Long-term Bitcoin holders start to cash in as short-term investors face losses

Long-term Bitcoin holders start to cash in as short-term investors face losses Quick Take

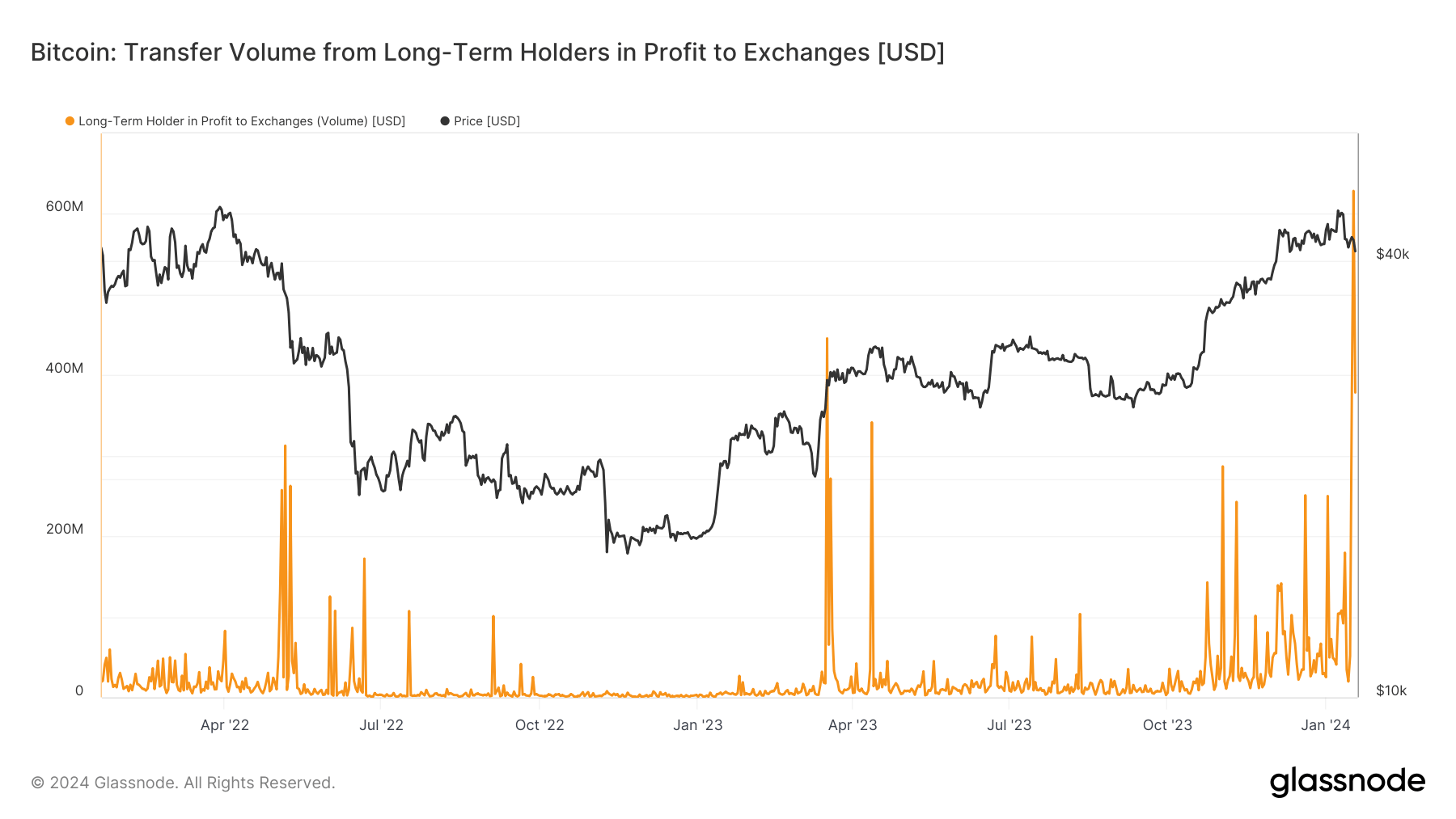

The Bitcoin market is showing differentiation in the behavior of long-term holders (LTHs) and short-term holders (STHs). LTHs, defined as holding Bitcoin for a period of more than 155 days, are beginning to send profits to exchanges. This trend is observed from the time when Bitcoin prices dipped to $26,000 from $30,000 in July 2023, a period roughly corresponding to the last 155 days.

