Dow Jones echoes 1987’s ‘Black Monday’ era with 13th consecutive positive close

Dow Jones echoes 1987’s ‘Black Monday’ era with 13th consecutive positive close Quick Take

Overview of Recent Market Developments

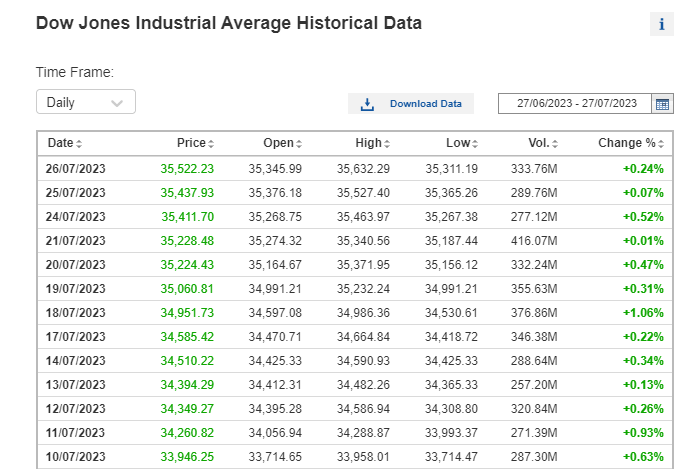

In an unprecedented movement, the Dow Jones index has notched its 13th consecutive positive close, a feat last witnessed in 1987. This year, interestingly, was marked by the infamous recession known as ‘Black Monday.’

Today’s economic conditions appear to echo the patterns of that time, bringing back memories of a turbulent financial landscape.

Parallels Between Now and 1987

The resemblance between the economic setting of 1987 and the present is hard to ignore. Key factors include climbing interest rates, a declining dollar, and growing trade deficits.

The Federal Reserve recently hiked the rates to a whopping 5.5%, marking the highest level since 2001. This decision, coupled with a weakening dollar and mounting trade deficits, underscores the volatility of the current market scenario.

Perspectives from the Field

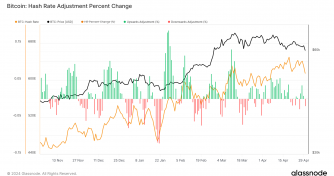

The Ranch Lawyer, a seasoned market analyst, has noted the extreme nature of current market conditions. He emphasizes the unusual stability of the S&P 500, which has seen 40 consecutive trading days without a single -1% day.

This observation further substantiates the notion that we are experiencing a unique, possibly tumultuous economic environment.