Federal Reserve trails global counterparts in balance sheet reductions, data reveals

Federal Reserve trails global counterparts in balance sheet reductions, data reveals Quick Take

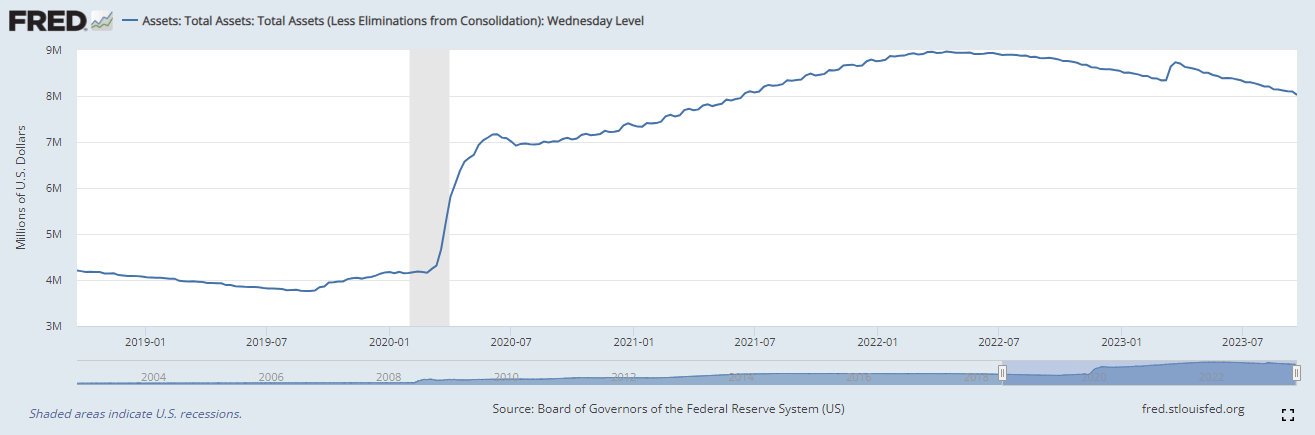

The Federal Reserve’s balance sheet of total assets has seen a reduction of an additional $75 billion in the past week, with total assets now slightly surpassing the 8 trillion mark. For context, prior to the COVID-19 pandemic, the Fed’s balance sheet was approximately $3.5 trillion.

Despite the considerable distance yet to be covered, substantial efforts have been made to reduce the balance sheet via quantitative tightening, achieving a reduction of about 5.5% year to date.

It is interesting, however, to juxtapose this with other leading global central banks. The Bank of England (BOE) has surpassed the Fed’s reduction rate with a 6.5% decrease, the People’s Bank of China (PBoC) at 7.5%, and both the Bank of Japan (BOJ) and the European Central Bank (ECB) have outpaced with reductions exceeding 10%.

This continuation of quantitative tightening will put further pressure on bond yields, with the U.S. 10-year treasury yield rising to 4.5%.

This data underscores the concerted global effort by central banks to rebalance their respective financial territories, navigating the delicate path of recovery in the post-pandemic world.