Local top? Why Bitcoin traders are starting to get slightly cautious

Local top? Why Bitcoin traders are starting to get slightly cautious Local top? Why Bitcoin traders are starting to get slightly cautious

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

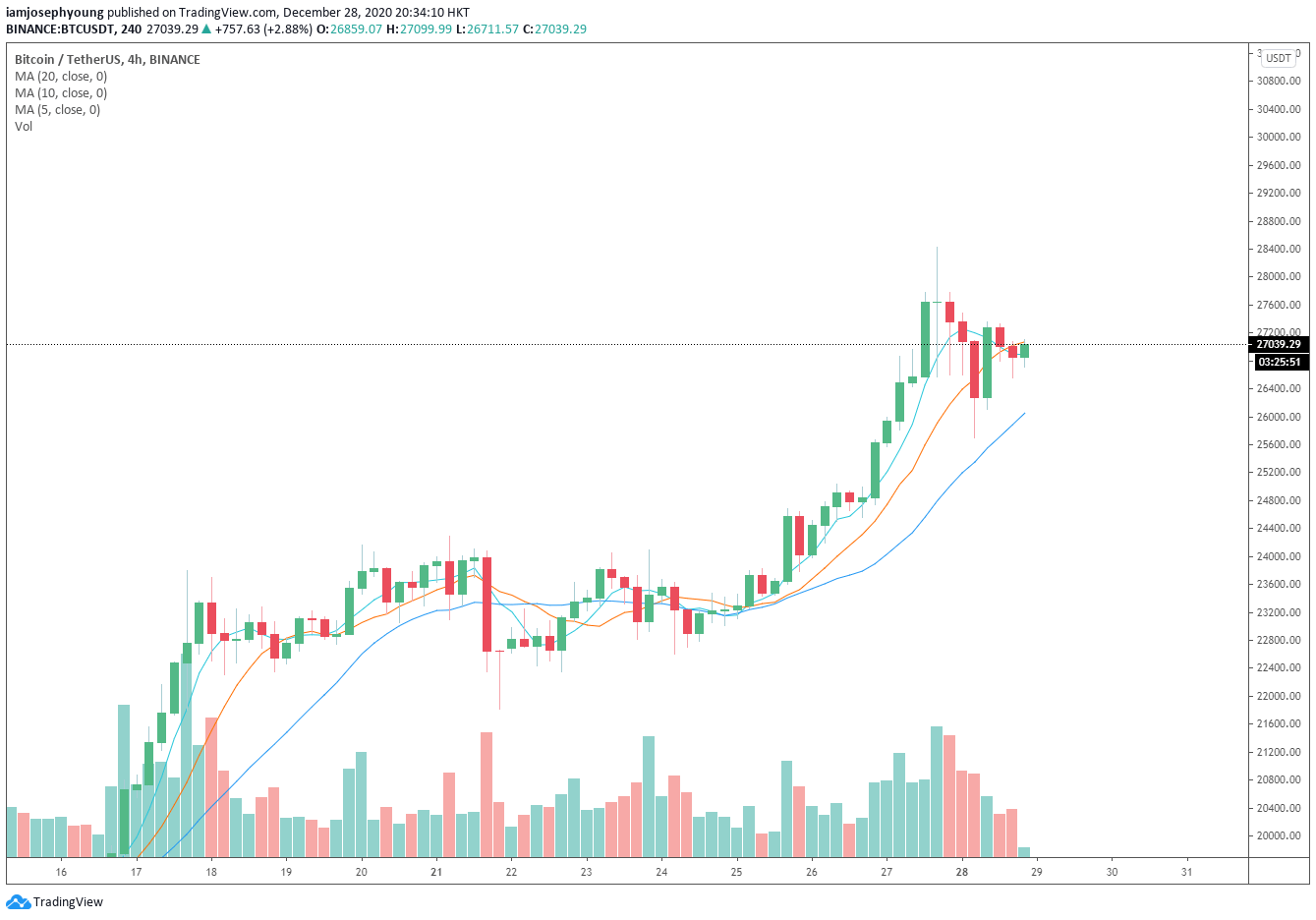

The Bitcoin price has seen a relatively large pullback since December 27, after it hit a peak at $28,422. Following a 6.5% drop, technical analysts and traders are becoming slightly cautious in the short-term.

Bitcoin demand came from derivatives, not institutions

The Bitcoin rally to over $28,000 occurred during the weekend when institutions are not trading.

Institutional investors, typically in the U.S. trade BTC through Grayscale and the CME Bitcoin futures exchanges. Hence, during weekends, retail investors and the derivatives market dominate BTC’s volume.

It was evident that the futures volume was the primary driver of Bitcoin’s uptrend in the last few days due to the discrepancy in the spot price and the futures price.

In crypto, the spot market means exchanges with no leverage where traders do not borrow capital to trade.

On Binance, for example, the difference in the price of Bitcoin on spot and futures markets was about $40. Bitcoin was consistently trading about $40 higher than the spot price during the weekend, which means the buyer demand came from futures traders.

The risk of the futures market becoming the main driver of the Bitcoin price is that the market can become overheated.

Several metrics can show whether the market is overcrowded or not. Most prominently, the funding rate rises steeply when the majority of traders in the futures market are buying or longing Bitcoin.

Hence, when the funding rate of Bitcoin is substantially higher than average, the risk of marketwide pullback increases.

On December 28, a pseudonymous trader known as “Byzantine General” said:

“Distortion has been consistently pretty high. And derivs sentiment has been in overdrive past couple of days. If we close this daily with a shooting star, then maybe this was the local top.”

Based on market data, the trader also emphasized that one more “squeeze” is likely, which means another spike upwards is a possibility.

Scott Melker, a cryptocurrency trader, also noted that a drop to $20,000 would surprise many, even though it is a major support area. He wrote:

“A drop to 20k to retest the former all time high as support would terrify many, when that price was a dream two weeks ago.”

There is one variable

According to Alex Saunders, a crypto investor, data show that retail investors are buying again. Although data from PayPal and itBit primarily show growing buyer demand for Ethereum, it shows that the retail appetite for crypto assets is rising. Saunders stated:

“Retail is buying again. $50M daily on PayPal via itBit & interestingly, of that ETH has gone from 10-20% to 27%. ETH/BTC looks to have bottomed on the weekly chart. BTC needs a rest. 2021 will be the year smart money finally comprehends Ethereum.”

Throughout 2020, analysts have attributed Bitcoin’s rally to institutional investors. If retail investors re-enter the market, it could fuel the market to see a renewed uptrend.

Bitcoin Market Data

At the time of press 6:21 pm UTC on Dec. 28, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.98% over the past 24 hours. Bitcoin has a market capitalization of $503.8 billion with a 24-hour trading volume of $51.69 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 6:21 pm UTC on Dec. 28, 2020, the total crypto market is valued at at $732.92 billion with a 24-hour volume of $211.72 billion. Bitcoin dominance is currently at 68.91%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass