Bitcoin’s short-term HODL waves rise, signaling potential rejuvenation in market dynamics

Bitcoin’s short-term HODL waves rise, signaling potential rejuvenation in market dynamics Quick Take

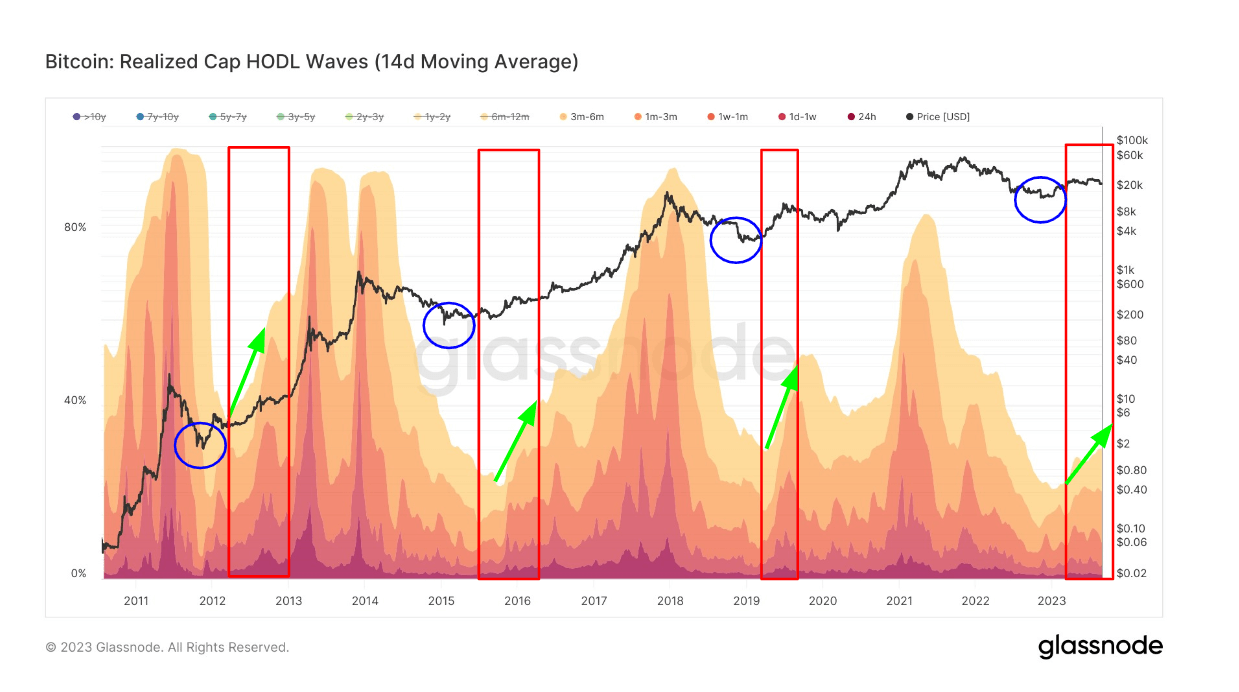

Recent data analysis has indicated a noteworthy trend within the Bitcoin market. Investors who have held Bitcoin for less than 155 days, identified as short-term HODL waves, are beginning to increase. This trend typically emerges post-cycle bottoms, a stage often identified by an upswing in ‘smart’ investors returning to the market. This re-entry tends to generate a Fear of Missing Out (FOMO) among retail investors, although this phase has yet to be observed.

Nevertheless, the increase in short-term HODL waves is a positive indication, suggesting a rejuvenation of investor interest and activity. This cohort is nearing 40% of the total Bitcoin supply, a level that could potentially have significant implications for the market dynamics. This insight provides an understanding of the current market conditions and the potential trajectory based on historical patterns, reflecting the cyclical nature of cryptocurrency markets.