The ‘crab’ market: Bitcoin hovers near $30,000, Ethereum fails to break $2,000

The ‘crab’ market: Bitcoin hovers near $30,000, Ethereum fails to break $2,000 The ‘crab’ market: Bitcoin hovers near $30,000, Ethereum fails to break $2,000

Bitcoin and Ethereum prices bounced back above key support levels as ‘bulls’ took advantage of oversold conditions yesterday. But the move didn’t last long.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Cryptocurrency markets bounced upward yesterday after a big drop with Bitcoin and Ethereum being up by 15% and 17% respectively.

The move came on the back of El Salvador president Nayib Bukele releasing rendered images of the proposed Bitcoin mining unit powered by the country’s active volcanoes (the thermal energy generated from volcanoes can be converted into electricity, and in turn be used to power mines).

However, prices retraced the entire move yesterday as sellers sold into strength. Traders took advantage of the oversold conditions on most of the cryptocurrencies. Buyers were active after the shakeout which pushed Bitcoin price to over $30,000.

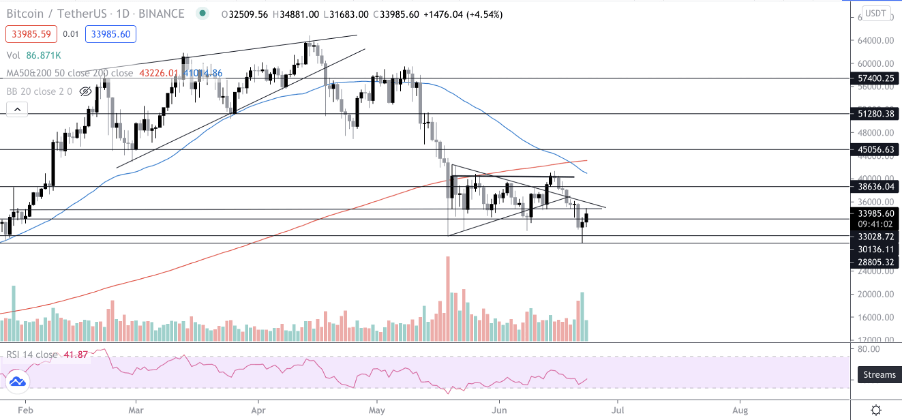

So what’s next for Bitcoin?

Bitcoin bounced off of the $28,800 support and managed to close the candle in a bullish ‘hammerhead’ pattern. (A hammer is a type of bullish reversal candlestick pattern.)

The next resistance is at the $36,600 region. A rejection is possible in that area unless the price uptrend is followed by a volume influx.

The relative strength index (RSI) also had a sharp rise after looking bottomed out. The positive buyback after yesterday’s drop clearly shows the buyer’s interest in bitcoin.

But the price continues to be ranging in between $30,000 and $38,000 areas.

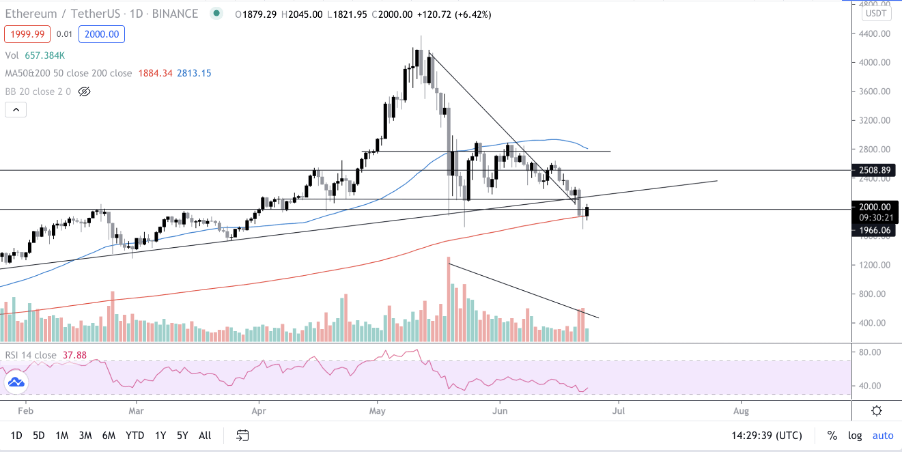

What’s next for ETH?

ETH price held well above the 200MA and bounced nicely back above $2,000. A daily close above $2,000 will be beneficial and can lead to positive price action in the coming days.

The next resistance area for ETH is around the $2,100 zone, where rejection is likely. However, volume is on the lower side and a volume push is needed to continue the price uptrend.