New paradigm: Ethereum fees regularly surpass Bitcoin, and it’s good for ETH

New paradigm: Ethereum fees regularly surpass Bitcoin, and it’s good for ETH New paradigm: Ethereum fees regularly surpass Bitcoin, and it’s good for ETH

Photo by Jonathan Chng on Unsplash

Fees on the Ethereum blockchain network are consistently surpassing Bitcoin and industry executives say it could spark a “new paradigm.”

Cole Kennelly, who heads growth at Staked, institution-focused decentralized finance (DeFi) firm, said:

“ETH fees are consistently materially higher than $BTC fees. A new paradigm.”

$ETH fees are consistently materially higher than $BTC fees. A new paradigm pic.twitter.com/rikYGZ9fzS

— Cole Kennelly ⬙ ? (@ColeGotTweets) October 18, 2020

Growing fees on Ethereum could cause three factors to materialize that might further fuel its medium-term growth. The potential catalysts are high gas leading to bigger ETH demand, continuous increase in user activity, and sustainability of DeFi.

High gas could lead to higher ETH demand

On the Ethereum blockchain network, transaction fees are called “gas.” When users send transactions, they are required to pay gas to miners, who then verify the transactions.

On Ethereum, users have to pay gas using ETH, even if they are dealing with other ERC 20 tokens. As an example, if a user wants to send Tether from one Ethereum address to another, the user still has to pay fees in ETH.

As such, when the user activity on Ethereum rises, and gas costs increase, the demand for ETH naturally rises.

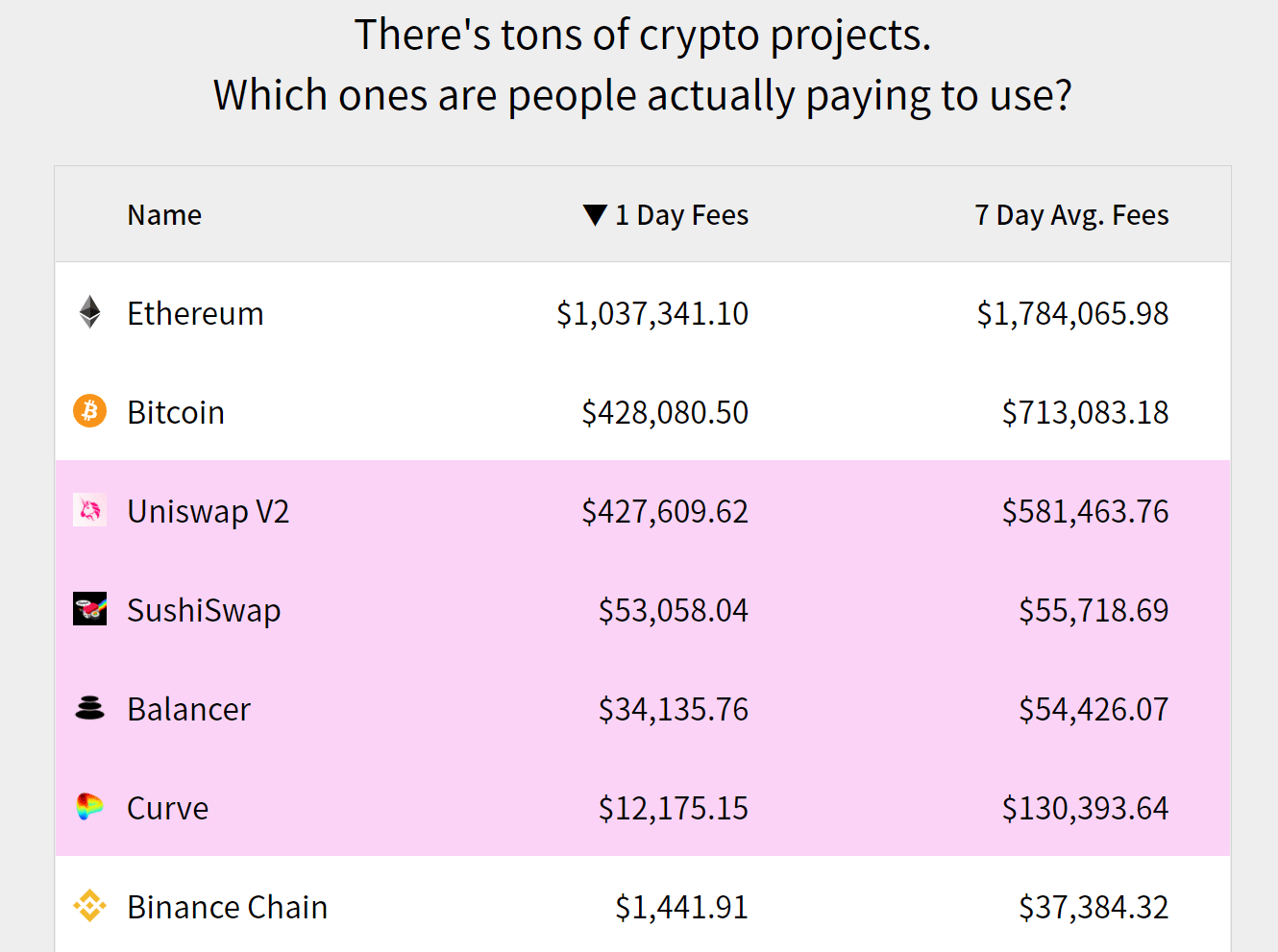

According to Cryptofees.info, the Ethereum network processed $1.78 million in seven-day average fees. In comparison, Bitcoin processed $713,000 in fees, with Binance Chain being the distant third.

Ethereum user activity is rising as ETH 2.0 nears

High fees on Ethereum reflect the rapidly growing user activity on the blockchain network. Approaching ETH 2.0, a major network upgrade, the noticeable rise in real user activity is optimistic.

ETH 2.0 would mark the switch from the proof-of-stake (PoS) to proof-of-work (PoW) consensus algorithm. To put it simply, the former does not require miners to verify transactions. Instead, users collectively process transactions through a process called staking.

ETH 2.0 rewards users that “stake” their tokens to process transactions on the blockchain. Staking requires users to allocate their tokens to the blockchain and during staking, they cannot spend or move their ETH. In return, they receive incentives from the blockchain.

If there is a substantially higher number of users utilizing ETH, it would aid in decentralizing the network approaching ETH 2.0.

It shows the sustainability of DeFi

The primary catalyst of the spike in ETH fees throughout 2020 has been the resurgence of DeFi.

According to the data from Defipulse, the total value locked (TVL) across DeFi protocols exceed $11.15 billion.

The high TVL of DeFi protocols despite the brutal pullback of DeFi tokens throughout October shows the market’s resilience.

“Mainstream Adoption — Whatever you think this means, DeFi doesn’t need it. $300m ETH sent daily to DeFi apps vs $156m to centralized apps Apps on pace for ~$500m annualized revenue 9. 600k users, still going parabolic,” DTCCapital head Spencer Noon said.

It demonstrates the appetite for DeFi, likely more stable DeFi protocols, from the broader userbase within the cryptocurrency sector.