Bitcoin searches on Google are rocketing upward even after the massive drop, here’s why

Bitcoin searches on Google are rocketing upward even after the massive drop, here’s why Bitcoin searches on Google are rocketing upward even after the massive drop, here’s why

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

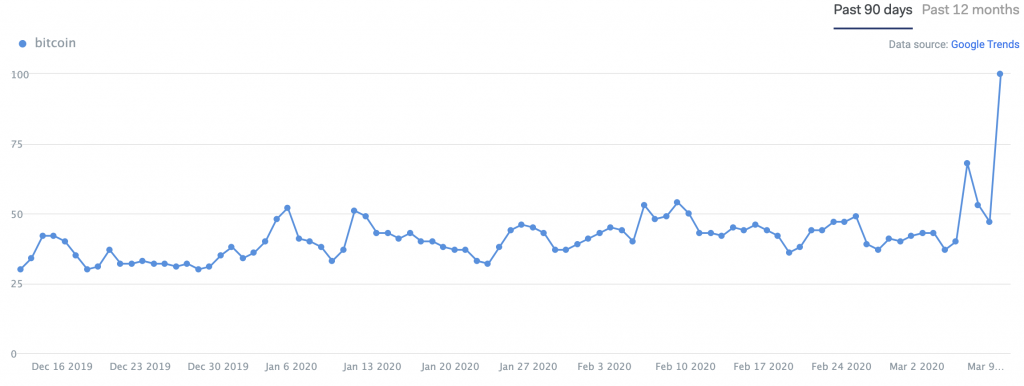

The search term “Bitcoin” has exploded in popularity on Google in the last week, suggesting the unfolding global economic crisis may be spurring on interest in BTC even in the wake of one of the coin’s most devastating sell-offs ever.

Worldwide search volumes for Bitcoin have broken out to hit a seven-month high according to data from Google Trends, having started to rocket on Wednesday, March 11.

At that time Bitcoin was trading just below the $8,000-mark and was yet to plunge into Thursday’s mammoth 39 percent sell-off, the biggest daily loss posted in seven years. The bulk of the damage took place on 100x-leveraged crypto derivatives exchange BitMEX, where an unprecedented $876 million worth of contracts were liquidated in a 24-hour window and the exchange went down for 45 minutes purportedly on account of hardware issues.

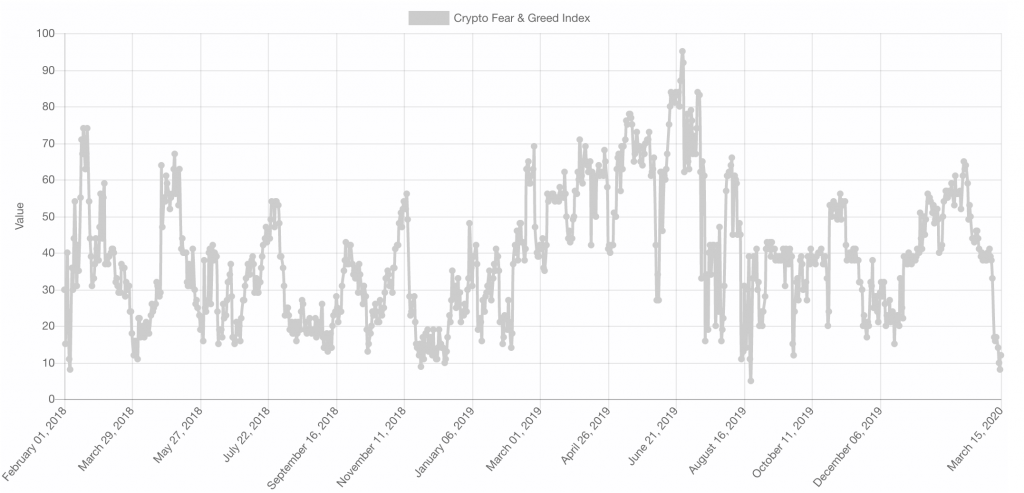

The rout sent the market into a furor from which it is yet to recover. On Saturday the Crypto Fear & Greed Index capitulated to a near-all-time-low of 8, indicating an immense level of fear that has only been surpassed once in the two-year history of the index. At present, the index stands at 12.

Bitcoin’s surge on Google comes off as a glimmer of hope for investors waiting for a sign the coin will be one of the winners in the unfolding global recession. This age-old prophecy of BTC as a gold-like safe haven took a hit last week when the original cryptocurrency plunged alongside stocks as traditional havens rallied. Now with the coin at $5,280, 62 percent of investors are holding at a loss, according to data from IntoTheBlock.

Intriguingly, users searching for Bitcoin on Google are also heavily looking at the terms “gold price,” “gold as an investment,” and “share price,” according to Trends. Users in Nigeria, Austria, and Switzerland are currently the most-interested in BTC considering search volumes.

Bitcoin Market Data

At the time of press 1:18 am UTC on Apr. 6, 2020, Bitcoin is ranked #1 by market cap and the price is down 9.34% over the past 24 hours. Bitcoin has a market capitalization of $90.7 billion with a 24-hour trading volume of $46.3 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:18 am UTC on Apr. 6, 2020, the total crypto market is valued at at $141.02 billion with a 24-hour volume of $151.59 billion. Bitcoin dominance is currently at 64.24%. Learn more about the crypto market ›