Bitcoin reaches peak realized price for short-term holders as new investor activity surges

Bitcoin reaches peak realized price for short-term holders as new investor activity surges Quick Take

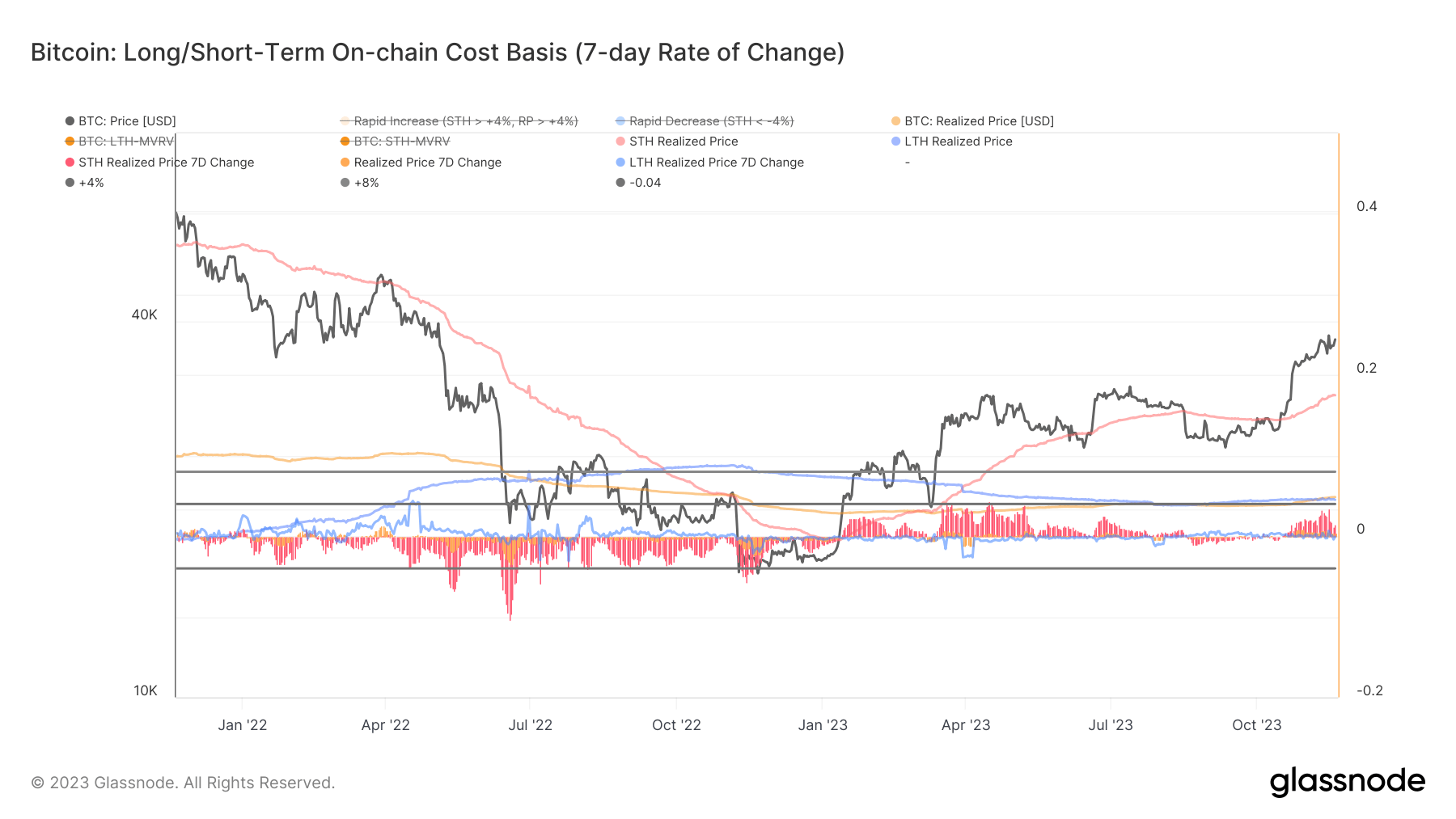

Bitcoin’s realized price, representing the aggregate on-chain acquisition cost, has hit its yearly high of $20,926. Concurrently, the short-term holder realized price – an indicator for coins outside exchange reserves moved within the last 155 days – has likewise achieved a yearly peak of $30,462. This ascension emphasizes an increased probability of these coins being spent on a given day and signifies the influx of new investors, with a remarkable 3% surge being the highest since May 2023.

In stark contrast, the long-term holder realized price, showcasing the on-chain acquisition cost for coins held beyond 155 days, continues to decline, now at $20,716. Nevertheless, with Bitcoin’s price still soaring over $37,000, CryptoSlate’s analysis suggests the four-year cycle could remain intact.