Bitfinex traders are longing Tezos (XTZ) in record numbers as price flirts with $4

Bitfinex traders are longing Tezos (XTZ) in record numbers as price flirts with $4 Bitfinex traders are longing Tezos (XTZ) in record numbers as price flirts with $4

Photo by Benjamin Voros on Unsplash

Ever factoring in the 12 percent correction Tezos has seen in the past day, the cryptocurrency is one of the top-performing in the past week. According to CryptoSlate data, Tezos, which has the ticker XTZ, is up 17.9 percent in the past seven days and up 27.68 percent in the past month.

Investors are embracing this price action, with data from Bitfinex indicating that traders are opening long positions for XTZ in record numbers.

XTZ longs are hitting all-time highs

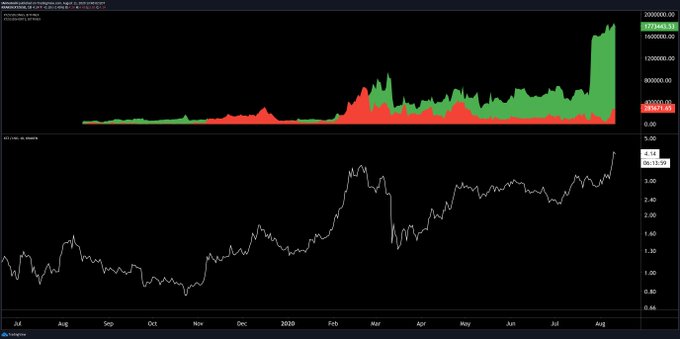

According to Bitfinex market data shared by Josh Olszewicz, a cryptocurrency analyst from Brave New Coin, there are more XTZ longs open than ever before.

According to the data, there are now more than 1,773,443 contracts of Tezos longs open compared to 285,671 contracts of Tezos short positions. That’s a ratio of 6:1.

This indicates that traders think the value of XTZ is going to head higher in the weeks and months ahead.

This much has been made clear by the sentiment about Tezos’ price outlook shared by multiple technical analysts. They say that the altcoin is primed to move higher as XTZ attempts to establish a new all-time high and enter “price discovery.”

Price discovery occurs when an asset establishes a new all-time high after a period of macro consolidation; this phase of a market cycle often results in an asset going parabolic as it sheds historical resistances.

Could Tezos encroach on Ethereum?

One narrative that may act as a boon for Tezos moving forward is how the network may be able to absorb some of Ethereum’s market share.

Ethereum is currently suffering from extremely high transaction fees as decentralized finance protocols promote the processing of hundreds of thousands of transactions a day. According to Eth Gas Station, an Ethereum transaction fee tracker, the cost of gas has reached 160 Gwei. This is over 1,500 higher than it was just four months ago.

The reason why users of the network are paying so much is that they see demand in transacting with Ethereum-based protocols and using Ethereum-based assets.

Tezos could begin to encroach on ETH’s market share, though, should Tezos-based protocols and assets offer similar or better incentives for usage than those based on its competitor, Ethereum.

Right now, though, Ethereum is easily beating Tezos by many measures.

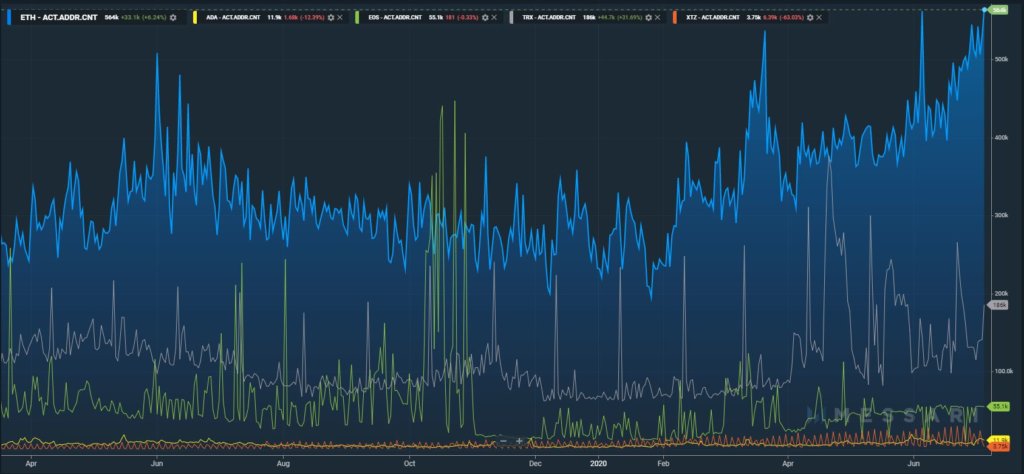

As reported by CryptoSlate previously, Ethereum has the highest number of daily active addresses out of all mainstream smart contract blockchains. As of early July, here’s how the data was broken down:

- Ethereum: 564,000 addresses

- Tron: 186,000 addresses

- EOS: 55,100 addresses

- Cardano: 11,900 addresses

- Tezos: 3,750 addresses

Tezos Market Data

At the time of press 9:34 am UTC on Aug. 12, 2020, Tezos is ranked #12 by market cap and the price is down 5.15% over the past 24 hours. Tezos has a market capitalization of $2.92 billion with a 24-hour trading volume of $484.88 million. Learn more about Tezos ›

Crypto Market Summary

At the time of press 9:34 am UTC on Aug. 12, 2020, the total crypto market is valued at at $350.92 billion with a 24-hour volume of $112.83 billion. Bitcoin dominance is currently at 60.35%. Learn more about the crypto market ›