Bitcoin Hash Rate Rapidly Growing Despite Price

Photo by Ivana Cajina on Unsplash

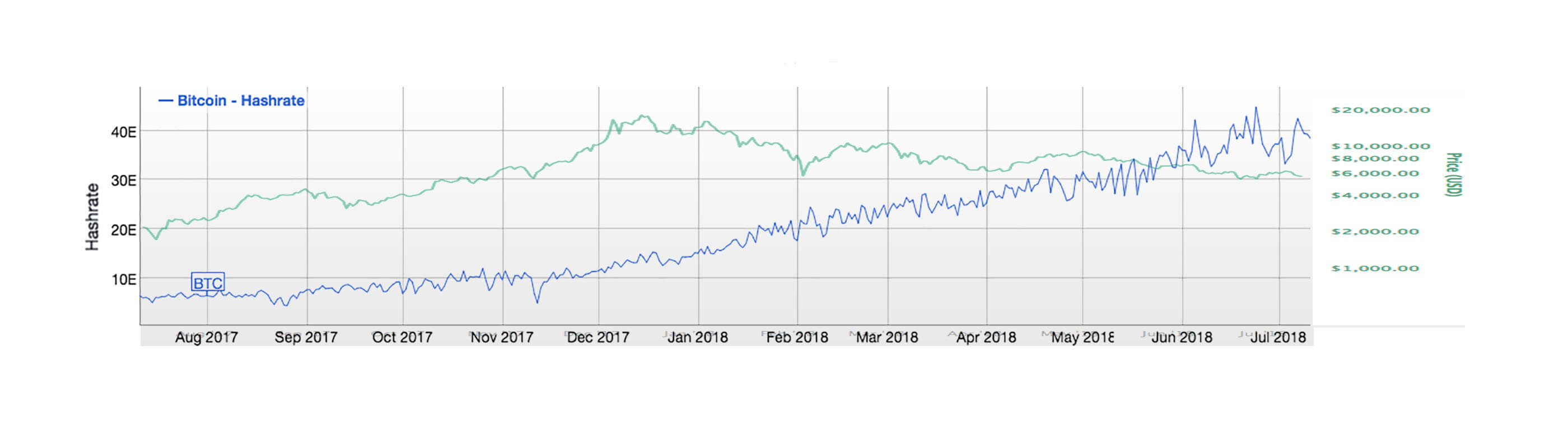

Despite Bitcoin’s 2018 price slump, the dominant cryptocurrency’s hash rate continues to surge at an astonishing pace. Although the value of Bitcoin has decreased by 53% since January 1st, 2018, the hash rate has increased 155% in the same time period.

The continued growth in hash power demonstrates a strong, continued belief in Bitcoin by miners worldwide and may foreshadow a hidden bullish trend.

Hash Rate Explained

In simple terms, mining is the process of running complex calculations in search of a specific number. In a race to find the number first, mining hardware is used to run through as many calculations possible to secure the block reward, currently at 12.5 BTC per block.

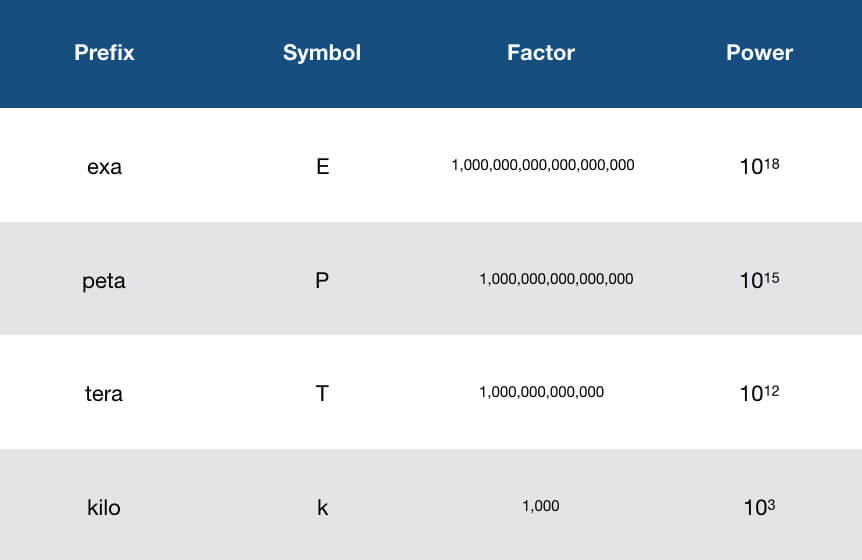

Each calculation attempt to solve the computation is known as a “hash” and the “hash rate” is computed in hashes per second(h/s).

