SEC ETF delay pulls market back leading to $130M liquidation havoc

SEC ETF delay pulls market back leading to $130M liquidation havoc SEC ETF delay pulls market back leading to $130M liquidation havoc

The SEC delay caused the broader cyptocurrency market to decline by nearly 4%.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The U.S. Securities and Exchange Commission’s latest delays on the spot Bitcoin (BTC) ETF applications led to a market-wide pullback that resulted in $130 million in liquidations over the last 24 hours.

SEC delays spot ETF decision

On Aug. 31, the financial regulator issued notices indicating the postponement of decisions on all ETF applications until October. The delay was attributed to the regulator’s need for adequate time to deliberate on the proposed rule change and the associated concerns.

This decision impacted applications from prominent firms, including BlackRock, Valkyrie, WisdomTree, Invesco Galaxy, Bitwise, and Wise Origin.

The recent delay comes as no shock, as it aligns with prior predictions by Bloomberg analysts Eric Balchunas and James Seyffart. They had foreseen the SEC’s inclination to defer applications while deliberating on its next move, especially after Grayscale’s recent legal success against the regulatory body.

Notwithstanding the SEC’s actions, these analysts maintain a positive outlook, suggesting that the chances of ETF approval have climbed to a promising 75%.

Bitcoin crashes

Following news of the delay, Bitcoin, already experiencing a cooling-off period following the Grayscale-induced recent surge, dropped by approximately 5%, pushing its valuation below the $26,000 mark. BTC was trading for $25,976 as of press time, according to CryptoSlate’s data.

Concurrently, the broader cryptocurrency market witnessed a nearly 4% decline, collectively amounting to a total market capitalization of $1.05 trillion.

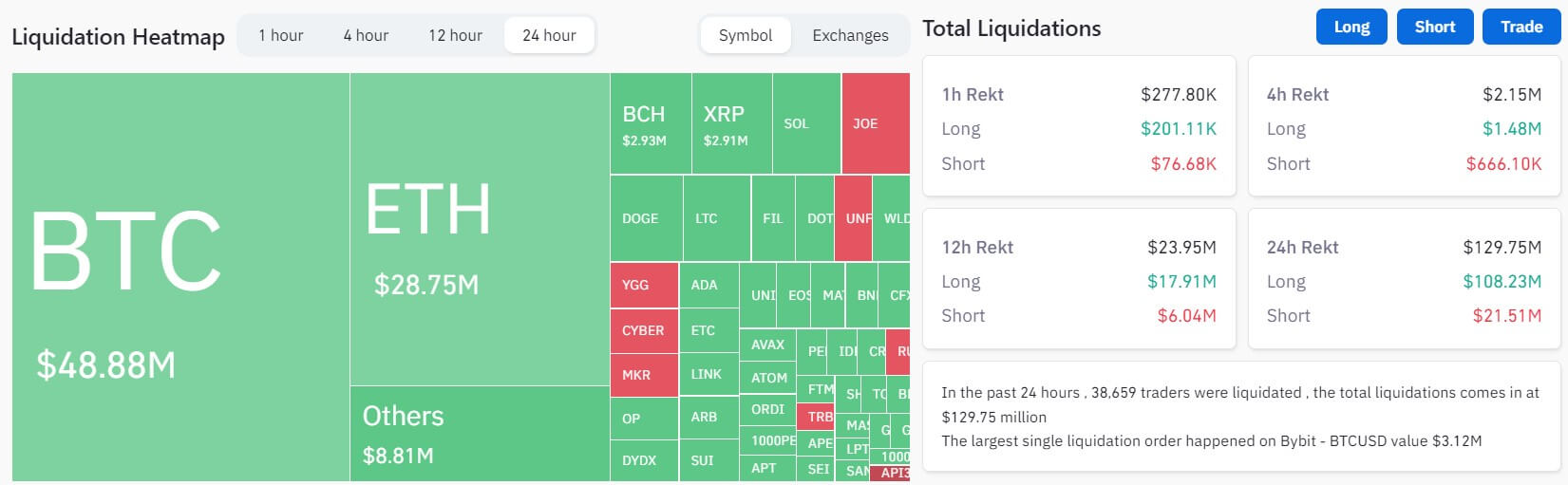

These price actions resulted in $130 million worth of liquidations that majorly affected long traders. Per Coinglass data, BTC and Ethereum (ETH) accounted for nearly $80 million of these positions, while traders with positions in assets like BNB, XRP, Bitcoin Cash, Solana, and others recorded millions in losses.

Meanwhile, the most significant single-order liquidation was a long BTCUSD position valued at $3.12 million on ByBit. Across exchanges, OKX and Binance accounted for more than 60% of the total liquidations.