Futures data suggests latest Bitcoin rally is just short-covering, most Bakkt contracts aren’t being settled

Futures data suggests latest Bitcoin rally is just short-covering, most Bakkt contracts aren’t being settled Futures data suggests latest Bitcoin rally is just short-covering, most Bakkt contracts aren’t being settled

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

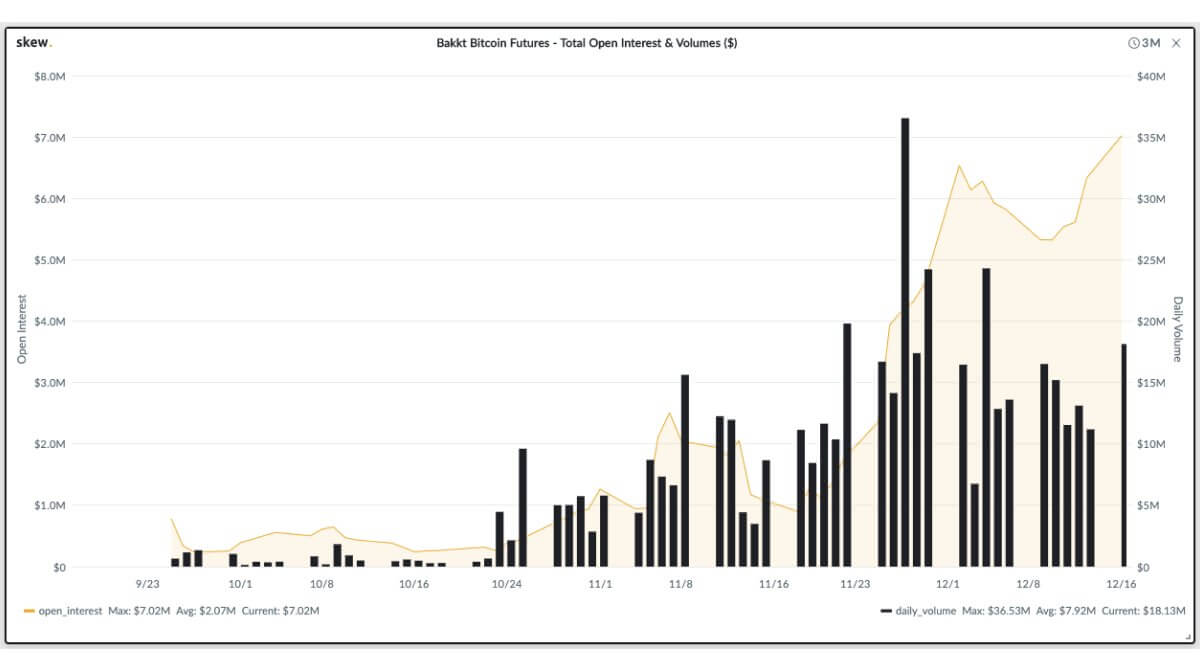

A massive drop in open interest on the CME and Bakkt Bitcoin futures contracts indicates short-covering has fueled BTC’s latest rally, likely egged on by the expiry of Bakkt’s December contract.

On Tuesday, open interest rocketed more than 1,000 percent on the cash-settled CME contract for December, the day after Bakkt hit an all-time-high for open interest on its physically-settled December contract, according to analytics outfit Skew Trading.

Shorts covered

The next day, open interest fell off a cliff on Bakkt and CME, dropping by 39% and 25% respectively . Coinciding with Bitcoin’s sharp thousand-dollar rally to the upside, the sudden drop in open interest suggests both CME and Bakkt traders have been exiting a large number of short positions and driving BTC up.

Wednesday's Bakkt Bitcoin Monthly Futures:

? Traded contracts: 6601 ($47.30 million, +74%) (New ATH ?)

? All time high: 6601 (12/18/2019)

? Open interest: $3.98 million (-39%)Knowing bots, we recommend this smart trading bot: https://t.co/W8ClGYnuNn pic.twitter.com/yfGFHrhXec

— Bakkt Volume Bot (@BakktBot) December 19, 2019

The timing of the rally is hardly surprising — coming just hours before the expiry of the Bakkt December contract. As previously reported by CryptoSlate, Bakkt’s push to offer cash-settled futures has called into question whether institutional traders are interested in gaining exposure to Bitcoin via physically-settled futures contracts. As such, the latest short cover suggests Bakkt’s contracts are functioning mostly as a vehicle for short-term speculation.

Many traders appear to have rolled over their contracts to January on both Bakkt and CME, however, which could translate to bullish sentiment for Bitcoin’s longer-term outlook.

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)