Introduction to Cryptocurrency Trading: The Four Types of Trades

Introduction to Cryptocurrency Trading: The Four Types of Trades Introduction to Cryptocurrency Trading: The Four Types of Trades

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Since Bitcoin began to appear in the news, everyone started to follow its price fluctuations. As a result, millions of new investors began trading cryptocurrencies. Of course, as with any investment vehicle, there are many different trading strategies, so it’s important to identify which one suits you best.

To be successful in the world of cryptocurrency trading you must know the market very well, but above all, you must know yourself. Perhaps this is even more important than knowing the market, and your future in the world of crypto may depend on this level of self-honesty.

If you don’t believe this, ask a trader how Cardano, IOTA, or a currency as crazy as TittieCoin works, and he may answer that he has no idea; however, if he is a good trader, he will know exactly how to profit from them only by applying the best strategies based on market analysis and adapting that analysis to his own personality.

In general, there are four types of cryptocurrency traders based on the time they take between the opening and the closing of an operation (between buying and selling or vice-versa). You can combine two or more strategies, but the important thing is to know how to distinguish them and the differences in each one. From shorter to longer times, the types of trading are:

- Scalping: This type of trading is done by buying and selling in seconds or a few minutes at most.

- Day Trading: Consists of opening positions at the beginning of the day and closing at the end of the day or earlier. Never leave positions open for more than 24 hours

- Swing Trading: Consists of keeping positions open for several days

- Position Trading: Consists in medium or long-term trading, with the possibility of waiting years to close a position

The Inpatient: Scalper

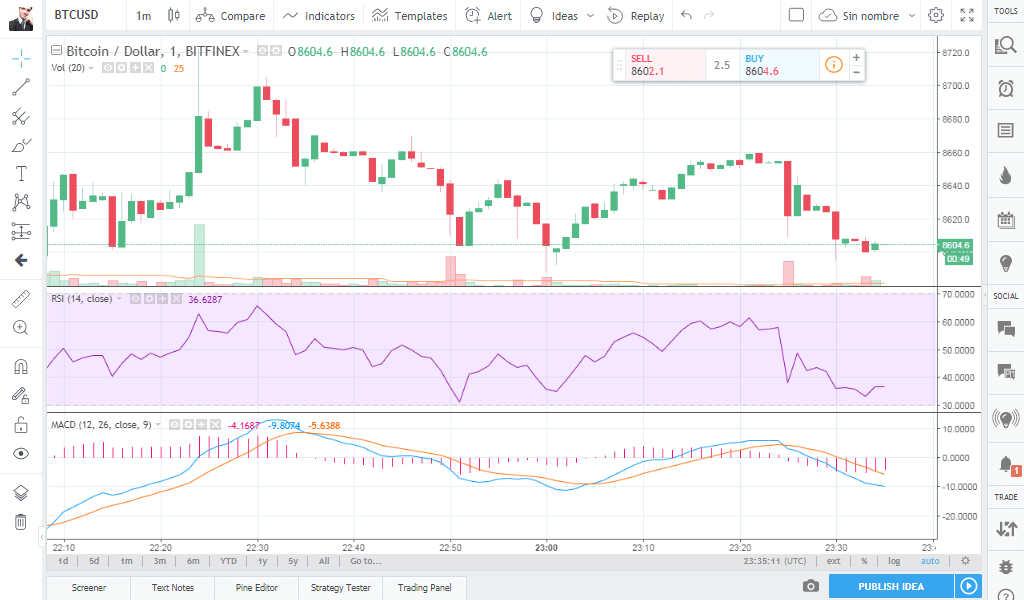

Scalping is a type of cryptocurrency trading which is based on buying and selling almost instantly. It is perfect for those looking for a fast trading style. The scalper does not take his eyes off the screen, seeing the variations in real time. These trades typically don’t last more than 5 minutes.

This type of trading requires a lot of leverage to obtain considerable profits, and it involves opening and closing many operations on the same day. The idea is to bet a lot of money to get very little profit but in a brief time.

The analysis of trends is not very important in this type of trading because short-term predictions are less accurate. If you are a scalper, you must know how to make quick decisions. You cannot “get attached” with a coin, and you must be very strict with your limits of Take-Profit and Stop-Loss.