LTHs who invested around that time transferred approximately 25,000 BTC, or around $1 billion, to exchanges on Jan. 17 and 18, thus indicating profit-taking. Interestingly, these long-term investors do not seem to be disposing of their holdings at a loss.

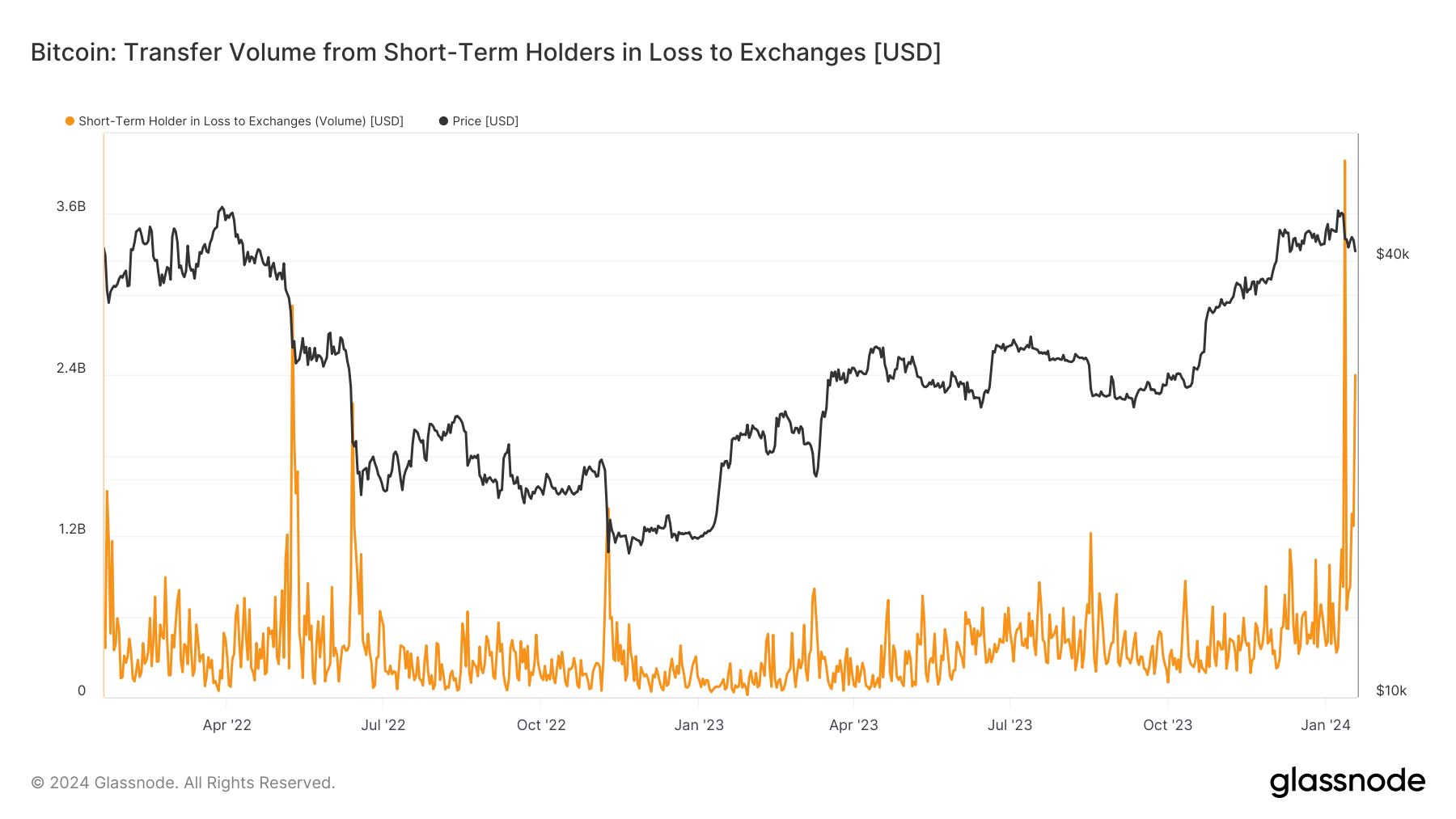

In contrast, short-term holders who hold their Bitcoin for less than 155 days exhibit more erratic behavior. They transferred a significant $2.4 billion worth of Bitcoin to exchanges at a loss on Jan. 18, indicating elevated levels of activity. Profits for these short-term holders are on the decline, and those who had intended to profit from Bitcoin’s rise to $49,000 have likely already done so.