How Chainlink (LINK) can now prove $1 billion of Wrapped Bitcoin on BitGo

How Chainlink (LINK) can now prove $1 billion of Wrapped Bitcoin on BitGo How Chainlink (LINK) can now prove $1 billion of Wrapped Bitcoin on BitGo

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Blockchain agnostic protocol and decentralized oracle provider Chainlink will now be used by crypto custodian service BitGo to provide verifiable proof of the latter’s $1 billion worth of Wrapped Bitcoin in storage, as per a release.

WBTC's $1 billion+ in Bitcoin will now gain additional security using #Chainlink's Proof of Reserve capability. We're thrilled to be working with @BitGo to enable greater transparency & therefore more usability for WBTC as a form of collateral across #DeFi:https://t.co/Zd53kmLYZ5

— Chainlink – Official Channel (@chainlink) October 1, 2020

The move is yet another high-profile partnership for Chainlink in the past week alone, after it announced developments with Theta Network and Blockstack earlier.

Chainlink’s $1 billion proof

In a blog post, BitGo said that over $1 billion locked up in the form of WBTC — an ERC20 token that represents underlying Bitcoin — showed that the demand for cross-chain crypto assets within DeFi was “very real.”

To further scale WBTC’s reliability and support its growing demand, BitGo said it would work with the Chainlink team to “streamline the auditability of WBTC reserves.” DeFi applications can now receive definitive onchain proof about the fully backed collateralization of WBTC, the firm noted.

“This novel onchain proof of reserve is possible because of the openness of the Bitcoin network, the transparency provided by BitGo, and the highly secure decentralized oracle network that Chainlink powers,” explained BitGo.

“BitGo has adopted Chainlink’s Proof of Reserve mechanism. Now live on testnet (and soon mainnet), this Chainlink functionality enables decentralized applications on Ethereum.”

The firm added the move helps to fully automate the burden of auditing the BTC value custodied by BitGo in a trustless and censorship-resistant manner, that “removes the need to rely on manual off-chain processes like reading audit reports.”

How the proof of reserves work

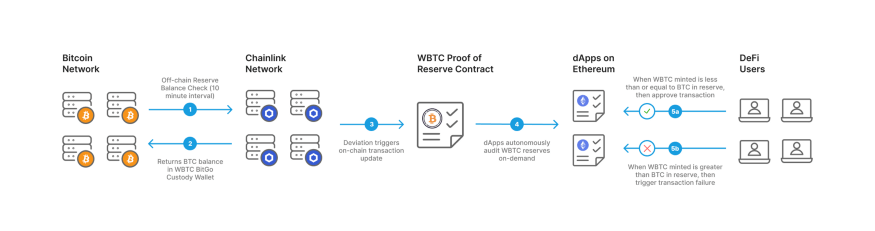

The proof-of-reserves work as follows: Chainlink’s oracles continually update and provide info on WBTC’s reserves on-demand, which can be used by other DeFi applications on Ethereum.

Smart contract applications on Ethereum can then query the Proof of Reserve Contract to instantly verify that each WBTC coin is fully backed by an equal reserve balance of BTC in BitGo’s custodian address on the Bitcoin blockchain, explained BitGo’s head of product Kiarash Mosayeri in the post.

The WBTC Proof of Reserve reference contract uses a decentralized Chainlink oracle to check the balances of BitGo’s WBTC custody wallets every ten minutes (the average time between Bitcoin blocks), he noted, adding:

“Whenever a deviation is spotted beyond a certain defined threshold (e.g. 1%), Chainlink oracles will push an on-chain update to the reference contracts with the new balance.”

Such a mechanism allows BitGo to verifiably provide the provability of its massive reserves, which in turn helps attract newer capital, regulation, and much-needed capital governance to the burgeoning crypto space.