Circle CEO: institutional market arrived in bitcoin as CME clears $1 billion in 1 day

Circle CEO: institutional market arrived in bitcoin as CME clears $1 billion in 1 day Circle CEO: institutional market arrived in bitcoin as CME clears $1 billion in 1 day

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

On May 13, as the bitcoin price climbed from $7,000 to $7,700 within hours and the CME bitcoin futures market recorded a daily volume of over $1 billion.

The CME Group tweeted:

CME Bitcoin futures reached an all-time record high of 33.7K contracts on May 13 (168K equivalent bitcoin), up nearly 50% from the last record of 22.5K contracts on April 4. See how market participants are using $BTC to manage uncertainty: https://t.co/hDgraMj5pe pic.twitter.com/ct1xkjoJDF

— CMEGroup (@CMEGroup) May 13, 2019

According to Jeremy Allaire, the CEO of Circle, a major cryptocurrency firm that operates digital asset exchange Poloniex and stablecoin USD Coin, the $1 billion volume recorded by CME Group indicates institutional investors have officially arrived in the cryptocurrency market.

Are Institutions Driving the Price of Bitcoin Up?

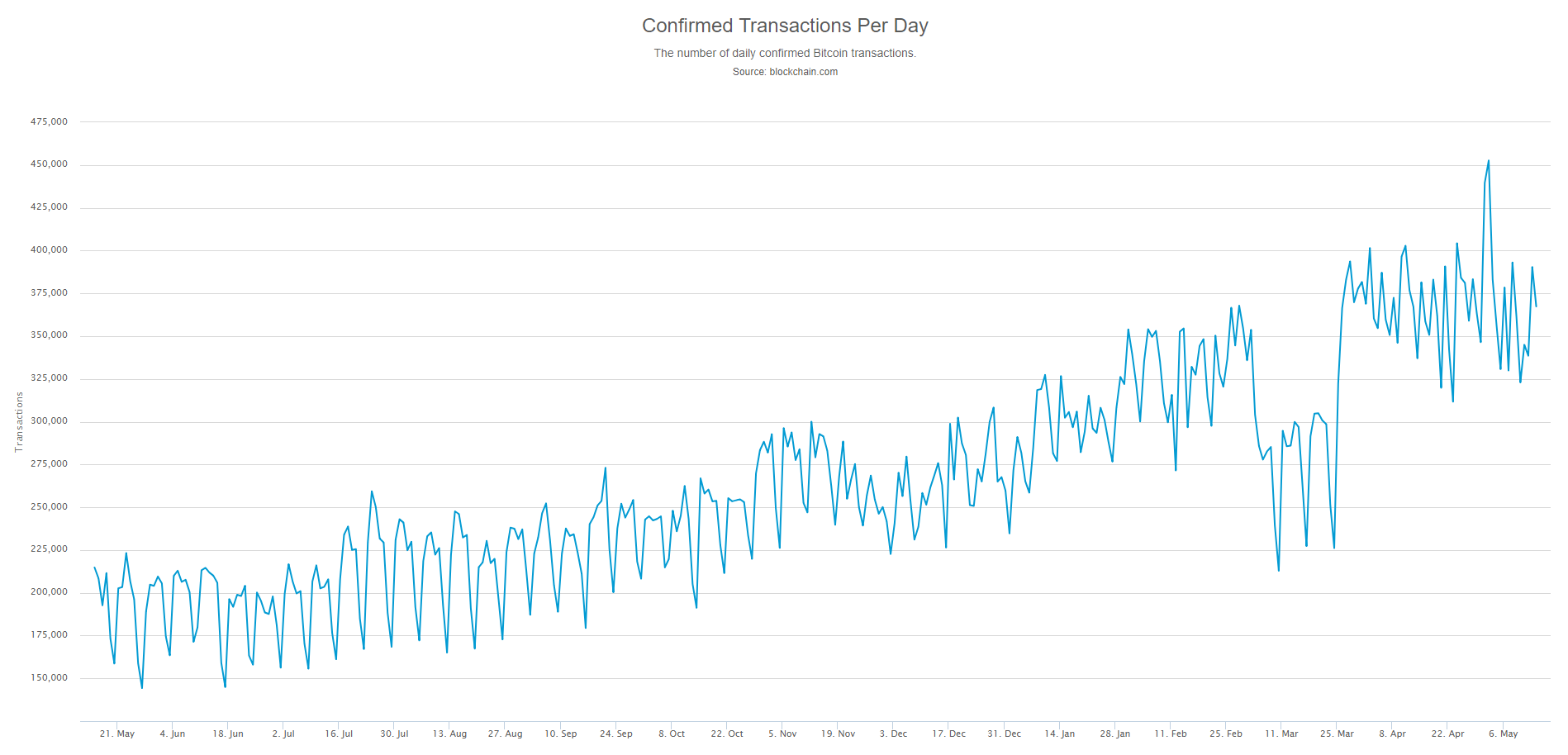

In the past month, as the price of bitcoin spiked by 62 percent against the U.S. dollar, both cryptocurrency exchanges and digital asset-backed investment vehicles began to see record high volumes.

