Ethereum hits multi-year low against Bitcoin erasing all gains since 2021

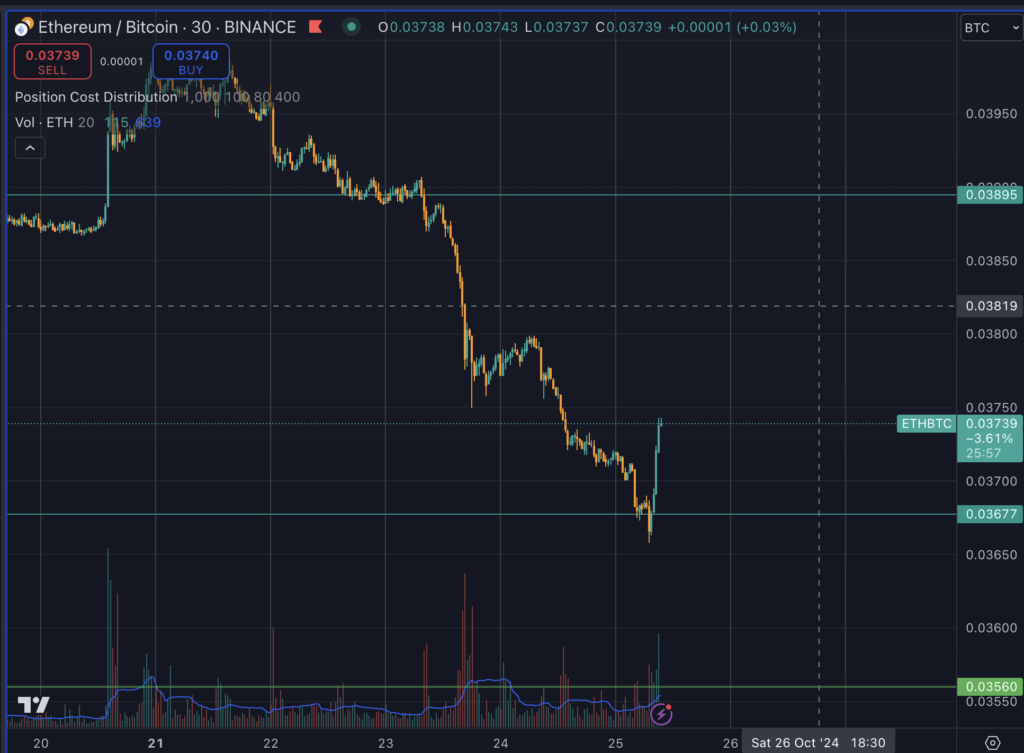

Ethereum hits multi-year low against Bitcoin erasing all gains since 2021 Ethereum has significantly underperformed Bitcoin over the year, with the ETH/BTC ratio declining 58% from its 2021 peak of 0.086 to a recent low of 0.0365. In the last week, the pair exhibited high volatility, dropping 8% before sharply rebounding 3% to 0.0374 today.

Several factors contribute to Ethereum’s relative weakness. Bitcoin has reasserted its dominance as the leading digital asset, attracting increased institutional interest. Unlike Bitcoin’s fixed supply, Ethereum’s issuance has been less predictable, potentially affecting investor confidence. The growth of Layer-2 solutions has impacted Ethereum’s revenue and perceived value, while competition from alternative Layer-1 blockchains like Solana challenges its market position. Additionally, the success of Bitcoin ETFs has shifted institutional focus toward BTC, while Ethereum ETFs have seen muted inflows by comparison.

Despite the downtrend, some analysts see potential for a recovery in the ETH/BTC ratio. Ethereum’s ongoing development and scaling solutions could renew investors’ interest. Some experts predict a potential recovery in 2025, aligning with the next anticipated crypto bull market.

Farside Investors

Farside Investors

CoinGlass

CoinGlass