Tether reports $5B reserve excess after making more profit than Goldman Sachs last quarter Oluwapelumi Adejumo · 11 months ago · 2 min read

Tether reports $5B reserve excess after making more profit than Goldman Sachs last quarter Oluwapelumi Adejumo · 11 months ago · 2 min read Tether reports $5B reserve excess after making more profit than Goldman Sachs last quarter

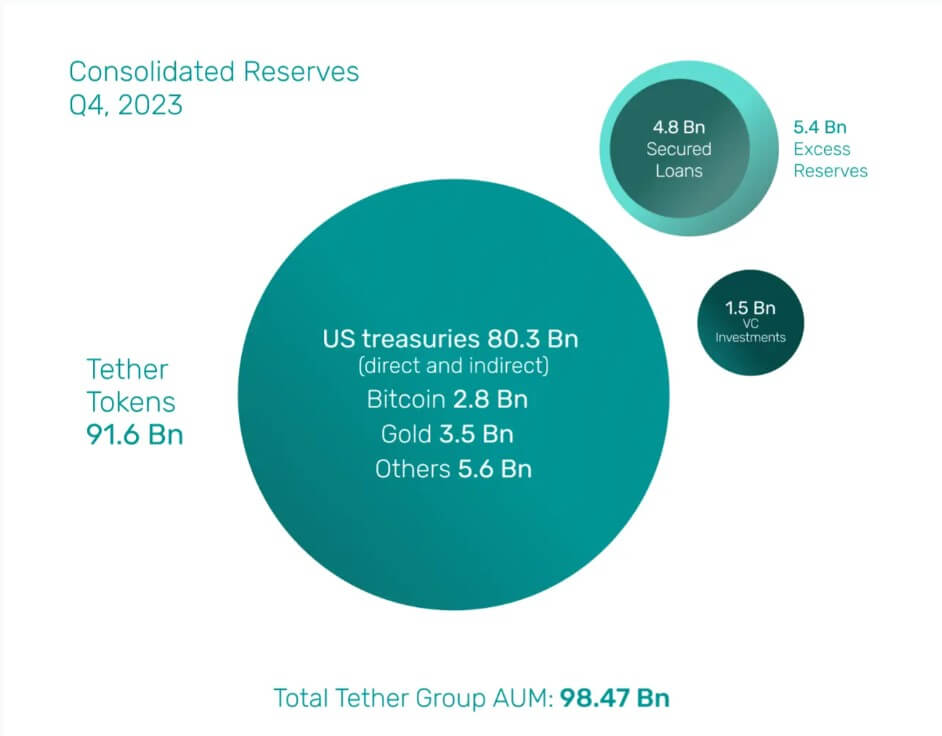

Tether revealed that it held profits of $5.4 billion in reserves 'to ensure highest resiliency.'

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Stablecoin issuer Tether boasted gains of approximately $2.85 billion during the fourth quarter of last year. The performance led to more profit than Wall Street giant Goldman Sachs, Bitwise chief investment officer Matt Hougan highlighted on X.

Goldman Sachs reported a profit of $2.01 billion in the last three months of the previous year, while Tether’s Q4 report revealed that its profits comprised $1 billion from U.S. Treasury bills and $1.85 billion from holdings in Gold and Bitcoin.

This remarkable performance can be attributed to the surge in the crypto market, driven by the enthusiasm surrounding the spot Bitcoin exchange-traded fund (ETF) between October and December 2023. During this period, Bitcoin’s value skyrocketed to over $42,000 from around $27,000, coinciding with Tether’s USDT supply rising to nearly 92 billion from approximately 83 billion tokens.

Observers noted that the increased demand for Tether’s fiat-backed stablecoin signaled a growing interest from institutional investors entering the market. CryptoSlate’s data shows that Tether’s USDT supply has risen to $96.2 billion as of press time.

However, despite its impressive performance, Tether’s overall profit for the year was $6.2 billion, notably lower than Goldman Sachs’s earnings of $8.52 billion.

Meanwhile, Paolo Ardoino, Tether’s CEO, emphasized that these substantial profits emphasize the company’s financial strength throughout the year.

“The substantial net profits generated not only in the last quarter of the year but throughout the year, amounting to $6.2 billion, showcases our financial strength,” Ardoino said.

Goldman Sachs, a globally renowned investment banking firm, holds the status of the second-largest investment bank in the world by revenue and is recognized as a systemically important financial institution by the Financial Stability Board.

Over $5 billion in excess reserves

The substantial profit margin enabled Tether to bolster its excess reserves to $5.4 billion. Of this, $640 million was allocated to various project investments, including sustainable energy, Bitcoin mining, AI infrastructure, and P2P communications. Tether does not consider these investments part of its reserves.

“Our investments in sustainable energy, Bitcoin mining, data, AI infrastructure, and P2P telecommunications technology illustrate our commitment to a more sustainable and inclusive financial future,” Ardoino explained.

BDO Italia, a prominent global accounting firm conducting Tether’s attestations, verified that the stablecoin’s excess reserves entirely covered its $4.8 billion in outstanding unsecured loans. Tether highlighted its achievement in eliminating the risk of secured loans from its token reserves.

As of December 31, 2023, Tether’s held assets were valued at $98.47 billion, with liabilities amounting to $91.59 billion.

Mentioned in this article

Oluwapelumi Adejumo

Journalist at CryptoSlateOluwapelumi values Bitcoin's potential. He imparts insights on a range of topics like DeFi, hacks, mining and culture, underlining transformative power.

Liam 'Akiba' Wright

Editor-in-Chief at CryptoSlateAlso known as "Akiba," Liam Wright is the Editor-in-Chief at CryptoSlate and host of the SlateCast. He believes that decentralized technology has the potential to make widespread positive change.

Latest Tether Stories

Latest Press Releases

Disclaimer: Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

Featured Story

Advertise HereIn this article

Launched in 2014, Tether is a blockchain-enabled platform designed to facilitate the use of fiat currencies in a digital manner.

Bitcoin, a decentralized currency that defies the sway of central banks or administrators, transacts electronically, circumventing intermediaries via a peer-to-peer network.

Tether Limited

Stablecoin Issuer Company in AsiaTether Limited is the company that introduced Tether (USD₮ or USDT), an asset-backed cryptocurrency stablecoin, in 2014.

Goldman Sachs

Advisory, Asset Management, Research, Venture Capital Company in North AmericaGoldman Sachs a leading global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments and high-net-worth individuals.

Paolo Ardoino joined Bitfinex at the beginning of 2015 and now serves as Chief Technology Officer.

Farside Investors

Farside Investors