Barry Silbert, the CEO of Digital Currency Group, a leading venture capital firm in the cryptocurrency sector behind Grayscale, said that the assets under management (AUM) of Grayscale’s Bitcoin Investment Trust (GBTC) hit $1.7 billion as it achieved a volume of $141 million.

ICYMI: $GBTC volume exceeded $141,000,000 today https://t.co/QLt2QcNQpm

— Grayscale (@GrayscaleInvest) May 13, 2019

Strictly regulated investment vehicles like bitcoin futures, Grayscale’s GBTC, and exchange-traded notes (ETNs) are often utilized by institutions to invest in the cryptocurrency space in a protected environment.

Allaire explained that the drastic surge in the volume of the CME bitcoin futures market and the overall increase in demand for other investment vehicles suggest institutions have started to commit to the market.

He said:

“In late 2017, the market rallied hard on the news that the CME would launch BTC futures and herald the institutional adoption of crypto. After the first markets launched in Jan 2018, the adoption as weak, and the market begin to sell off (for many other reasons too). Fast forward to yesterday, and we’ve just seen $1B in futures contracts traded in one day, decisively marking May 13, 2019 as the day that we can say that the institutional market has arrived in crypto.”

The emergence of highly anticipated alternative markets and futures products like Bakkt’s bitcoin futures market that are expected to record large volumes could further fuel the interest of institutions towards the market.

Earlier this week, Bakkt released an update regarding the launch of bitcoin futures contracts developed by Bakkt in collaboration with ICE Futures U.S. and ICE Clear U.S., disclosing its filing with the Commodities and Futures Trading Commission (CFTC).

Kelly Loeffler, the CEO of Bakkt, said:

“Customers active in crypto markets — and many still waiting to get in — have had a voice in shaping the design of the initial product offering. As detailed in the ICE Futures U.S. filing with the CFTC today, bitcoin futures will be listed on a federally regulated futures exchange in the coming months.”

A wider range of investment vehicles and federally regulated markets supporting bitcoin may serve as a signal of market maturation for institutional investors, which would allow institutions to become more comfortable in allocating capital into the asset class.

When Will Retail Investors Come in?

The recent upward momentum of crypto assets including bitcoin is said to have been triggered by institutional investors and existing investors in the cryptocurrency market.

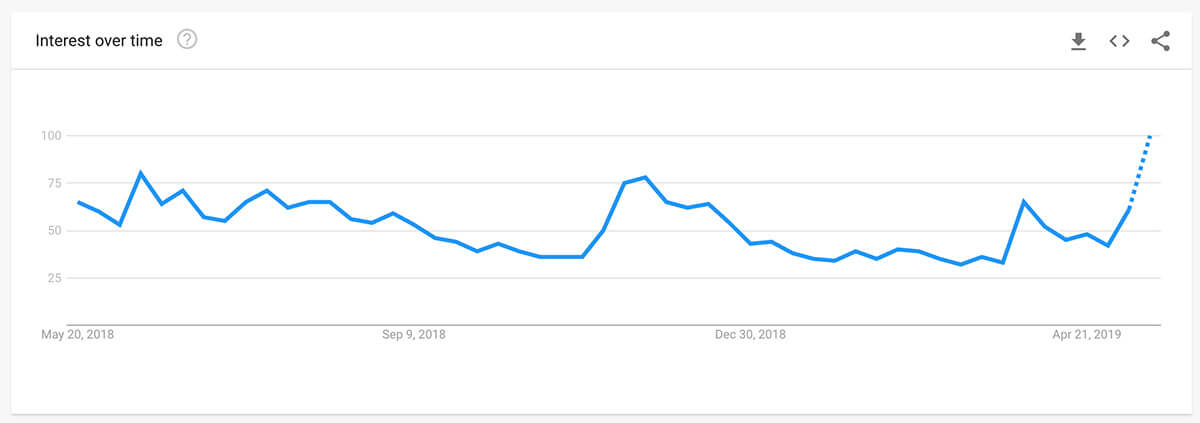

While it may take retail investors that suffered large losses during the 16-month correction from 2018 to early 2019 to recover and develop an appetite for crypto assets once again, Google Trends data suggests that the interest towards the cryptocurrency market from the mainstream is on the rise.

Bitcoin Market Data

At the time of press 4:10 pm UTC on Dec. 7, 2019, Bitcoin is ranked #1 by market cap and the price is up 3.59% over the past 24 hours. Bitcoin has a market capitalization of $172.18 billion with a 24-hour trading volume of $32.53 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:10 pm UTC on Dec. 7, 2019, the total crypto market is valued at at $252.18 billion with a 24-hour volume of $109.58 billion. Bitcoin dominance is currently at 68.30%. Learn more about the crypto market ›

Mentioned in this article

Bitcoin

Bitcoin  Circle

Circle  Digital Currency Group

Digital Currency Group  Bakkt

Bakkt  Poloniex

Poloniex  CME Group

CME Group  Jeremy Allaire

Jeremy Allaire  Barry Silbert

Barry Silbert  Kelly Loeffler

Kelly Loeffler

CoinGlass

CoinGlass

Farside Investors

Farside Investors