Bitcoin sees sharp decline in correlation with tech equities, Kaiko says

Bitcoin sees sharp decline in correlation with tech equities, Kaiko says Bitcoin sees sharp decline in correlation with tech equities, Kaiko says

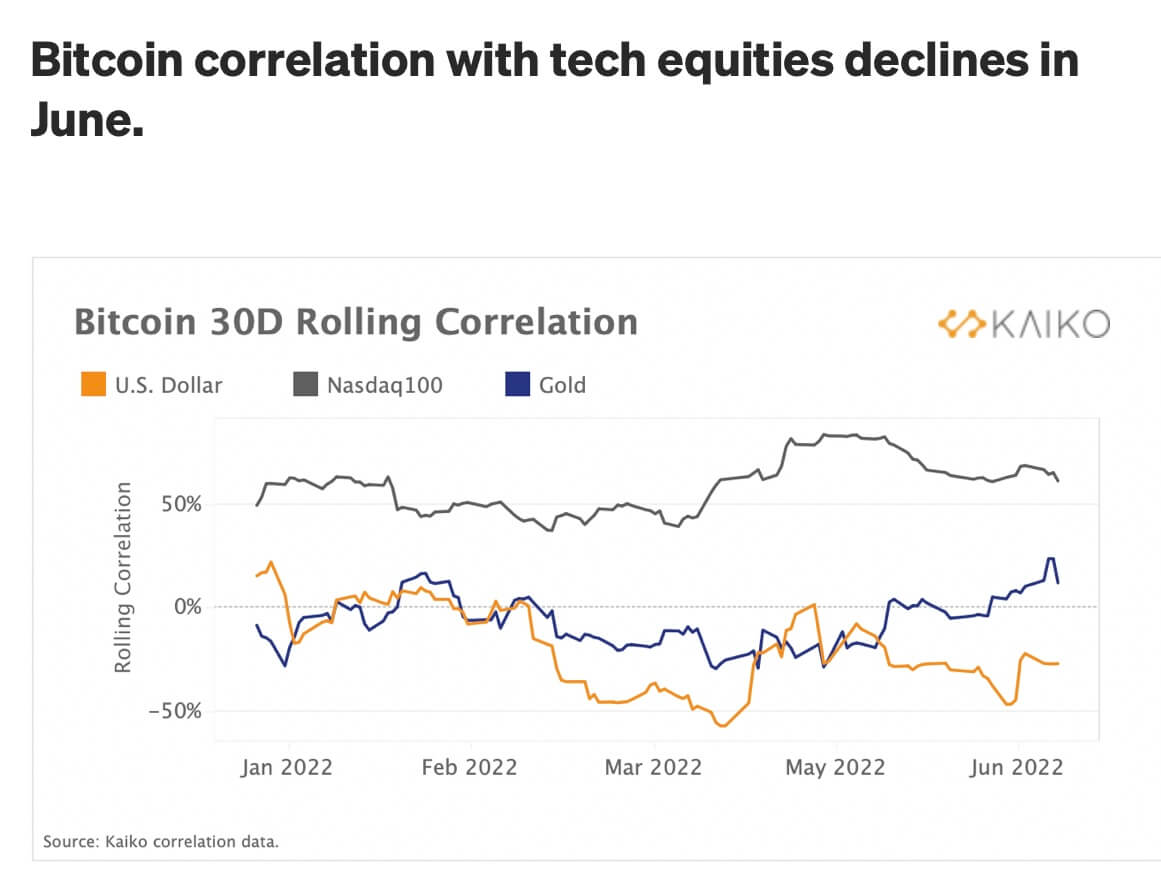

Bitcoin remains mostly uncorrelated to gold and its correlation with tech equities declined in June.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The correlation between Bitcoin (BTC) and Nasdaq 100 reduced this month after reaching a record of .8 last month, according to a new Kaiko report.

While Nasdaq closed the week on a positive note of over 7%, Bitcoin continues to trade in the $21,000 range. But Bitcoin remains mostly uncorrelated to the asset it has been compared with on multiple occasions, gold.

The correlation between Bitcoin and the precious metal asset is at over 50% presently. But its correlation with the US dollars has been alternating throughout the year between 0 and a negative .6.

Bitcoin and Nasdaq 100 have had their performance correlating for some time due to the increased interest of institutional investors in crypto. But the recent hike in interests rate and fears of recessions appears to have affected Bitcoin more than tech equities.

Bitcoin sell-off was spot driven

According to Kaiko, on-chain data reveals that the current crypto sell-off was caused by the spot traders rather than the derivatives market.

Per the report, Ethereum (ETH) and Bitcoin trading volume have declined since the start of the year. After peaking in May 2021, volatility also started reducing in September 2021.

But the weekly trading volume and price action have been relatively stable and on the same levels since then.

According to the report, this shows that there has been a calculated effort by investors to de-risk their position. Thus, the decline is not due to a futures market sell-off.

Additionally, the funding rates on Bitcoin’s derivatives markets show that the futures market wasn’t responsible for the sell-off. The funding rates on BTC perpetual futures have maintained a stable trend despite the sharp price decline.

Funding rates are currently at 0.005% above neutral. If the futures market were responsible for the sell-off, it would be negative, similar to Terra’s failure last month.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass