Gaming unique active wallets grew 60% in 2022 – on-chain transactions up 37%

Gaming unique active wallets grew 60% in 2022 – on-chain transactions up 37% Gaming unique active wallets grew 60% in 2022 – on-chain transactions up 37%

Wax, Hive, and BNB chain became the most popular gaming blockchains with 353,000, 234,000, and 136,000 daily UAWs, respectively

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Web 3 gaming on-chain transactions and Unique Active Wallets (UAW) recorded 37% and 60% growth during 2022, according to a recent report from DappRadar.

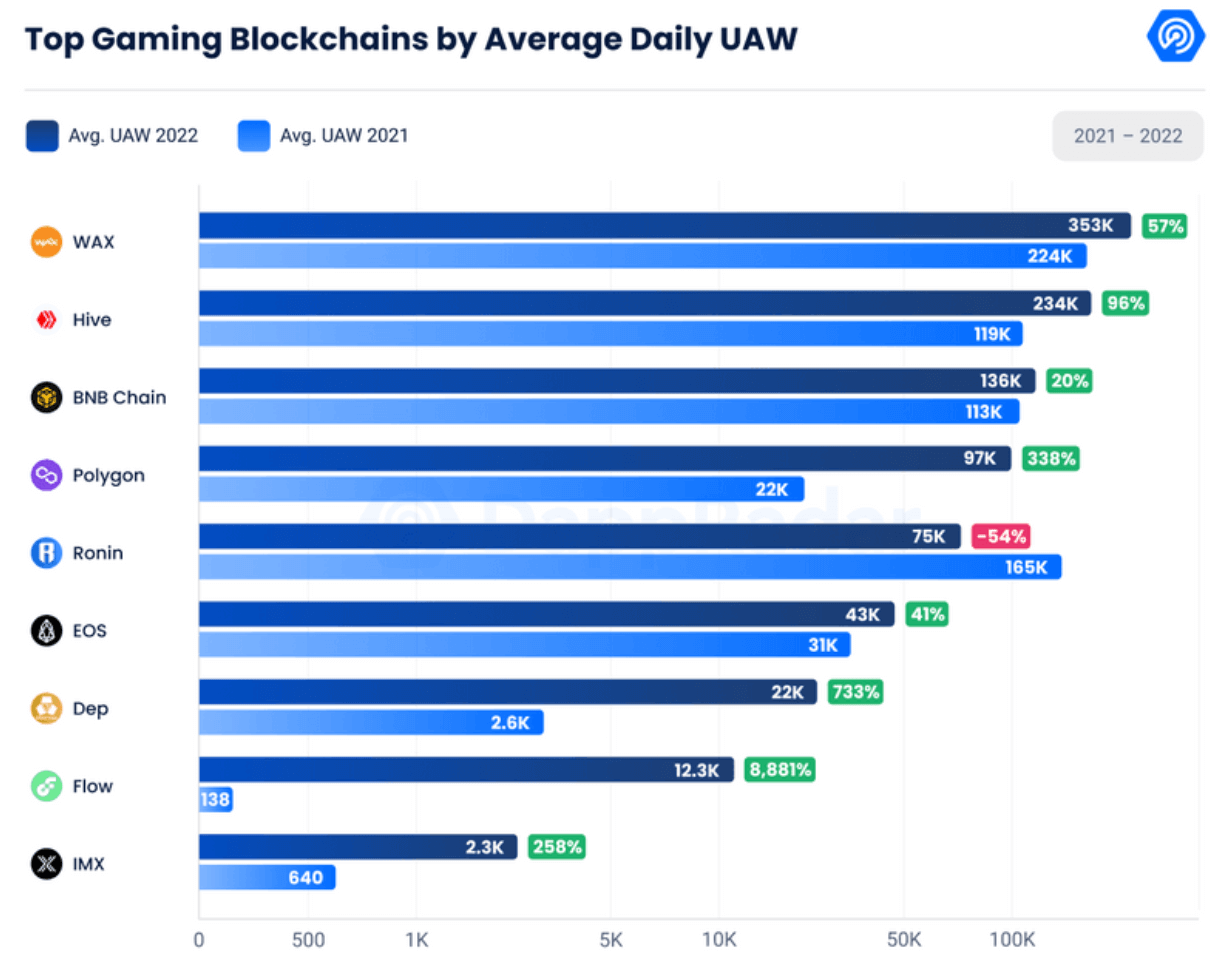

The top three most popular gaming blockchains were Wax (WAXP), Hive (HIVE), and BNB Chain (BNB), with 353,000, 234,000, and 136,000 daily UAWs, respectively, according to the DappRadar report.

Gaming growth

Currently, 1.15 million daily UAWs connect to gaming dApps, marking a 60% increase over 2021. This increase in daily gaming UAW numbers also allowed games to dominate DeFi UAWs in 2022.

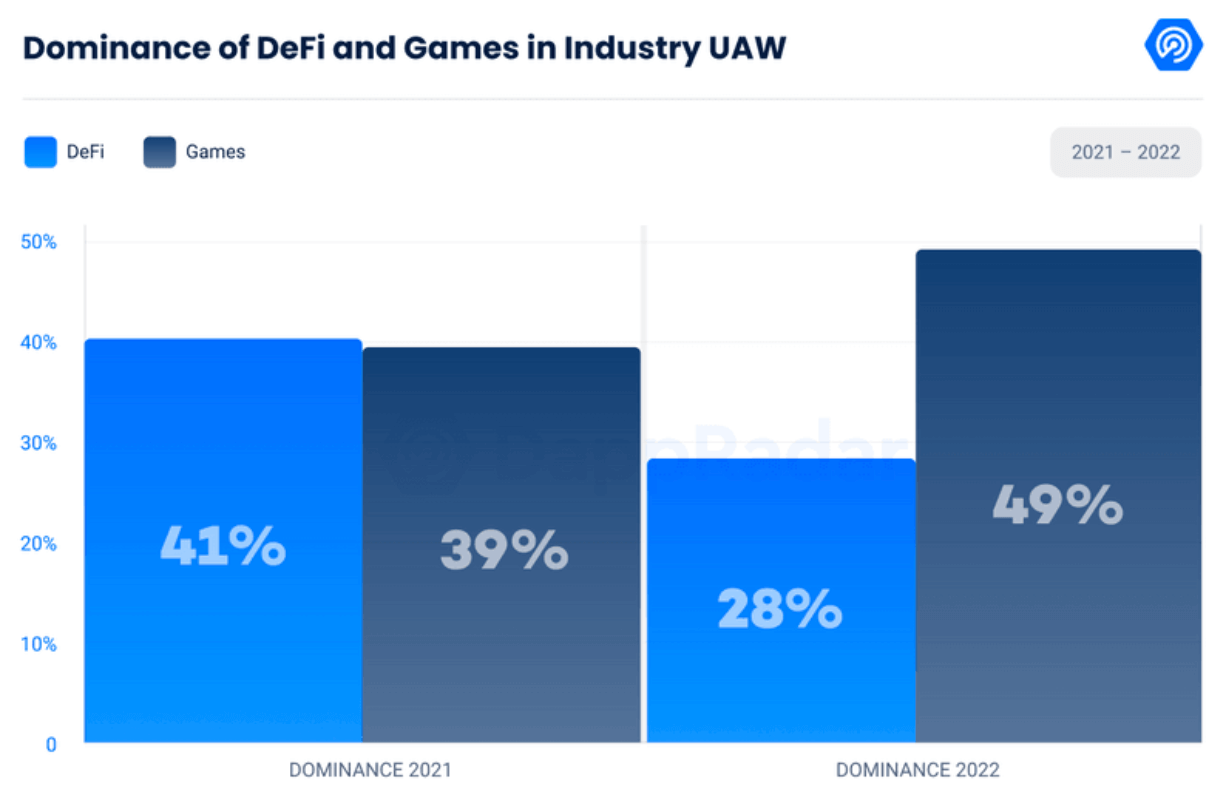

In 2021, Defi UAWs were dominant by occupying 41% of the industry share, while gaming’s was 39%. This changed to 28% for Defi and 49% for gaming in 2022, positioning the gaming UAWs as the dominants of the market.

Meanwhile, on-chain game transactions have increased to 7.4 billion in 2022, marking a 37% increase since 2021 and an impressive 3,260% since 2020. One unique wallet conducted 25 gaming on-chain transactions on average in 2022.

This growth was recorded despite the halting effects of the bear market, which caused many aspects of the crypto sphere to shrink. Gaming activities, however, currently account for 49% of the on-chain activity DappRadar tracks.

Chains

Protecting its ranking in 2021, Wax remained the most popular gaming blockchain that hosted the highest number of daily UAWs. Wax attracted 353,000 daily UAWs, which marked a 57% increase from 224,000 in 2021.

Hive, BNB Chain, and Polygon (MATIC) followed WAX as the second, third, and fourth in ranking with 234,000, 136,000, and 97,000 daily active UAWs, respectively. 2022’s numbers marked 96% and 20% year-over-year growth for Hive and BNB Chain.

However, Polygon’s UAW count in 2022 marked a staggering 338% growth since 2021. The report states that the chain owes this expansion to the popularity of games like Arc8, Benji, Bananas, Crazy Defense Heroes, and Pegaxy.

Increasing its daily UAW count from 138 in 2021 to 12,300, Flow (FLOW) recorded the most extensive growth in 2022 with 8,881%.

Investments

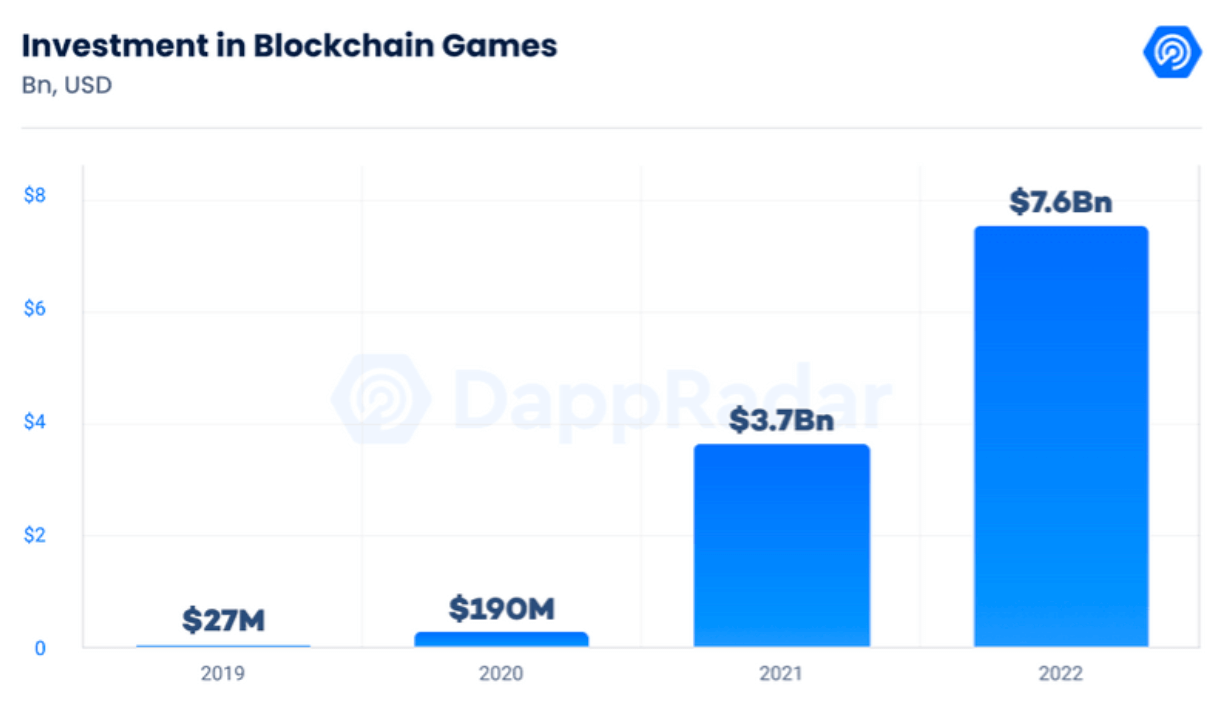

Throughout 2022, Web3 Gaming and metaverse projects jointly raised $7.6 billion in investment, which marks a 59% increase since 2021.

