Charlie Lee explains 45% Litecoin (LTC) rally in face of strong Bitcoin dominance run

Charlie Lee explains 45% Litecoin (LTC) rally in face of strong Bitcoin dominance run Charlie Lee explains 45% Litecoin (LTC) rally in face of strong Bitcoin dominance run

Photo by Marek Piwnicki on Unsplash

Unlike what many traders expected, the past few weeks and months have been all about Bitcoin.

While certain altcoins have enjoyed strong rallies, BTC has consistently moved higher, resulting in a long-awaited correction in the Bitcoin dominance metric. Per CoinMarketCap, the metric is up from the lows of 55 percent seen in the summer to 65 percent today.

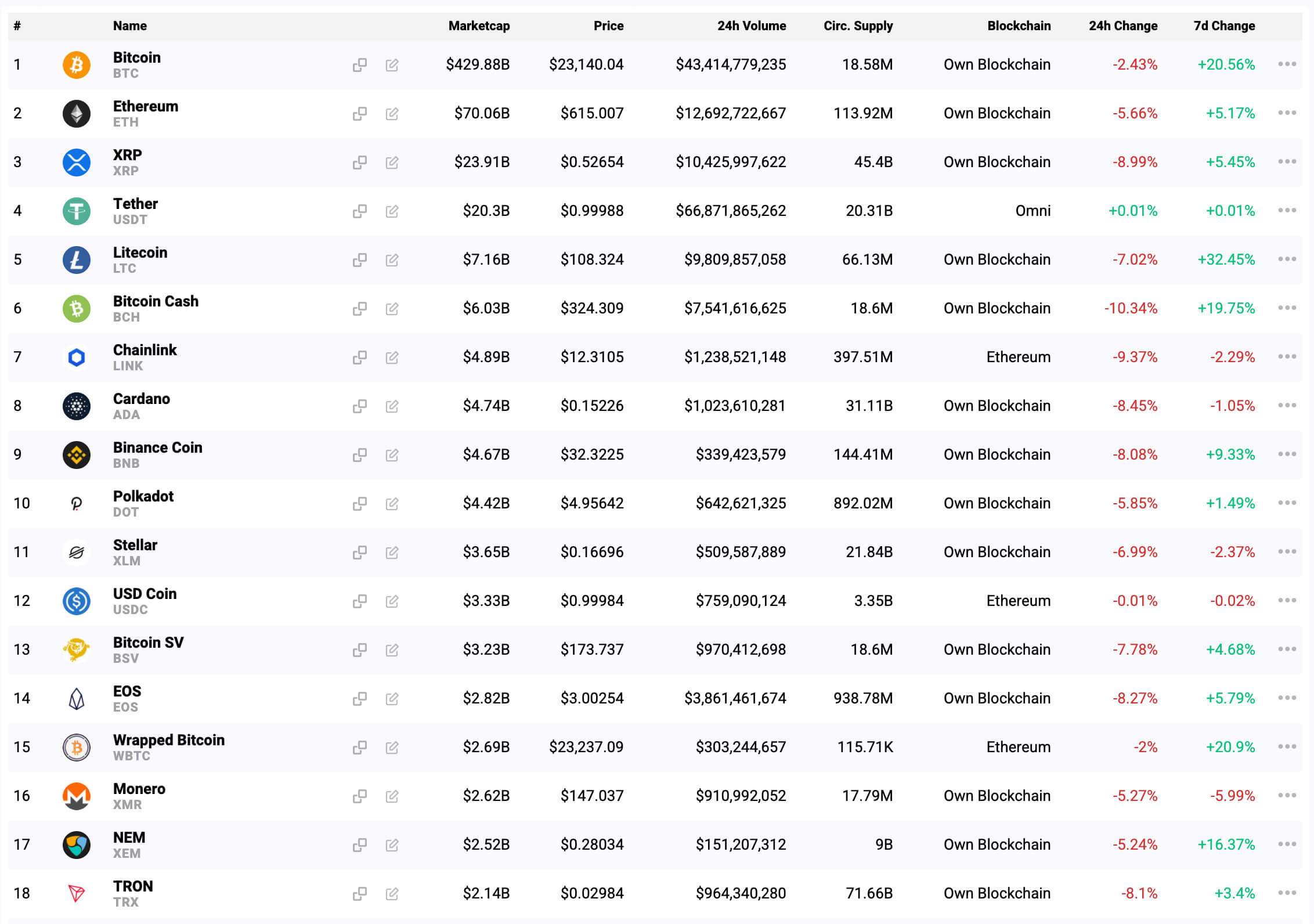

You can see the divergence in the performance of BTC and altcoins well if you look at the performance of the crypto market in the past week.

Per CryptoSlate data, while Bitcoin is up 25 percent in the past seven days, Ethereum, XRP, Cardano, amongst other top altcoin names have only seen 10 percent rallies. Check the table seen below, which shows this divergence quite clearly.

Litecoin (LTC) appears to be a big winner despite BTC’s relative rally against many altcoins.

Charlie Lee, the founder of the cryptocurrency and an early Bitcoin adopter, recently explained why this may be the case.

What’s with the Litecoin rally?

Lee recently published a tweet that garnered much traction on Crypto Twitter outlining Litecoin’s value proposition and bull case despite a large number of detractors in recent months.

Some of the following are reasons he listed for why Litecoin is outperforming:

- Litecoin has a large amount of liquidity compared to other altcoins due to widespread exchange support

- It is widely supported by cryptocurrency ATMs

- Litecoin is fielding institutional support via Grayscale’s investment vehicles

- Litecoin has dominance in its mining algorithm, Scrypt

- It has low fees and relatively fast transactions compared to Bitcoin

- It has the benefit of a long “Lindy effect,” as evidenced by its long lifetime compared to other altcoins

Litecoin's value proposition:

– High liquidity & on every exchange