You MAY like Scalping if:

- You like coffee

- You prefer quick strategies

- You prefer to react more than analyze

- You are impulsive

- You can not wait long without knowing how your operations are going

- You are willing to spend several hours in front of the computer watching graphics

- The connection of your computer is fast and stable

You may NOT like Scalping if:

- You enjoy a cup of tea in the tranquility of your home

- You do not like working under pressure

- You prefer to analyze your actions well before acting

- You get distracted fast

- You want to get significant benefits

- You do not wish to risk a lot

Famous Scalper: Paul Rotter, does more than 100,000 daily operations

The Relaxed: Day Trader

Day trading is a short-term trading strategy that consists of opening a few positions at the beginning of the day and closing them at the end. This way, there is a greater range of action and a quieter period of operation, controlling the risks of leaving a trade open for a few days and suffering a change of trends by an unexpected event. i.e., if you live in the United States and leave a position open, bad news from Asian governments may cause a fall while you sleep. In the same way, some good news may generate an increase, but at the end of the day, what matters to the Day Trader is having control over the information.

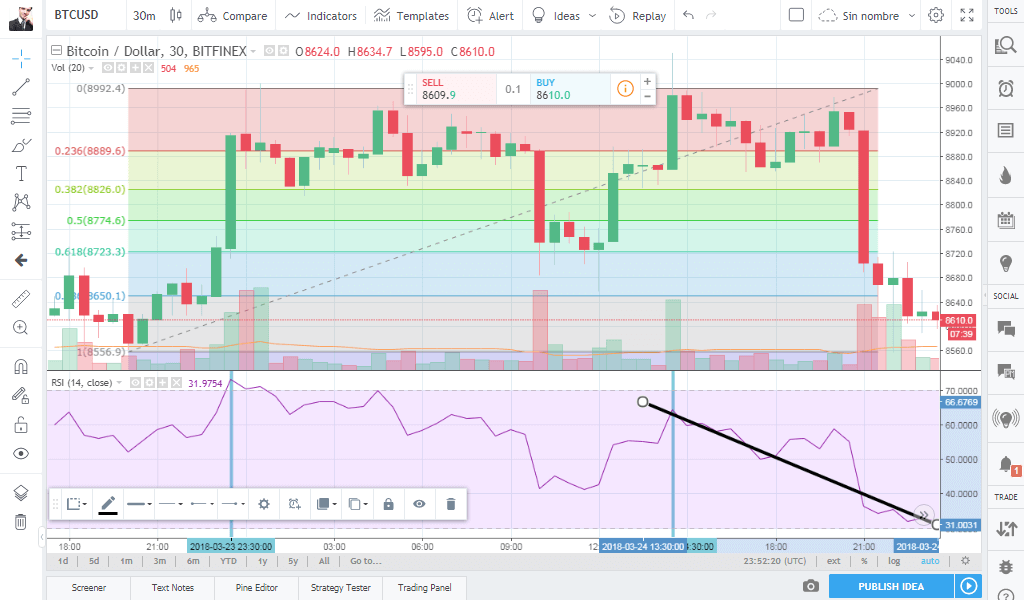

The most common candles daytraders operate with are candles from 15 to 30 minutes. Sometimes they observe 4-hour behaviors to see if their trading is part of a trend.

They use indicators and technical analysis. The most recommended ones are the MACD and the RSI.

You MAY like Day Trading if:

- You are starting in the world of trading and want to use a type of comfortable trading that allows you to evaluate your results and modify your strategies

- You want to know at the end of the day how your trading went

- You like security and feel in control

- You have an occupation that does not allow you to devote all your time to trading but you are an enthusiast of this world (maybe from time to time you look at the graphics of your favorite crypto through a widget on your phone)

You may NOT like Day Trading if:

- You like long-term trading

- You do not like technical analysis

- You are an expert and trading is your life

Day trading is for a level between a complete novice and a proficient trader.

Famous Day Trader: In the world of ForEx Takashi Kotegawa is a very successful day trader who has amassed several Million Yen in profits.

The Patient: Swing Trader

This is the most common type of trading in the cryptomarket. Generally, because of the significant volatility of altcoins, traders buy a currency and then change it to USD, BTC or ETH only to buy another altcoin and thus maintain their wave of profit (most altcoins are quoted mainly against Bitcoin).

