Bitcoin price surge to $35,000 triggers over $1.5B in profit-taking

Bitcoin price surge to $35,000 triggers over $1.5B in profit-taking Quick Take

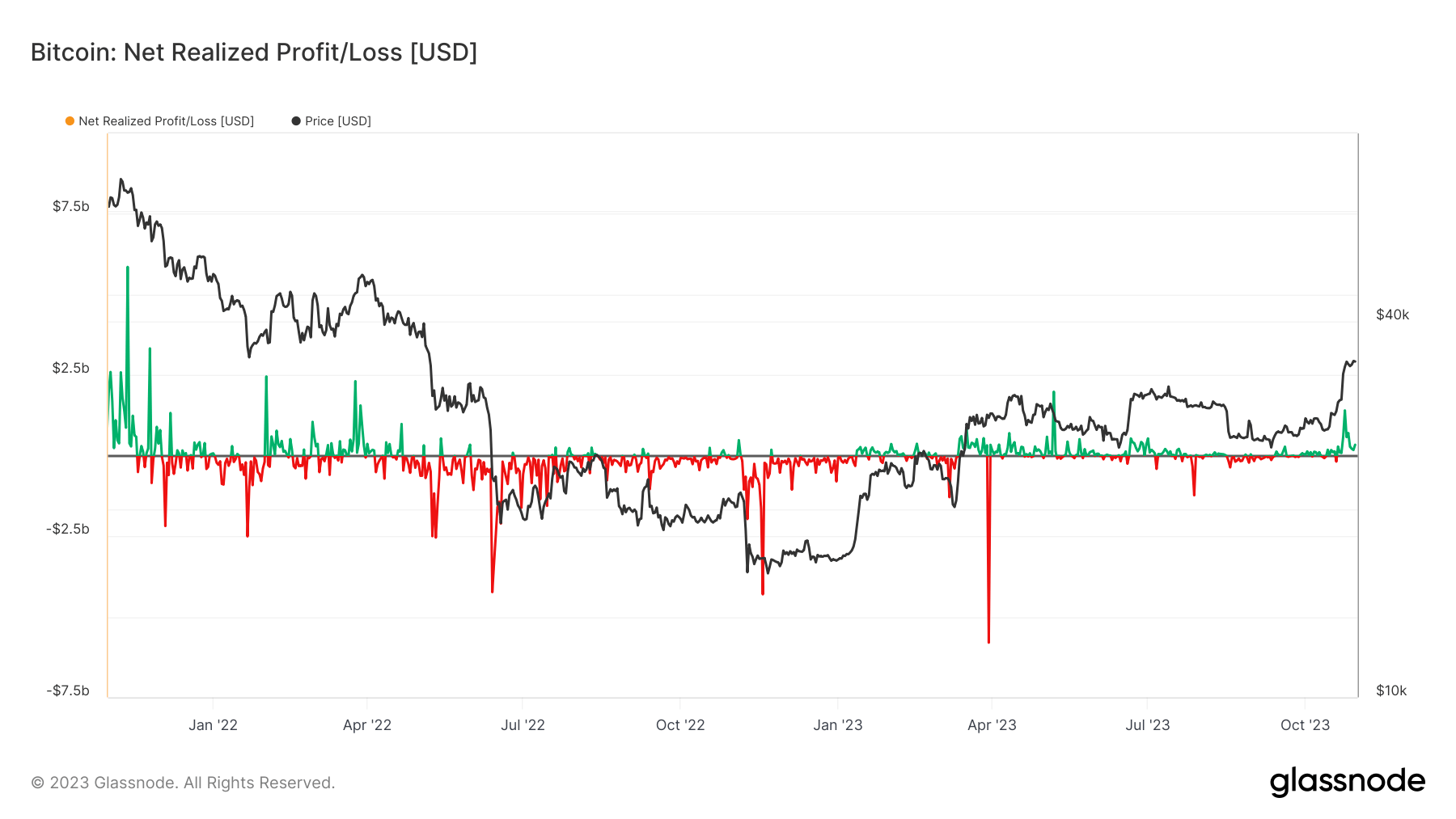

CryptoSlate’s recent data analysis reveals intriguing patterns in Bitcoin profit-taking behaviors amid volatile market conditions. The analysis showed that the Bitcoin price level of $35,000 has acted as a short-term resistance, with a surge in profit-taking around this point.

