Bullish for Bitcoin: There’s been $20 trillion in global stimulus since COVID-19 started

Bullish for Bitcoin: There’s been $20 trillion in global stimulus since COVID-19 started Bullish for Bitcoin: There’s been $20 trillion in global stimulus since COVID-19 started

Photo by Matthieu Gouiffes on Unsplash

The past few months have been the worst months for many economies around the world since the Great Depression. Dozens of millions have become unemployed, revenues have fallen off a cliff, and there is growing social unrest as different groups address the COVID-19 pandemic in different ways.

Governments, as a result, have been forced to throw trillions of dollars at trying to save every facet of the economy in a way that dramatically boosts Bitcoin’s long-term value proposition.

Governments and central banks have spent $20 trillion on fighting COVID-19

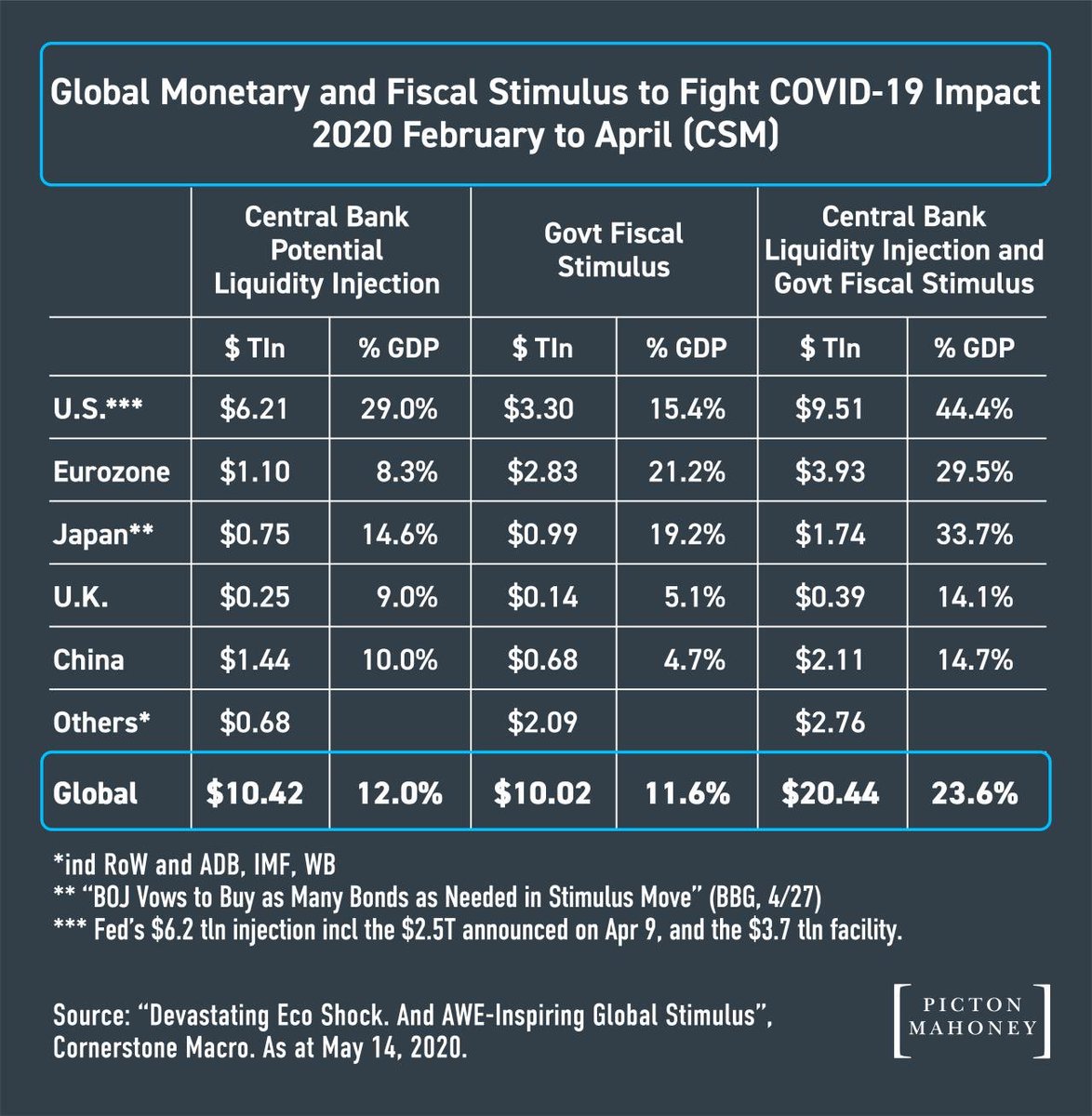

A chart from asset management firm Picton Mahoney and shared by Dan Tapiero, a prominent hedge fund manager and gold and Bitcoin bull, indicates that governments and central banks have spent $20 trillion (normalized in U.S. dollars) fighting the economic impacts of the COVID-19 outbreak.

This is equivalent to the annual GDP of the U.S. and approximately 25 percent of the world’s GDP.

This stimulus (and what comes next), Tapiero and many others think, will boost Bitcoin dramatically.

Bitcoin could stand to benefit

The world has reached a fork in the road it seems: governments can agree to stop stimulating the economy, which would cause deflation, or they can continue to print trillions of dollars to try and save the economy, which should create inflation.

In both cases, analysts say, Bitcoin benefits.

In a world with inflation, BTC’s absolute scarcity enforced by block reward halvings will likely entice investors to try and secure their wealth in the cryptocurrency. As Tuur Demeester postulated in a recent interview:

“I think a price target of like $50,000 is not insane at all, especially given just how crazy the money printing is. I would even say between $50,000-$100,000.”

This has become such a mainstream narrative that legendary billionaire investor Paul Tudor Jones released a note titled “The Great Monetary Inflation,” in which he said that he would be investing his fund’s capital into Bitcoin (allocation of a few hundred basis points) due to the monetary inflation going on.

In a world with deflation, you could have entire economies start to break down and institutions collapse due to the rising real value of debt. Bitcoin acts as a hedge in case of the collapse of institutions and potentially even governments.

Of course, the boiling down of an ever-changing world economy into two distinct scenarios is a bit of an oversimplification, but the point is that analysts think the current macroeconomic backdrop is perfect for Bitcoin to succeed.

Crypto and blockchain fund BlockTower Capital recently released a research note entitled “Demand is Coming,” in which the firm’s analysts put the current case for Bitcoin best:

“With all of these catalysts on the horizon, what’s become clear is that the macro case for Bitcoin has never been more obvious. […] Heading into the back half of 2020, the future looks pretty bright…”

Farside Investors

Farside Investors