– #2 supported on ATMs

– 350m @PayPal users

– $104m @Grayscale LTCN trust

– 99% Scrypt hashrate dominance

– MWEB fungibility/privacy

– Low fees & fast txns

– $500b+ value transferred

– 9+ years w/ zero downtime

? pic.twitter.com/YSCwxA57Lb— Charlie Lee [LTC⚡] (@SatoshiLite) December 21, 2020

LTC appears to be benefiting from retail interest via PayPal as well.

While the data below does not highlight Litecoin in particular, LTC is up 45 percent in the past week as PayPal’s exchange partner, ItBit, has seen its trading volume spike to $105 million all-time highs. Bitcoin Cash (BCH), another PayPal-supported cryptocurrency, is also outperforming a vast majority of large-cap altcoins this past week.

PayPal crypto 24H volume spiking to ATH yesterday to $105M.For context, post-Thanksgiving was $85M.

Slowly, then suddenly…

Source: https://t.co/MmLEMXeJmB pic.twitter.com/rPPweR8ACq

— Santiago R Santos (@santiagoroel) December 17, 2020

Analysts attribute retail investors’ liking of Litecoin (relative to other altcoins) to two things: first and foremost, the view that LTC is silver while BTC can be likened to gold; and secondly, the view by some investors that because Litecoin is cheaper per unit, it may be a better investment than Bitcoin.

Three Arrows Capital’s Su Zhu recently highlighted that fact in a podcast episode with crypto researcher “Hasu.”

DeFi to take Litecoin’s spot

Some still think Litecoin’s dominance is under threat, though, even if it will perform well for the foreseeable future.

As reported by this outlet previously, Kyle Samani, co-founder and managing partner of Multicoin Capital, recently said that it “perplexes him how Chainlink has a $10 billion market cap,” quipping that he “doesn’t know who is holding all these things” and who the buyers are. The same applies to Litecoin and “many other assets in the top 10,” the investor explained.

Other analysts think that coins with cash flow, like many of the DeFi plays, may begin to creep up on Litecoin and other top altcoins in the years ahead.

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass