There’s a potential competitor to Ethereum’s Yearn.finance (YFI): DeFi analyst

There’s a potential competitor to Ethereum’s Yearn.finance (YFI): DeFi analyst There’s a potential competitor to Ethereum’s Yearn.finance (YFI): DeFi analyst

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

For months, the term “yield farming” has been a prominent meme in the crypto space, with users of Ethereum’s decentralized finance ecosystem using it incessantly to describe their search for ever-higher yields.

It’s surprising, then, that there was no DeFi project that harnessed this meme to its advantage — at least not until Harvest Finance (FARM) came along.

Just under two weeks ago, a pseudonymous group of developers with the process of giving “bread to the people” launched the project, aiming to make the “hard work” of using Ethereum and DeFi “easier.”

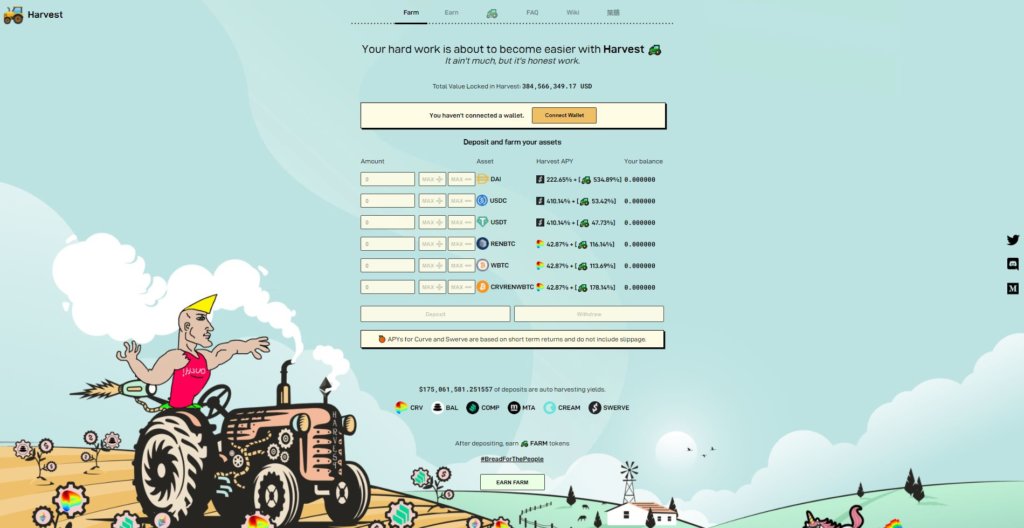

Since its launch just around two weeks ago, it has seen a surge in adoption: the project has a purported $384 million worth of cryptocurrency locked in it. Its token, as well, has garnered a market capitalization in excess of $10 million.

What is Harvest Finance?

Harvest Finance is a DeFi protocol that pools user funds, then uses them in yield farms to achieve the highest returns at low gas costs.

The platform currently supports top stablecoins like DAI, USD Coin, and Tether’s USDT, along with two tokenized Bitcoins and a Curve liquidity provider token for the RenBTC-WBTC pool.

The stablecoins are currently being put to work in Swerve, a Curve fork that is promising to be more decentralized and “community-owned” than its predecessor. Swerve has over $600 million of locked value in its contracts.

The tokenized Bitcoin is being put to work in Curve.

Unlike some other pooled yield farming protocols, Harvest has an added component of the FARM token. FARM is a token that is distributed to providers of capital to the pool, providers of liquidity to FARM-crypto trading pairs on decentralized exchanges, and a coin that is continuously bought back.

30 percent of the profits made by the farms are used to purchase FARM, meaning the coin basically provides dividends for holders.

Competitor to Yearn.finance?

Prominent decentralized finance commentator and analyst CryptoYieldInfo suggested that the recent direction Harvest and FARM are moving in suggests the project may be a competitor to Yearn.finance (YFI):

“This might be a strange comment but if $YFI has a competitor, then it might be $FARM. Several leagues below of course. But worth looking at.”

This is in reference to Yearn.finance’s core product, Vaults (yVaults), which pool funds and then deposits them into farming strategies. Harvest actually has begun to encroach on Vaults in terms of total value locked in the farming strategies.

This might be a strange comment but if $YFI has a competitor, then it might be $FARM.

Several leagues below of course.

But worth looking at.

— Cryptoyieldinfo.YFI (@Cryptoyieldinfo) September 10, 2020

It’s important to note that unlike Yearn.finance, though, there are some security concerns.

For one, there is not a multi-signature setup in place, meaning control of the strategies used by the farms and the distribution of coins is currently controlled by pseudonymous developers. As we saw with Chef Nomi of SushiSwap, even though the developers may be transparent to start, things can change.

Harvest also seems to be going with the strategy of maximizing yields over security. Namely, Yearn.finance didn’t switch its stablecoin strategy from Curve to Swerve, presumably to ensure users don’t lose any funds in case of a bug in the Swerve contracts.

Harvest is being audited, though, by PeckShield and other top firms in the space. PeckShield has released a preliminary “sanity check” report and found no logic errors in the contracts.