a mark.

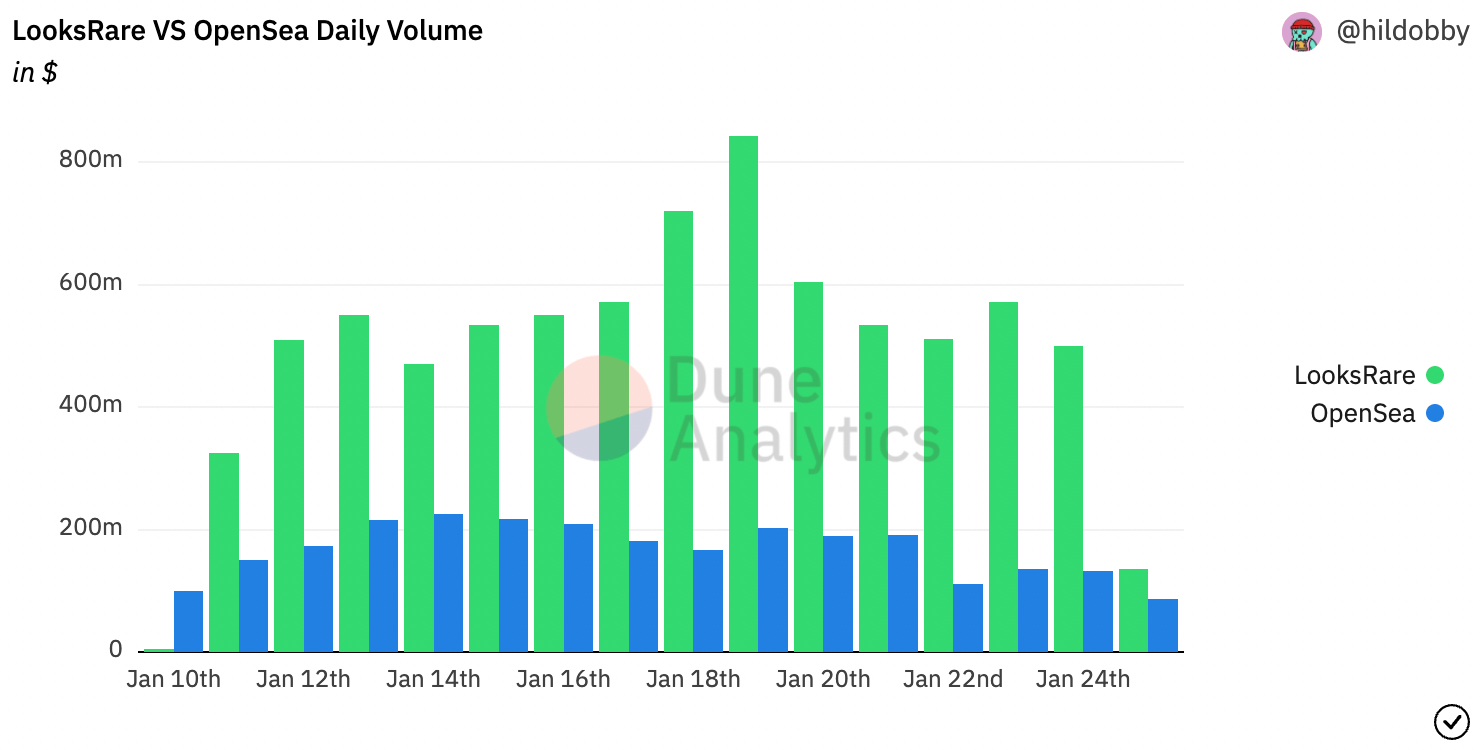

By releasing a token first thing, LooksRare took off with a bounce, airdropping LOOKS tokens eligible to all OpenSea users who traded NFTs for more than three ETH. On the second day of its existence, trading volumes on LooksRare already exceeded that of OpenSea, and this has continued being the case for the past two weeks since launch. For this whole period, the trading volume in dollars on LooksRare has held itself to more than four times than on OpenSea.

Fees are funneled back to platform users

The secret sauce behind the immediate success of LooksRare spells tokenomics, and token incentives that OpenSea, as discussed above, cannot engage in.

Like OpenSea, LooksRare charges a two percent fee (in ETH), all the difference being that those fees are funneled back to the platform users who earn LOOKS when they interact with the platform. Furthermore, users are incentivised to stake the LOOKS earned to additionally earn yield at a, for the moment at least, very high annualized return.

And here’s the thing, 60 percent of staking yields come in wrapped ether (WETH), which is basically the same as real ETH, and the rest in LOOKS that compound over time. This is admittedly, well, rare. Not many yield farms pay out in WETH/ETH.

At the time of writing the LOOKS token is trading at $3.87, while it topped at $7.1 just before the whole crypto market came tumbling down the last few days. The token is ranked at number 117 in total market cap, currently just over $665 million, about five percent of the recent valuation of OpenSea.

What happens when the incentives run out?

