MicroStrategy’s Bitcoin holdings surpass 400,000 BTC after latest $1.5 billion buy

MicroStrategy’s Bitcoin holdings surpass 400,000 BTC after latest $1.5 billion buy MicroStrategy’s Bitcoin holdings surpass 400,000 BTC after latest $1.5 billion buy

MicroStrategy's Bitcoin accumulation reaches milestone, representing 1.9% of total supply.

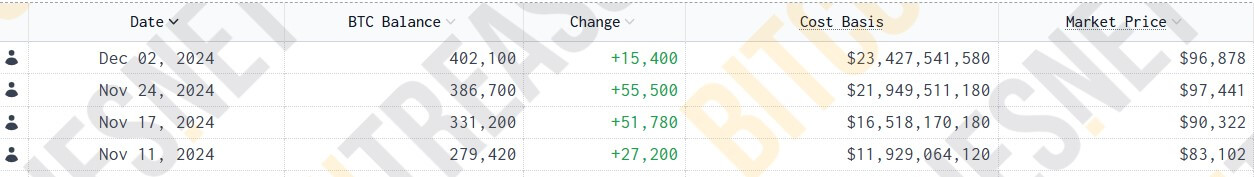

MicroStrategy has added 15,400 Bitcoin (BTC) to its holdings, spending around $1.5 billion, according to a Dec. 2 filing with the US Securities and Exchange Commission (SEC).

This marks the company’s fourth consecutive weekly purchase, with an average acquisition price of $95,976 per Bitcoin.

The latest transactions occurred between Nov. 25 and Dec. 1, bringing MicroStrategy’s total Bitcoin holdings to 402,100 BTC. They were acquired for approximately $23.4 billion at an average of $58,263 per Bitcoin.

At current market rates, the company’s Bitcoin stash is worth around $40 billion, representing 1.9% of the total Bitcoin supply.

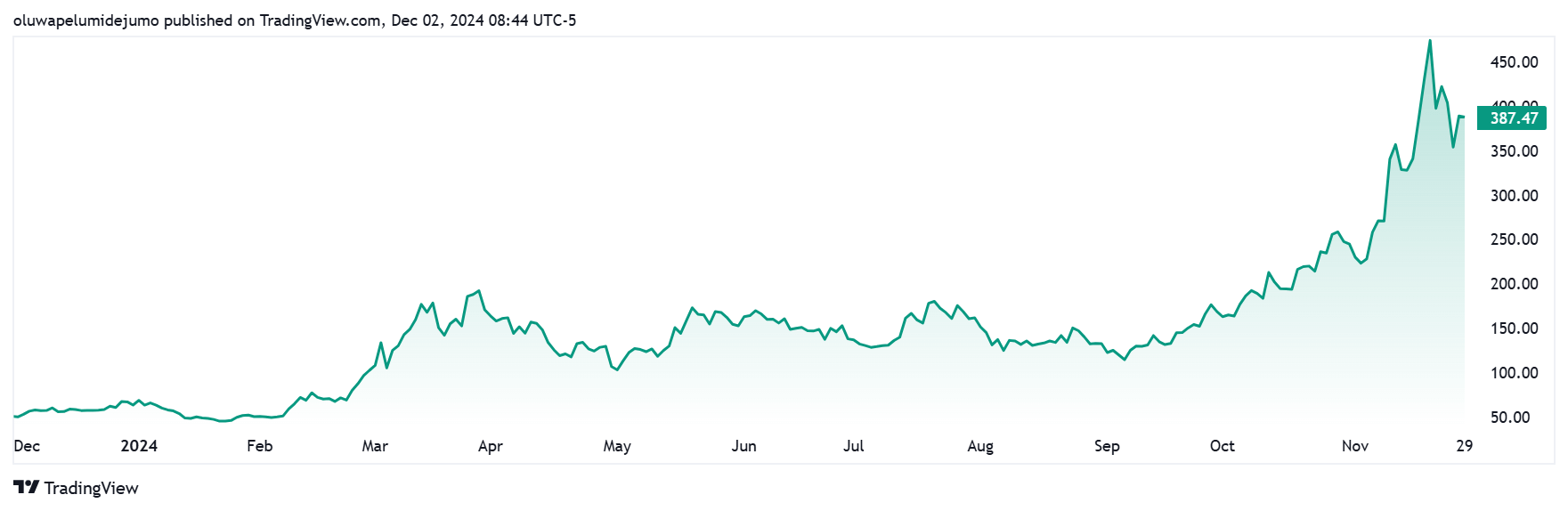

Since adopting its Bitcoin-focused strategy in 2020, MicroStrategy has remained a prominent player in the crypto space. Its aggressive purchases and surge in share price have drawn significant attention.

