Ethereum sees rocketing open interest and futures volume; here’s what this means

Ethereum sees rocketing open interest and futures volume; here’s what this means Ethereum sees rocketing open interest and futures volume; here’s what this means

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ethereum has found itself caught within a firm and unwavering uptrend throughout the past 48-hours, with Bitcoin’s surge past $7,000 providing ETH with some significant momentum that has allowed it to outperform the aggregated market.

This rally has led the cryptocurrency to see a massive surge in futures trading volume and open interest (OI) on popular trading platform BitMEX, with both of these things being a sign that the crypto will see further near-term volatility.

Because ETH has underlying technical strength and has formed what is widely considered to be a bullish market structure, it is a possibility that the crypto will soon rally towards $200.

Ethereum volatility unlikely to let up anytime soon, data shows

Ethereum’s recent rally has allowed it to surge from multi-day lows of $140 to highs of nearly $175, with the crypto only trading down marginally from this level.

This rally has allowed ETH to outperform Bitcoin, and data now seems to suggest that analysts anticipate it to see a further extension of this volatility in the near-term.

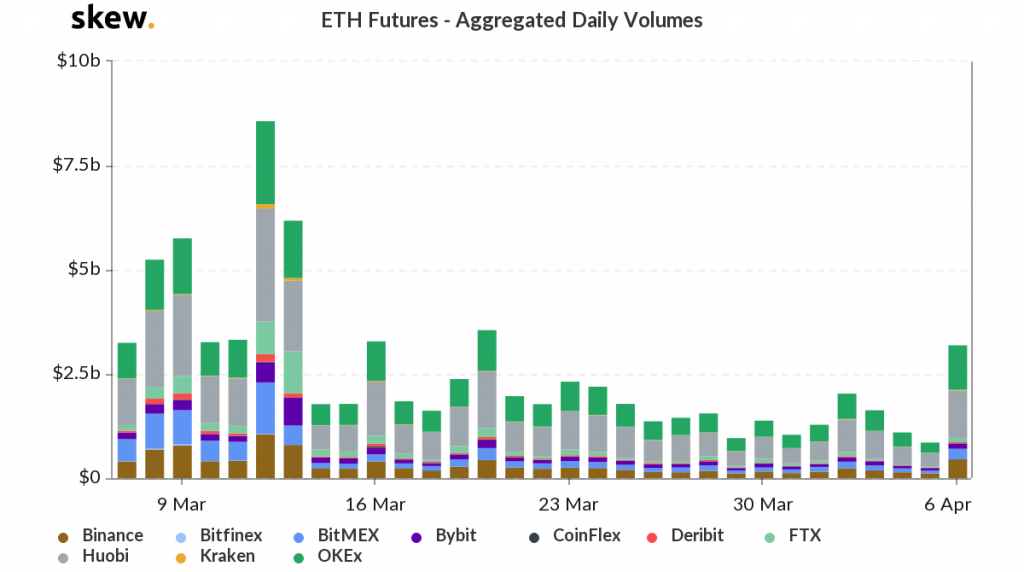

According to data from research and analytics platform Skew, Ethereum saw a notable surge in its futures volume on April 6th, with this uptick in volume stemming from Binance, Huobi, and OKEx.

As seen on the above chart, this led futures volume to rocket from roughly $1 billion on April 5th to $3 billion on the 6th, hitting levels not seen since March 20th, which is when the crypto rallied from $115 to $150.

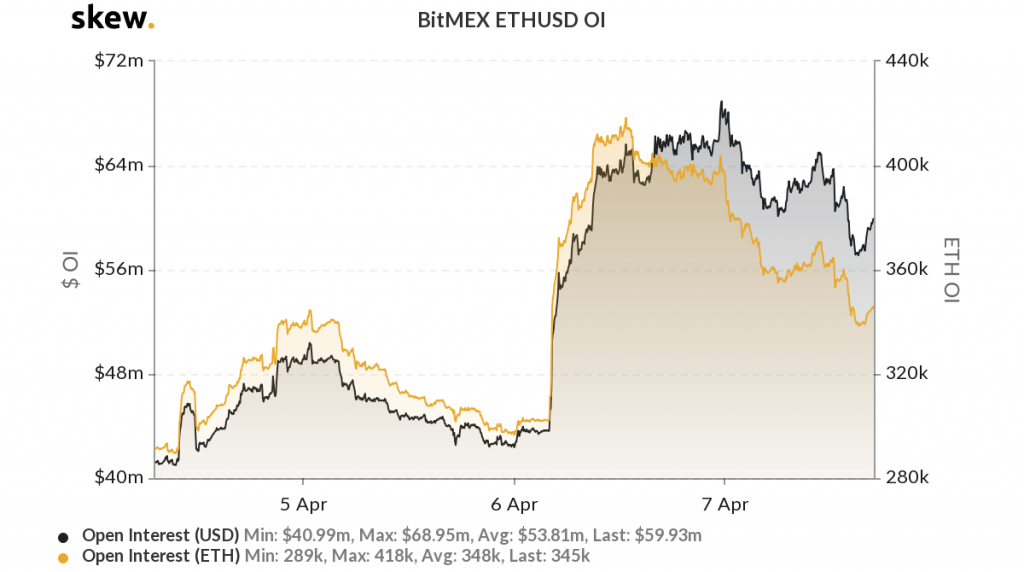

Concurrently with the rise in futures, open interest on Bitmex also rose sharply, a sign that retail traders are also anticipating further volatility.

Which side will this volatility favor?

As reported by CryptoSlate yesterday, a simple ascending triangle that Ethereum recently established and confirmed may allow it to climb towards $200 in the near-term, with this pattern being highly bullish.

Furthermore, $200 is also where there is significant resistance and liquidity, making this an ideal region for long ETH traders who may be looking to exit their positions.

Although Ethereum may remain closely correlated to Bitcoin, its outperformance of the benchmark cryptocurrency may give it room to run significantly further if BTC is able to continue inching higher.

The massive increase in trader activity – per ETH’s rising open interest and futures volume – may also work to fan the flames currently fueling its uptrend.

Ethereum Market Data

At the time of press 6:44 pm UTC on Apr. 7, 2020, Ethereum is ranked #2 by market cap and the price is up 4.8% over the past 24 hours. Ethereum has a market capitalization of $18.9 billion with a 24-hour trading volume of $22.34 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 6:44 pm UTC on Apr. 7, 2020, the total crypto market is valued at at $208.3 billion with a 24-hour volume of $162.5 billion. Bitcoin dominance is currently at 64.32%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)