ASICs (application specific integrated circuits) have become the sole mining hardware used to mine Bitcoin due to their increased hash rate ability and higher energy efficiency. One ASIC has a mining power of approximately 12 tera-hashes per second. For comparison, in 2013, the total hash rate of the Bitcoin network on April 29, 2013, was 79.02 Th/s.

Growing Number of Miners

The hash rate of Bitcoin continues to hike at a rapid pace, indicating a growing number of Bitcoin miners. So far in 2018, it has grown 155%, from 15.04 Eh/s to 38.43 Eh/s.

One possible explanation for the increase in hash rate is Bitcoin’s value. Although Bitcoin has lost a lot of value in 2018, the block reward of 12.5 Bitcoin is still worth over $78,000 today. At Bitcoin’s peak, a single block was worth almost a quarter million dollars and miners may view the current market as a way to accumulate more Bitcoin at lower prices.

Another possibility explaining the increase in hash rate could be upcoming Bitcoin “halvening,” estimated to occur around May 25, 2020. With the reward set to decrease from 12.5 BTC per block to 6.25 per block, miners may be trying to accumulate as much Bitcoin possible, before difficulty further increases and rewards decrease. The price of BTC at the time of the last two halvenings were $660 and $12 in 2016 and 2012, respectively.

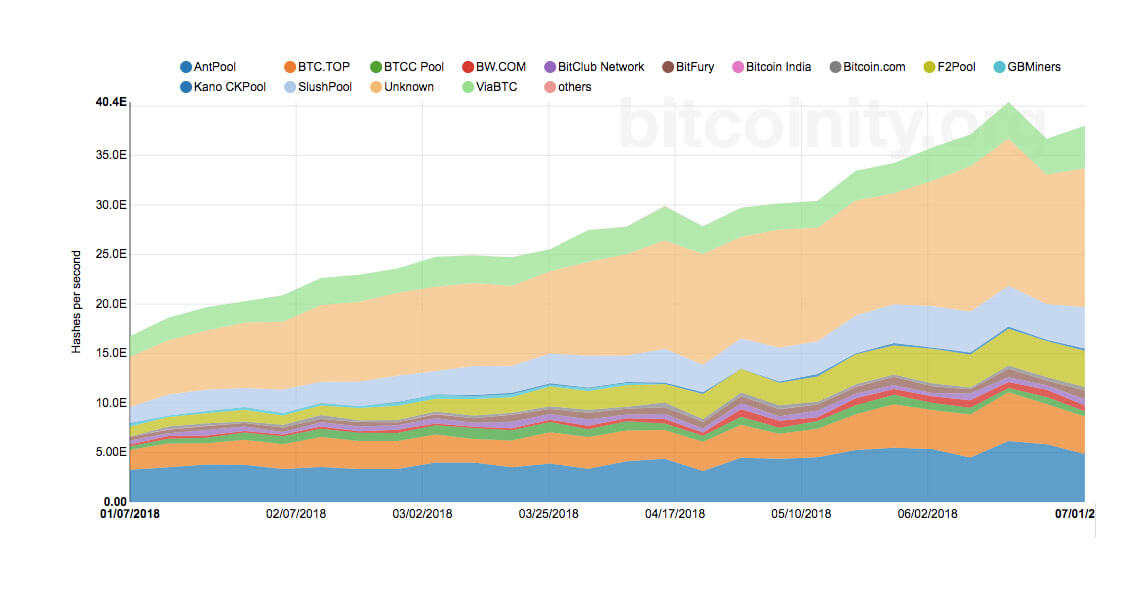

One interesting thing to note in the increase of hash rate is the contribution of hash power outside of the world’s biggest mining pools. This is beneficial to the Bitcoin network as it makes the power of mining less concentrated.

Overall, it is a positive sign that miners continue to demonstrate their support for Bitcoin through the increasing growth of hash rate. Instead of abandoning Bitcoin to mine other cryptocurrencies, they persist and strengthen the Bitcoin network.

It will certainly be interesting to see if the conviction of miners is ultimately worthwhile and Bitcoin makes the run that bulls anxiously await.

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass

Blockchain.com

Blockchain.com

Farside Investors

Farside Investors