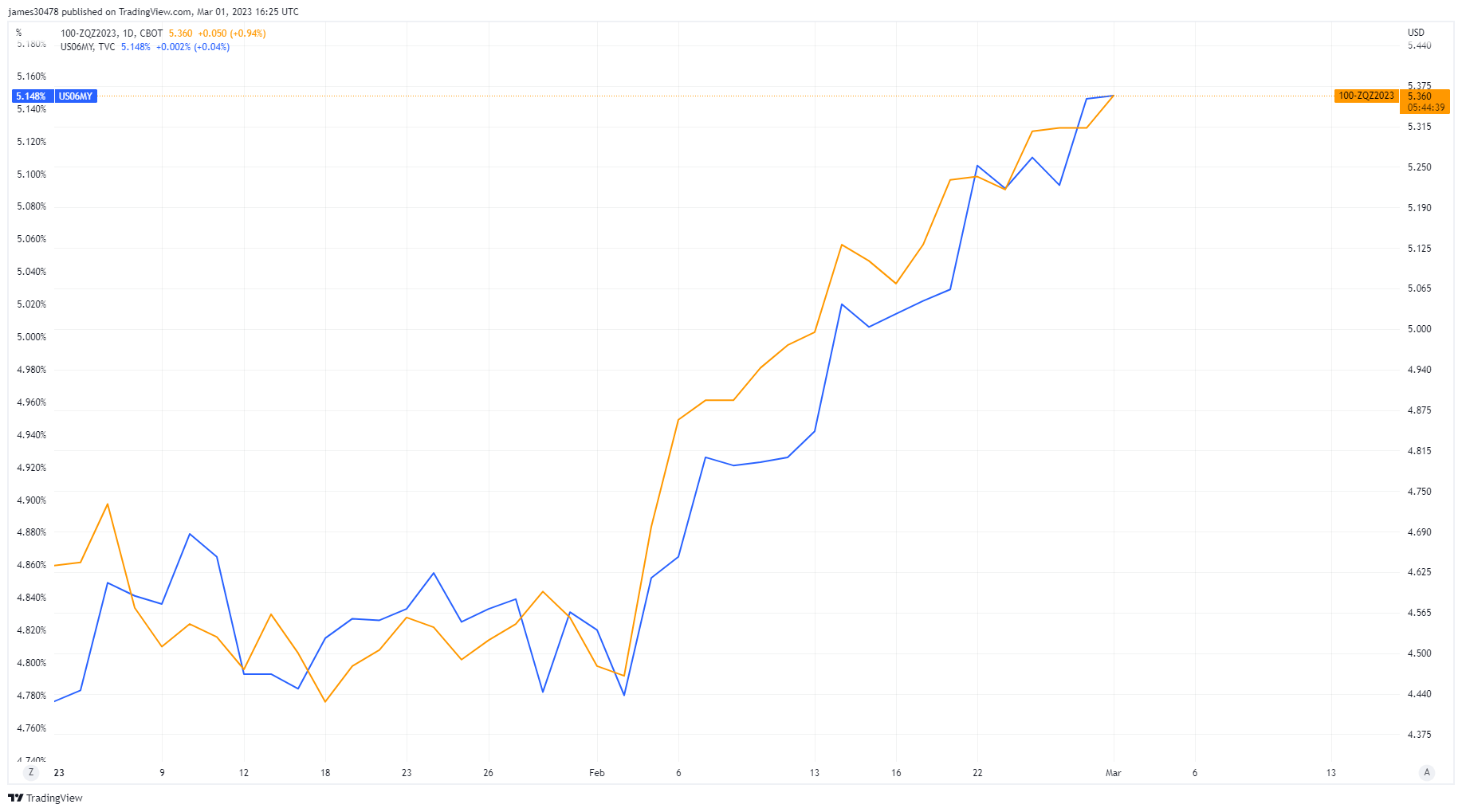

Treasury bills continue to soar as fed swaps price in peak policy rate of 5.5% in December

Treasury bills continue to soar as fed swaps price in peak policy rate of 5.5% in December Our Analysis

- We expect short-term treasury yields to start taking allocation from other assets as savers get rewarded by central banks during this hawkish period.

- However, the debasement rate far exceeds the return adjusted for inflation.

- This could be bearish for crypto as treasury bills (U.S. 06 Month Yield) are over 5%, the highest level since 2007.

Highlights

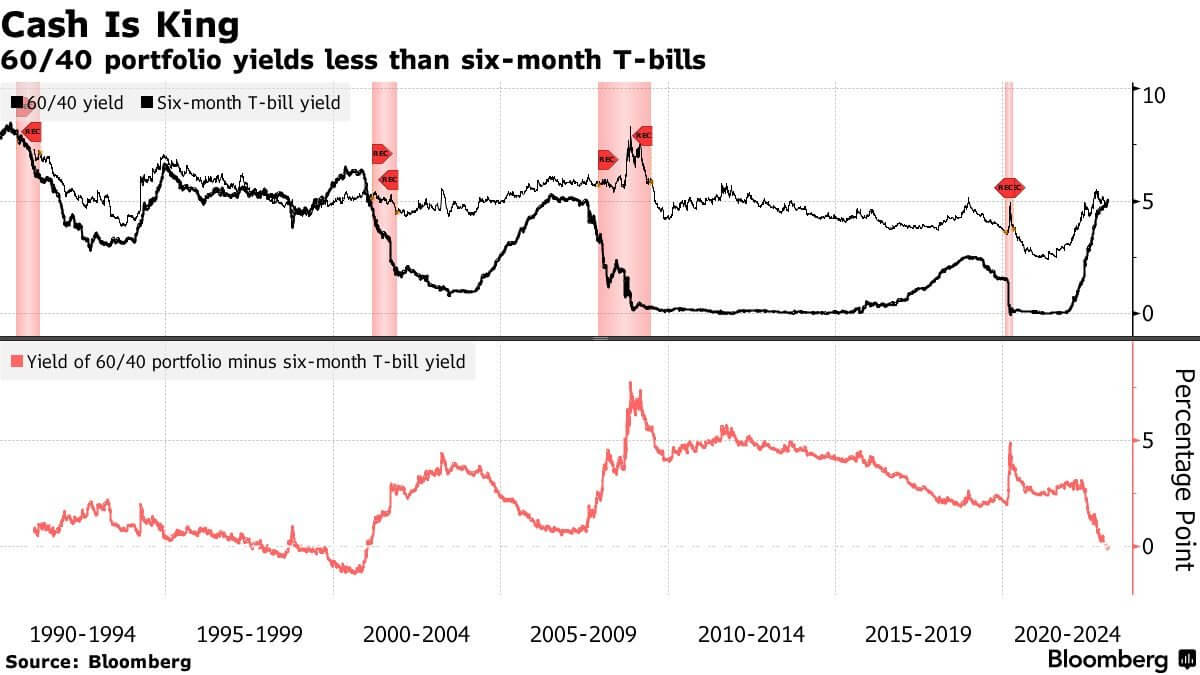

- According to Bloomberg, cash is now paying more than a traditional stock portfolio for the first time in over two decades.

- Six-month T-Bill yields surpass 5% for the first time since 2007.

- The last time this happened was in the early years of the 2000s.

- December Fed Funds Futures are now trading at 5.4%