Specifically, on Oct. 24, over $1.5 billion of realized profit was reported, marking the second-highest profit-taking event this year. The only other higher instance occurred on May 7, coinciding with Bitcoin’s significant drop from $30,000 to $25,000.

The data further showed that a majority of this profit-taking was led by short-term holders, specifically those who purchased Bitcoin within the last 155 days when the price rose from $25,000 to $34,000.

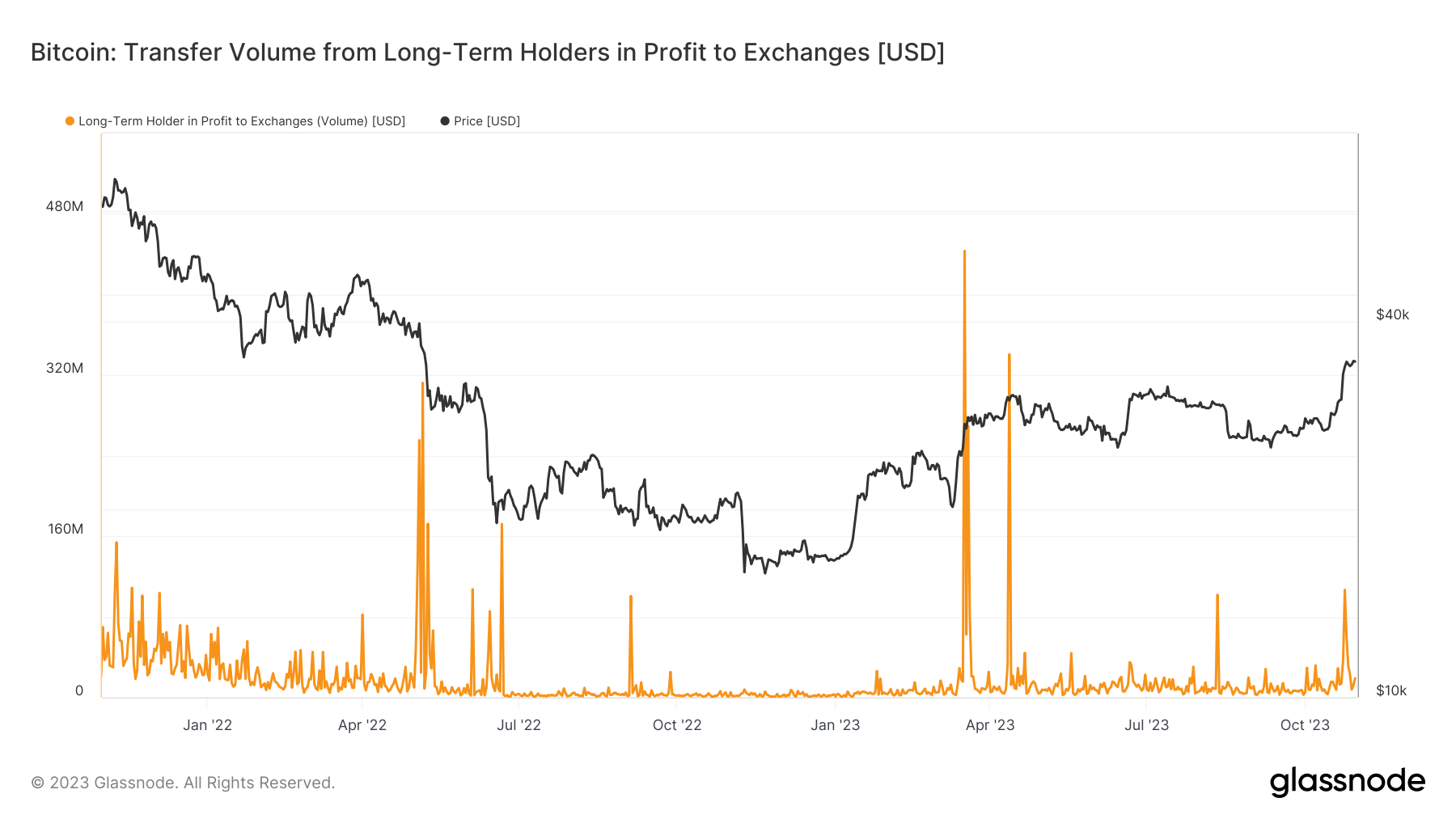

Interestingly, profit-taking among long-term holders appeared to be minimal, accounting for a mere $100 million. This indicates a level of steadiness in the market amid shorter-term turbulence.