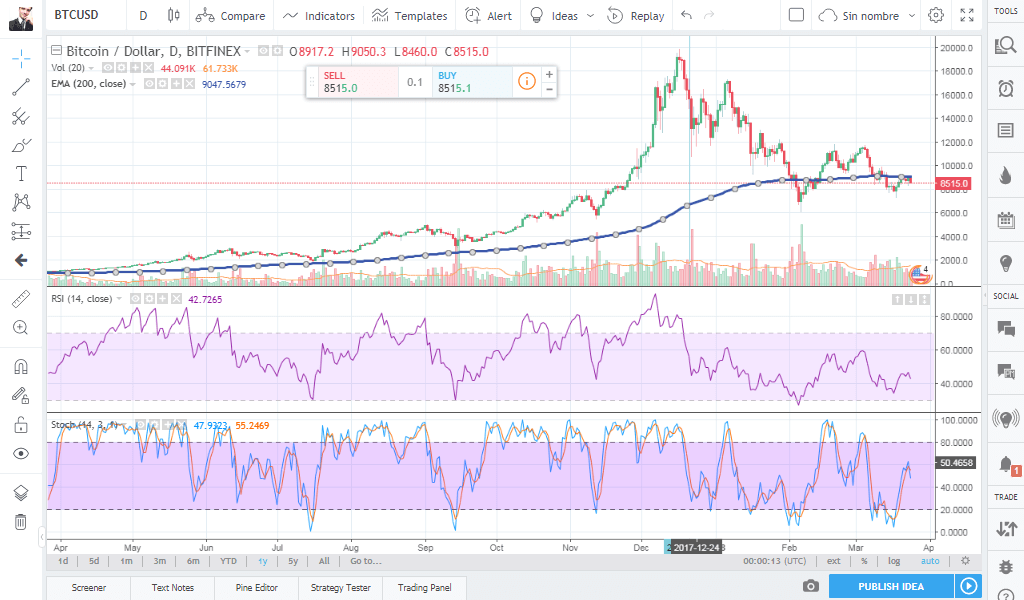

Swing trading cryptocurrencies consists of opening trade and leaving it for a reasonable period of time, from hours to several days. They generally use candles from 12 hours onwards with other essential indicators. One that is not usually missing is the volume of the market. The use of technical analysis is of great importance.

The most common indicators are the MACD, RSI, Stochastics, however many prefer to use other signs that provide a more general view of market behavior: Fibonacci Regressions, Gann forks, Bollinger, EMAs, etc.

You MAY like Swing Trading if:

- You are a regular reader of CryptoSlate

- You have some knowledge of statistics and enjoy doing technical analysis or following such bits of advice

- You have a background in Forex

- No need to profit immediately

- You are a patient and calculating person

- You have a wide margin of Stop-Loss and Take-Profit

- You can take a fall without being alarmed

You may NOT like Swing Trading if:

- You don’t like technical analysis

- You’re impulsive

- It makes you nervous to leave open trades without being in control of what happens while you sleep

- You’re a Weak-Hander

- You fall fast prey to the FOMO and the news.

Famous Swing Traders: Paul Scholardi and Zhao Dong (this one, before turning into a successful millionaire, started by losing 9000 BTC in one a day, which led him to contemplate suicide…)

The Marathon Runner: Position Trader

Position trading is a trading strategy that is more “investment” than “trading.” It consists of opening positions and leaving them for several weeks to years. It requires extensive knowledge of aspects beyond the technical ones. Long-term investors are willing to take a significant amount of risk in favor of the possibility of making a considerable amount of profit.

An in-depth study is necessary to know the reliability of each move that is made, for this reason beyond the technical analysis, traders must continuously apply fundamental analysis studies.

The most common candles studied go from 1 day to 1 month depending on how willing investors are to maintain their position.

You MAY like Position Trading if:

- You can take a position and maintain it despite the different opinions that the market may spread circumstantially.

- HODL is your Word

- You’re a very patient person.

- Your vision is focused on the long-term, your expectations are much deeper

- You do not expect profits based on market behavior but on the aspects that influence the market. It’s a more general view

You may NOT like Position Trading if:

- You prefer to go with the trend of a market even if you think differently

- You need the money you invested in crypto

- You prefer to do technical analysis without having to watch “the big picture.”

- You get very excited if you see an excessive gain or you are afraid of a possible fall.

Famous Position Traders: The Winklevoss Twins, Max Keiser, George Soros

Conclusion

It’s important to know what kind of personality you have. If you’re nervous, maybe a Pump and Dump can make you lose money in a short time. If you are very patient and operate in the short term, you could end up well below your Stop-Loss waiting for a recovery that will never come but in weeks perhaps.

After you know your personality and trading style, it is crucial that you understand the market in order to trade successfully. Is the coin being bumped in social media or is it its natural behavior? Is there any news that could affect your crypto trading? Does the currency fluctuate continuously, or is it more stable and stays in a constant range? All these questions are essential for efficient trading. Remember the quote:

“Don’t invest more than you can lose.”

But above all, as serious as the trading world may be, make sure you enjoy your trip.

Blockchain.com

Blockchain.com

Farside Investors

Farside Investors

CoinGlass

CoinGlass