Long-term Bitcoin holders’ recent sell-off raises ghosts of past capitulations

Long-term Bitcoin holders’ recent sell-off raises ghosts of past capitulations Quick Take

Bitcoin’s long-term holders (LTHs), those who have held for more than 155 days, have traditionally been perceived as the ‘smarter money’ due to their experience weathering Bitcoin volatility. Key to their strategy is buying Bitcoin during price slumps and offloading during market euphoria.

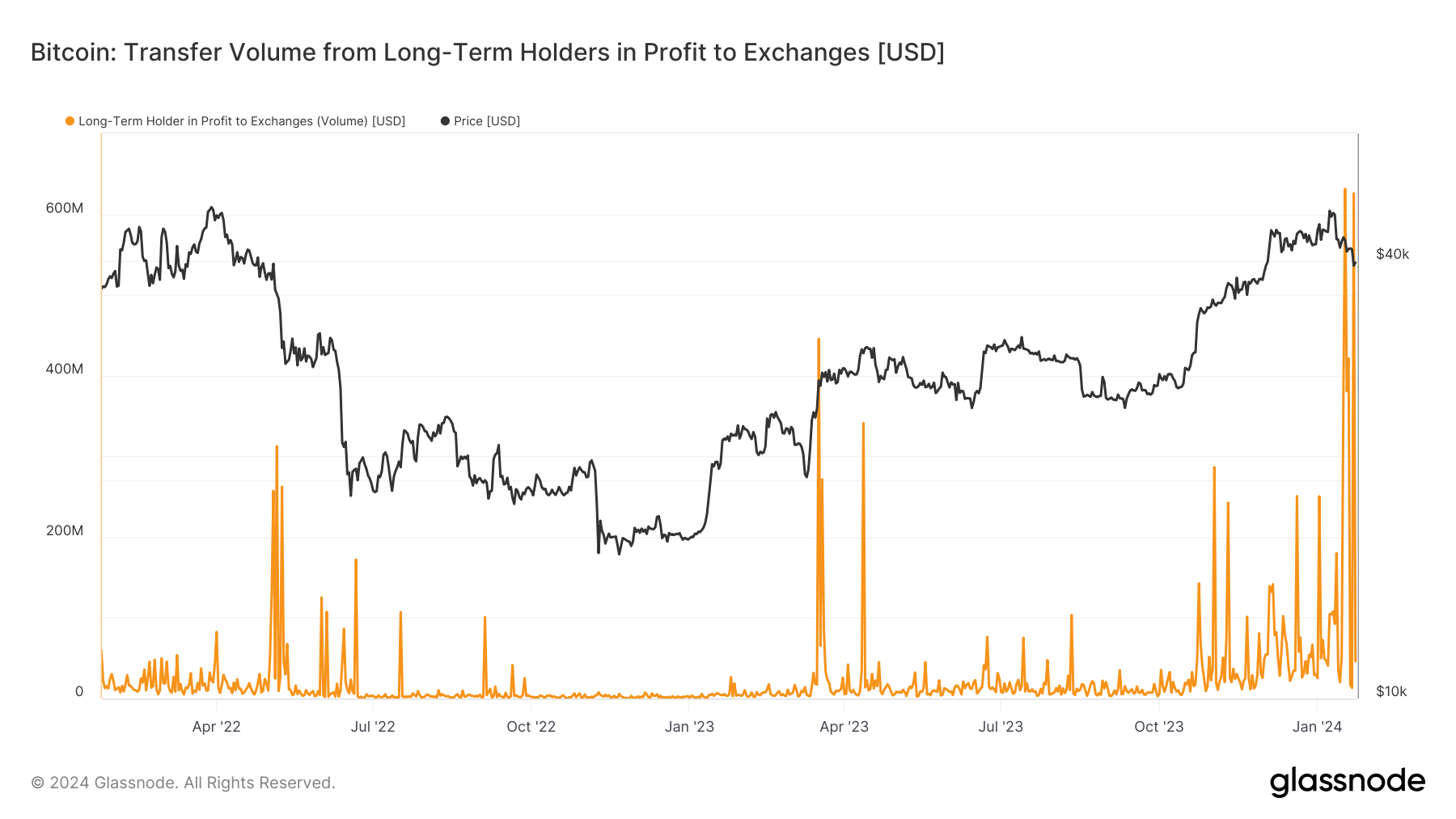

However, observed recent trends hint at a shift. Data analysis indicates that LTHs initiated a sell-off, and this trend has persisted. Notably, on Jan. 22, approximately $625 million in profit was transferred to exchanges, drawing parallels to the activity on Jan. 17.