This is, of course, wash trading as much as wash trading goes, but one may argue that that’s the point in employing token incentives – people flip NFTs on LooksRare, not perhaps because the platform is so much better than OpenSea’s, it probably isn’t given OpenSea’s head start, but because they have a fair chance to earn money while doing so. To the ideological, at least the fees do not end up in the pockets of the platform owners.

Does this mean everything is rosy around LooksRare? Not exactly.

While the trading incentives are real, yields from yield farming tend to decrease over time – the current APY will probably not age well. Whether or not the platform retains its trading volume is anyone’s guess. What happens when the incentives run out?

Second, LooksRare launched without audited smart contracts, and without an open, public GitHub repo. This does not look good; it’s downright irresponsible and users must beware of the technical risks involved.

Trading volume and users is trending down

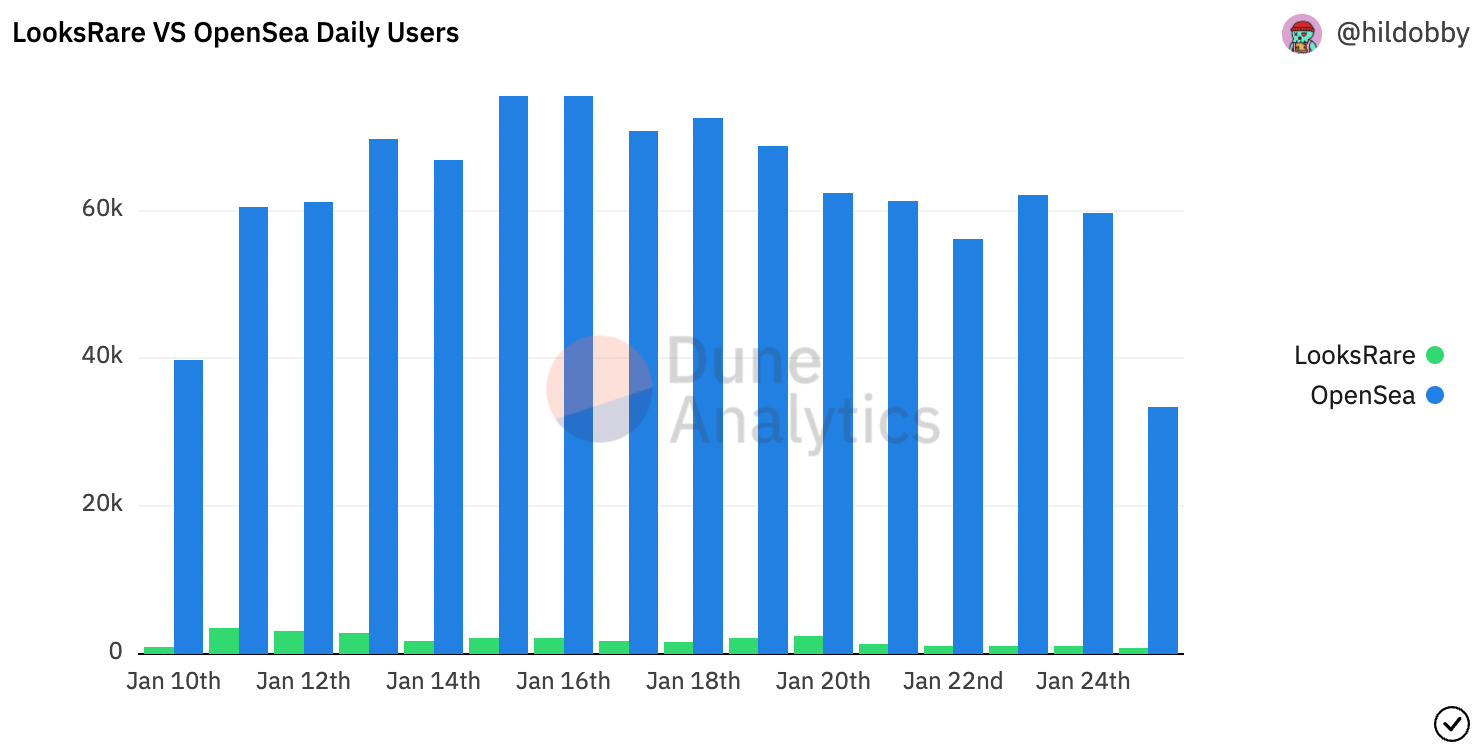

Third, and perhaps most importantly for the future of LooksRare, the number of daily users is not as impressive as the trading volume, which, by the way, is trending downwards since the top on the 19th of January. Whether the latter is an effect of the general bearish market at the moment, or due to users actually abandoning LooksRare for good, is an open question.

