Bitcoin mining stocks dwarf Bitcoin’s gains amid short squeeze buzz

Bitcoin mining stocks dwarf Bitcoin’s gains amid short squeeze buzz Quick Take

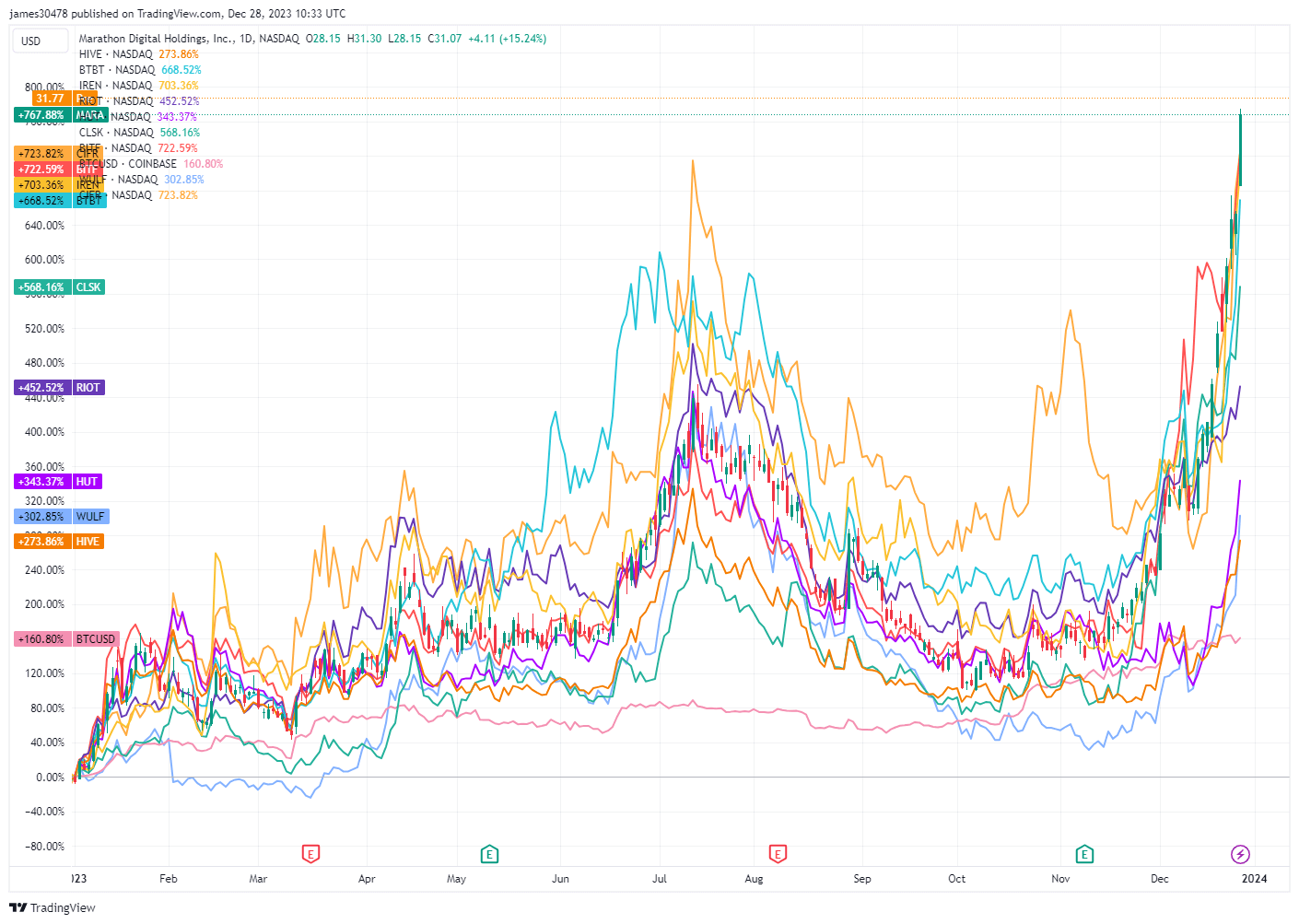

Bitcoin mining stocks have seen a remarkable performance in 2023, outpacing Bitcoin’s already impressive 160% YTD surge. Key mining players, including Hive and Marathon Digital Holdings, have recorded skyrocketing growth figures at an astonishing 274% and 767% YTD, respectively.

Data from Fintel points to an intriguing phenomenon – a significant percentage of short interest in these mining stocks, corroborated by analyst Mortensen Bach. This short interest has added momentum to their upward trajectory. CryptoSlate observed a divergence a few months prior between miners and Bitcoin’s price, a trend that has now caught up and exceeded the Bitcoin price.

| Mining Stock | Short Interest % |

|---|---|

| $HUT | 32.74% |

| $WULF | 22.58% |

| $MARA | 22.60% |

| $CIFR | 20% |

| $RIOT | 18.16% |

| $BTBT | 13.73% |

| $CLSK | 8.42% |

| $SDIG | 7.20% |

| $BITF | 6.51% |

| $HIVE | 5.25% |

| $IREN | 4.01% |

| $BTDR | 3.13% |

| $MSTR | 20.93% |

Source: Fintel

The Bitcoin mining proxy, WGMI, has surged 143% in the past three months, compared to Bitcoin’s 64% increase. The interplay of high short interest and rising prices on these mining stocks suggests a potential short squeeze scenario playing out. As prices continue to climb, shorts may be closing their positions, propelling prices upwards.

CoinGlass

CoinGlass

Farside Investors

Farside Investors