This on-chain indicator may spell trouble for the 88% of Ethereum investors who are underwater

This on-chain indicator may spell trouble for the 88% of Ethereum investors who are underwater This on-chain indicator may spell trouble for the 88% of Ethereum investors who are underwater

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

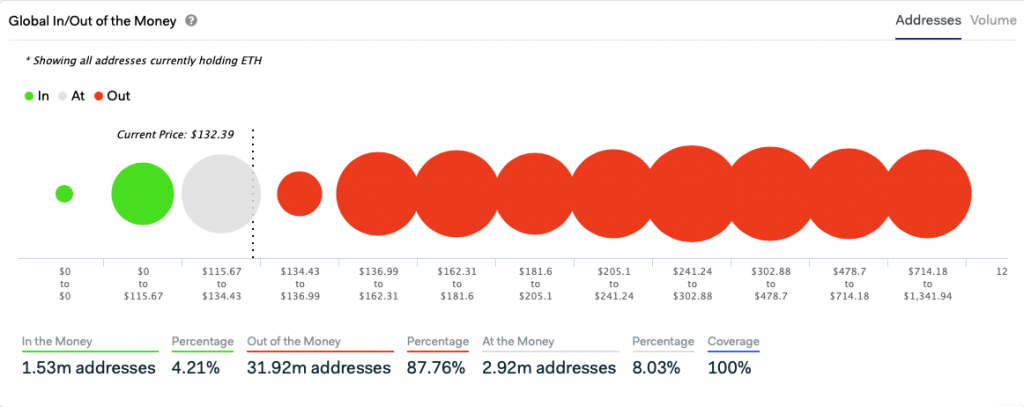

Data shows that a whopping 88 percent of Ethereum investors are currently underwater on their investment, with the crypto’s massive decline from its all-time highs leaving a trail of financial destruction in its wake.

This figure, although already shockingly large, may balloon even more in the weeks ahead, as some grim on-chain data suggests that ETH may be positioned to see some further bearishness in the days and weeks ahead.

The number of Ethereum “bagholders” just keeps growing: 88% are at a loss

Data from on-chain research and analytics firm IntoTheBlock elucidates an interesting trend when it comes to Ethereum investors’ profitability.

Currently 88 percent of the crypto’s investors are at a loss, with only 12 percent acquiring their cryptocurrency at below its current price.

This statistic, when put in contrast with Ethereum’s macro price action, isn’t too surprising, as the second-largest cryptocurrency by market cap has declined significantly from its early-2018 highs of over $1,400 that was set at the peak of the bull market.

After facing a violent downtrend after tapping these highs, ETH reeled to lows of $80 in December of 2018 before once again revisiting the $80 region just a few weeks ago.

With this turbulent price action in mind, it’s clear that the only Ethereum investors who are currently profitable are those who bought the crypto’s recent lows and those who entered positions before the insane 2017 bull run.

Another striking statistic relating to the crypto’s embattled investors is the fact that nearly 4 million ETH addresses – roughly 10 percent of the total number of existing addresses – acquired their tokens at between $714 and $1,340.

This grim on-chain data suggests the number of unprofitable ETH holders may soon grow

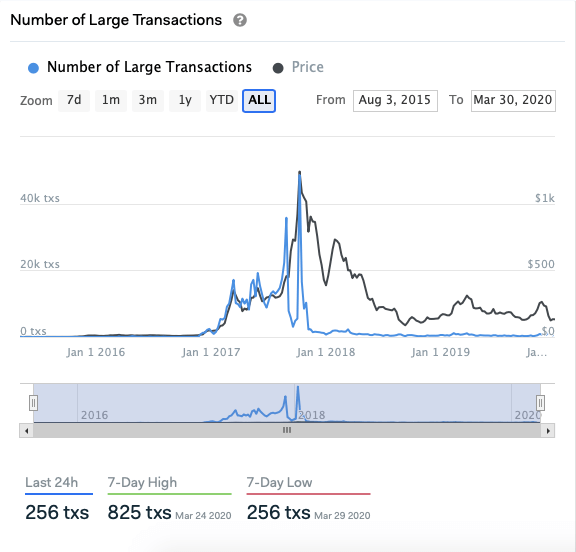

Another set of key data elucidates an alarming trend when it comes to the number of large transactions that have occurred on Ethereum’s blockchain, with this number diving in recent times.

According to IntoTheBlock, the decline in large transactions – which are deemed that are greater than $ 100,000 USD in value – is a highly bearish on-chain signal that suggests the crypto may be poised to see some near-term downside.

While looking at the above chart, it is clear that the large transaction volume often front-runs notable price movements, with its ongoing decline suggesting that ETH’s price may soon follow suit and also decline further.

Ethereum Market Data

At the time of press 4:28 am UTC on Apr. 1, 2020, Ethereum is ranked #2 by market cap and the price is up 0.1% over the past 24 hours. Ethereum has a market capitalization of $14.69 billion with a 24-hour trading volume of $10.98 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 4:28 am UTC on Apr. 1, 2020, the total crypto market is valued at at $179.32 billion with a 24-hour volume of $106.29 billion. Bitcoin dominance is currently at 64.87%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant