Bitcoin rally sparks exchange activity

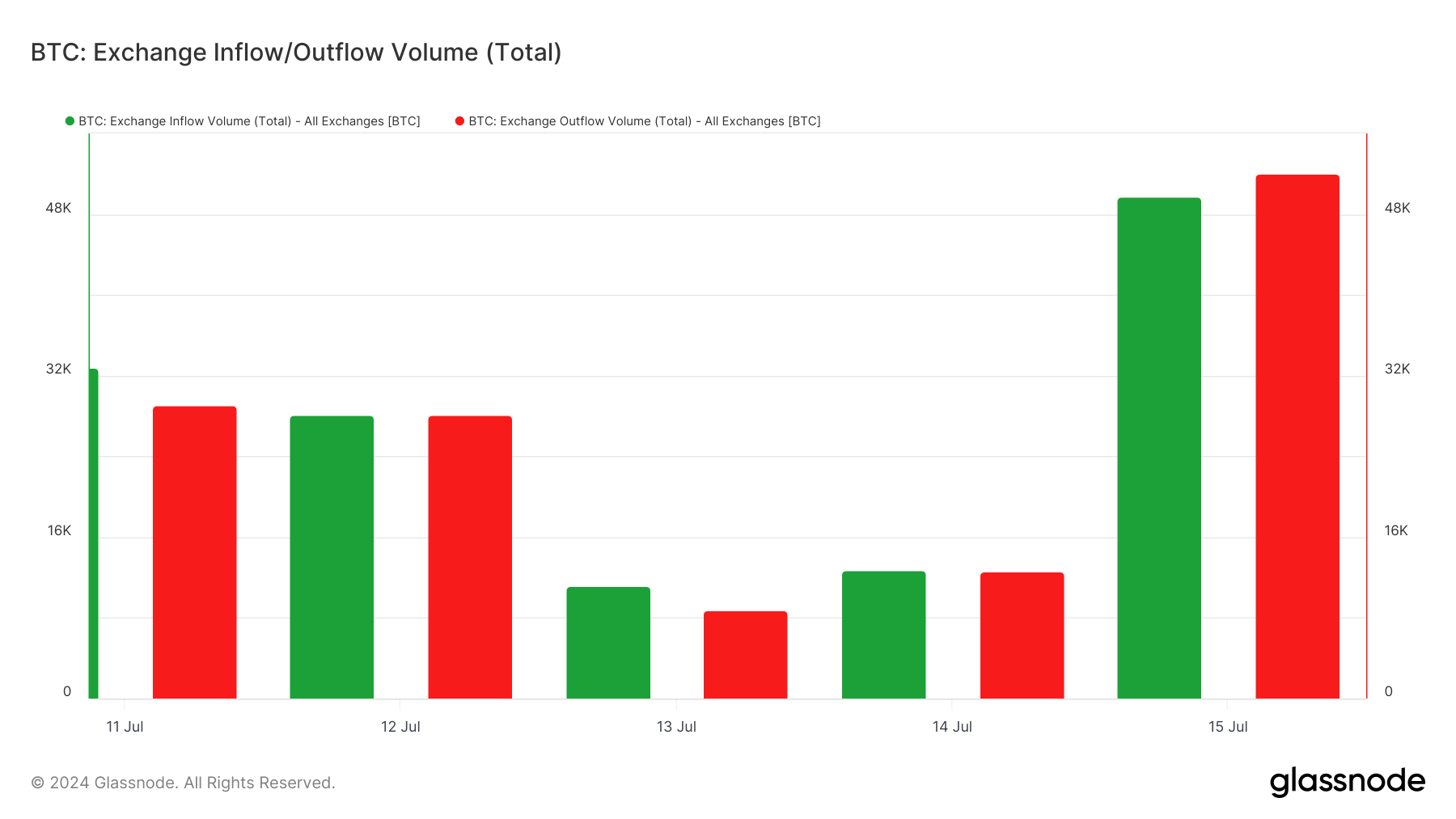

Bitcoin rally sparks exchange activity Bitcoin’s rally past $64,000 caused a significant spike in exchange activity. Data from Glassnode showed a sharp increase in exchange inflows between July 14 and July 15, increasing from 12,684 BTC to 49,769 BTC. It indicates that many market participants moved their Bitcoin to exchanges, likely to realize profits driven by the price rally.

The increase in exchange inflows was outpaced by exchange outflows, which increased from 12,674 BTC to 52,062 BTC in the same period. This action can be interpreted as a sign of confidence among holders who believe in further price appreciation and choose to secure their assets off exchanges to avoid selling pressures.

The concurrent rise in inflows and outflows alongside the price increase reflects a market experiencing both profit-taking and strategic long-term holding. As the price increased, both realized and unrealized profits grew, encouraging varied strategies among investors. Short-term traders likely drove the inflows to exchanges, while long-term holders were responsible for the significant outflows.

Farside Investors

Farside Investors

CoinGlass

CoinGlass