In 20219 and 2020, the total amount of investments raised by these fields was measured in millions. It reached billions for the first time in 2021, with a total of $3.7 billion.

The three most significant investments that fell under this category in 2022 were Flow’s $725 million Ecosystem Fund, the $500 million investment fund by Immutable X, and the $450 million funding raised by Yuga Labs and Polygon each.

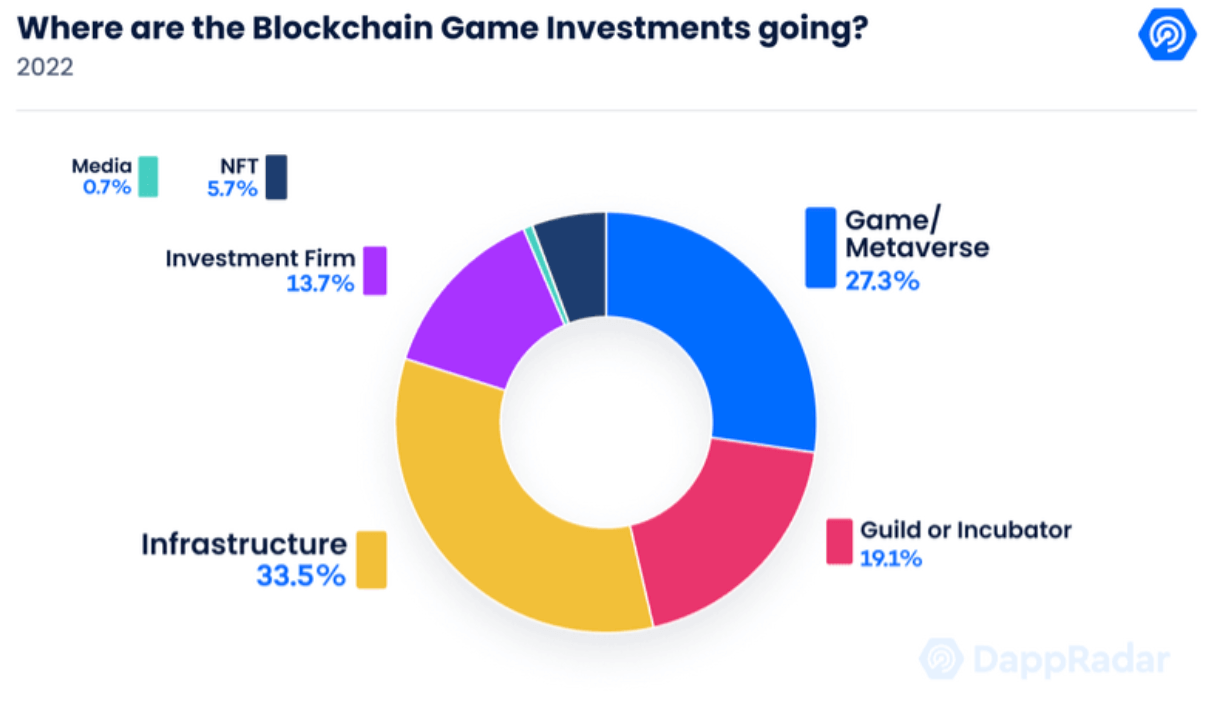

The above graph represents the breakdown of the $7.6 billion spared in gaming and the metaverse in 2022. Projects focusing on infrastructure reserved 33.5% ($2.54 billion) for themselves. Another $2 billion went to individual gaming and metaverse projects, which accounted for 27.3% of the total amount. Guilds and incubator programs got another $1.4 billion, while investment firms got $1 billion.

CoinGlass

CoinGlass

BTC

BTC