This year, the company’s stock has soared by more than 515% and briefly earned a spot among the top 100 US publicly traded firms by market capitalization. Despite Bitcoin’s own 2024 gains of 117%, MicroStrategy’s $87 billion market cap exceeds double the value of its Bitcoin assets.

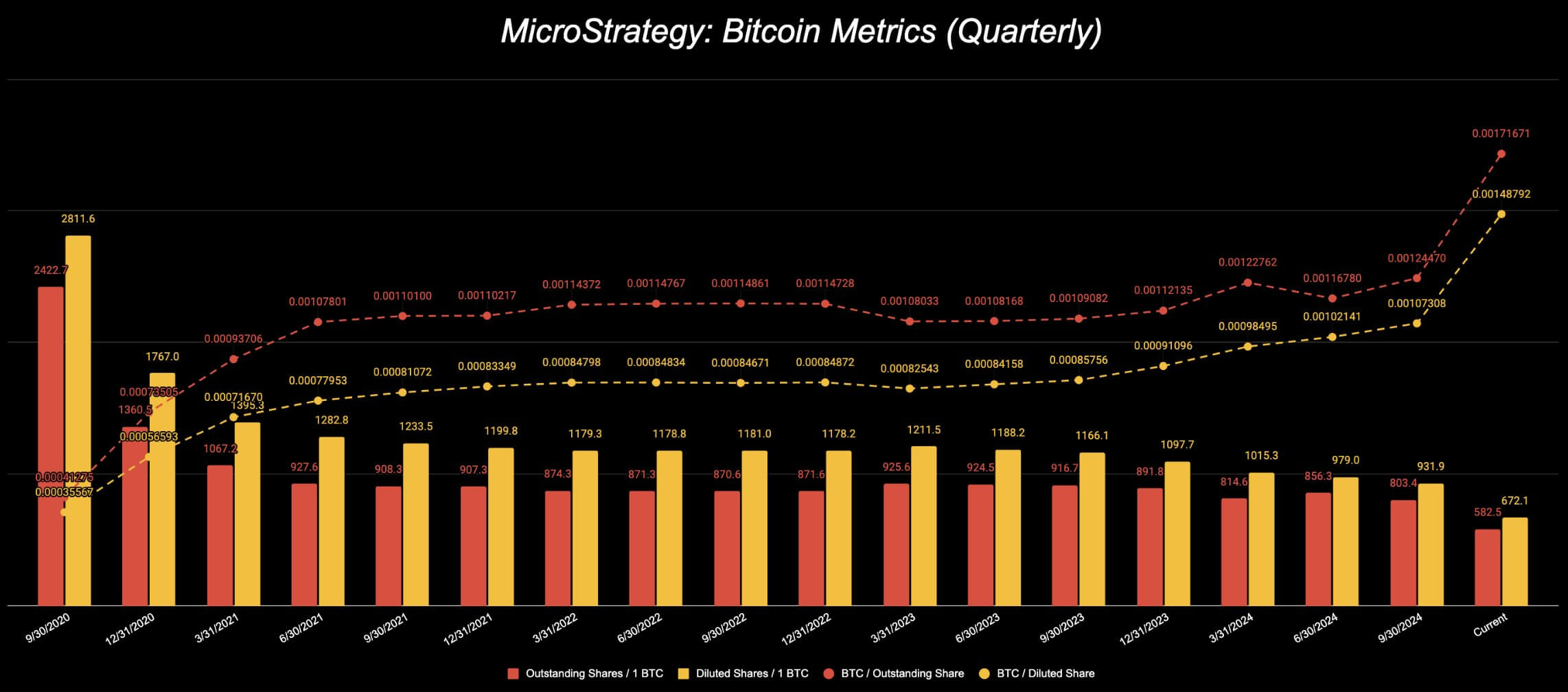

Market analyst Ben Werkman pointed out that the company’s BTC-to-share ratio has continued to climb this year. He also noted that MicroStrategy has $11.3 billion remaining in its at-the-market (ATM) equity offering program, which could fund further purchases.

Meanwhile, MicroStrategy’s updated metrics include BTC per fully diluted share at 0.00148792 and BTC per outstanding share at 0.00171671, underscoring the company’s strategic execution.

CryptoQuant

CryptoQuant