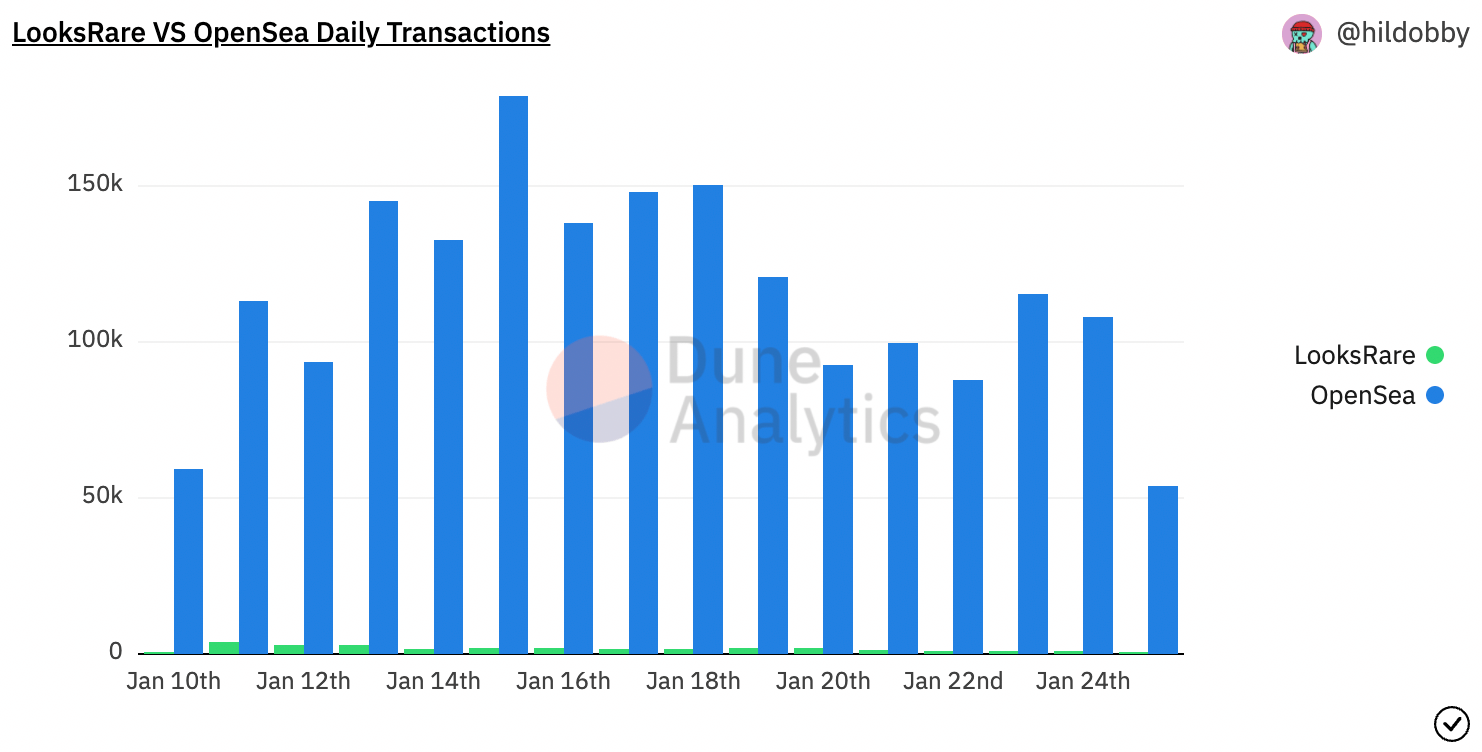

Aside from trading volume in dollar terms, trading volume in terms of the number of daily transactions has been in OpenSea’s favor all the time, with the number of trades being about a hundred times more on OpenSea.

The number of daily users on LooksRare peaked at 3,540 users on the day after the launch, according to data from Dune Analytics, and has never seen this level since. The number of daily users have basically trended downwards during the whole two weeks period of LooksRare’s lifetime, and went below 1,000 for the first time on the 24th of January. By comparison, the number of daily users on OpenSea has been above 60,000 except for two of the days during the same two-week period.

Also, and more of a side note, LooksRare does not support any Layer-2 networks on Ethereum while, at least, OpenSea does support the Polygon sidechain.

NFT markets need more competition

The OpenSea NFT marketplace is, for the moment at least, totally dominating the NFT market on Ethereum, and by extension the world. The platform’s market share is hovering around 90 percent, and the centralized structure is in the hands of the founders and a few venture capitalists. A not very upsetting view is that the market needs more competition.

OpenSea’s dominance has already had some unfortunate casualties in the form of deplatformed platform users, albeit due to understandable intellectual property issues. But perhaps the most dangerous implication of OpenSea’s dominance is the fact that wallets, and just about everything else, is using OpenSea’s API to access NFT on-chain data, as pointed out by Moxie Marlinspike, founder of the messaging app Signal. If OpenSea goes dark for some reason, people won’t be able to see their NFT in, for instance, MetaMask.

Whether a player like LooksRare will change this situation is highly uncertain, although not impossible. Whether LooksRare will be able to grow and establish a significant market share on behalf of OpenSea remains to be seen. For one, there’s a significant network effect at play to the benefit of OpenSea. LooksRare have a few but important issues to fix, yes, but on the other hand, the project has one hugely important upside, one we’ve seen play out many times in this industry: the awesome power of tokenomics.

CryptoQuant

CryptoQuant

LOOKS

LOOKS