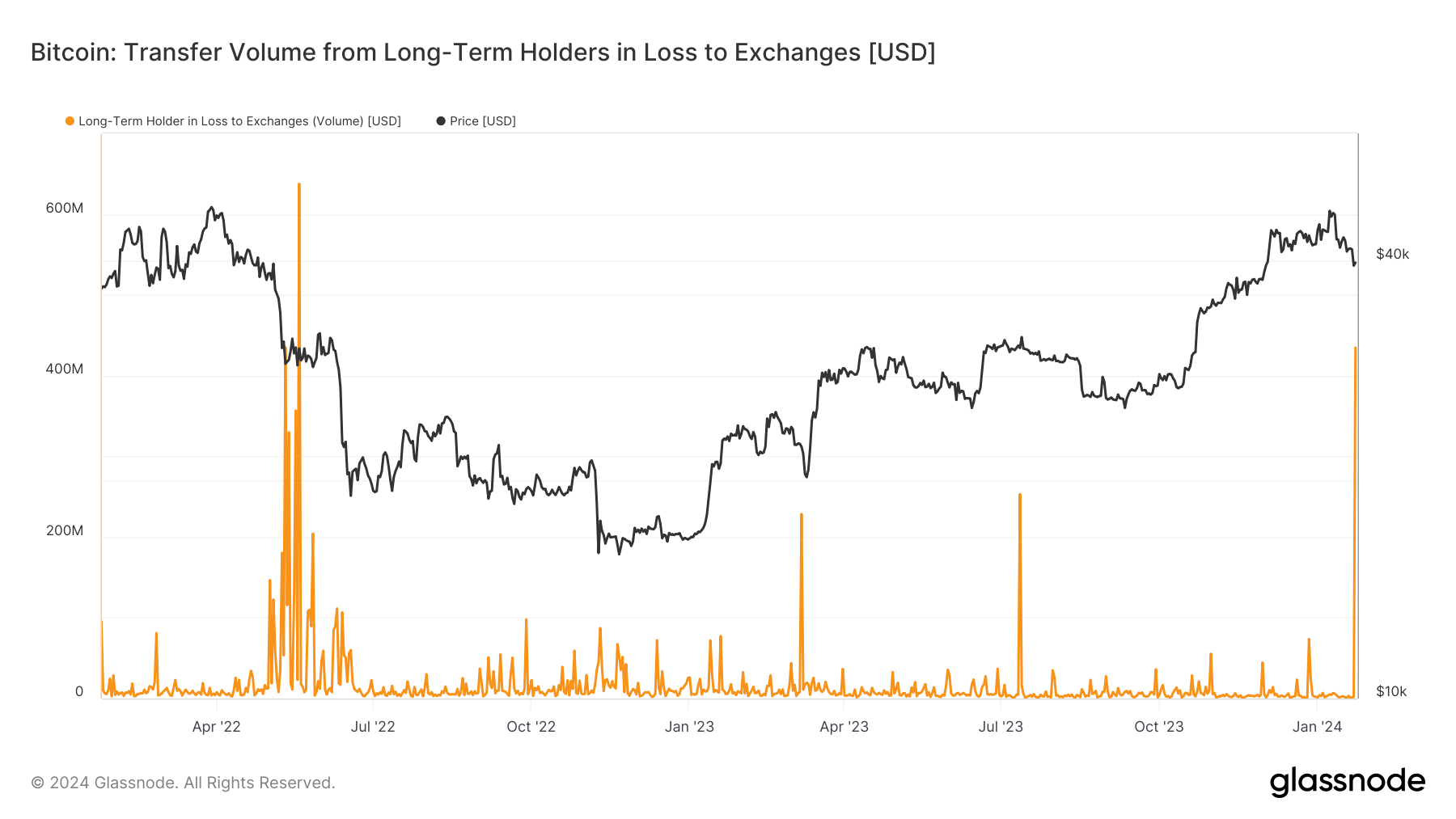

The data trends began to raise eyebrows on Jan. 23, when LTHs transferred coins to exchanges, incurring a substantial loss of approximately $430 million due to Bitcoin falling below $39,000. This situation ominously mirrors the pre-Luna collapse capitulation witnessed in May 2022. Back then, a nearly identical amount was sent to exchanges at a loss, followed by a more severe loss of over $600 million just a week later, right before Bitcoin’s value shockingly plummeted below $20,000.

The repetition of such losses could point towards increasing evidence of capitulation among Bitcoin’s long-term stakeholders.