Hong Kong and US ETFs see modest outflows on mixed day

Hong Kong and US ETFs see modest outflows on mixed day Quick Take

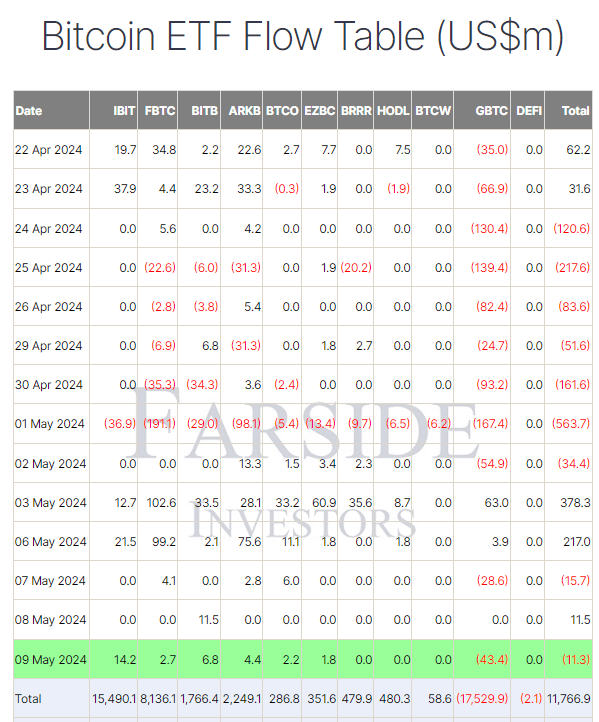

US ETFs

According to the latest Farside data, US Bitcoin exchange-traded funds (ETFs) experienced outflows on May 9, totaling $11.3 million. Notably, the Grayscale Bitcoin Trust (GBTC) witnessed a $43.4 million redemption, marking its largest single-day outflow since May 2. GBTC has now recorded a total of $17.5 billion in outflows.

Six different US ETFs recorded inflows, with BlackRock’s IBIT product leading with $14.2 million. IBIT has now accumulated $15.4 billion in total inflows. Additionally, the remaining three ETFs comprising the top four—Bitwise (BITB), Fidelity (FBTC), and ARK (ARKB)—also experienced inflows. In total, US ETFs have now witnessed $11.7 billion in cumulative net inflows, according to Farside data.

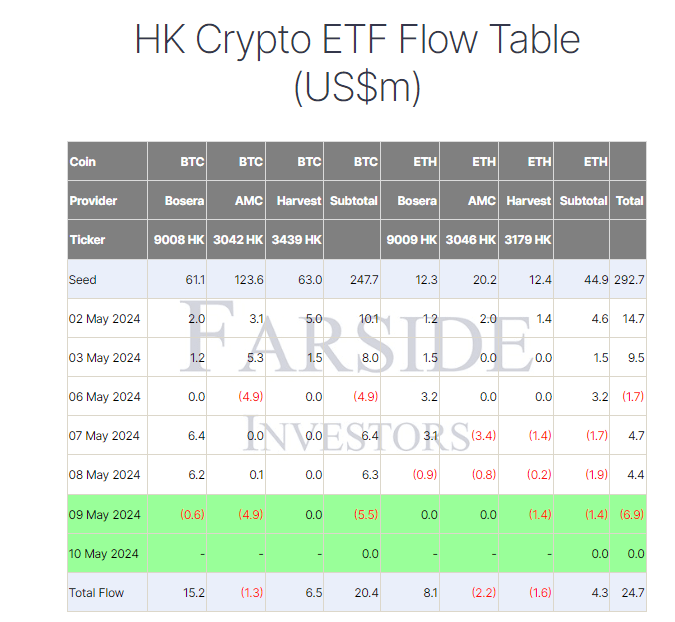

HK ETFs

According to Farside data, the Hong Kong (HK) ETF market encountered difficulties on May 9, with Bitcoin ETFs experiencing $5.5 million in outflows and Ethereum ETFs losing $1.4 million, totaling a combined outflow of $6.9 million for the day. Nevertheless, HK’s Bitcoin and Ethereum ETFs maintain total net inflows of $20.4 million and $4.3 million, respectively, bringing the total net inflow to $24.7 million.

Farside Investors

Farside Investors

CoinGlass

CoinGlass