The Biggest ICOs of All Time & What Sets Bancor Apart

The Biggest ICOs of All Time & What Sets Bancor Apart The Biggest ICOs of All Time & What Sets Bancor Apart

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

It’s no wonder why the year 2017 was dubbed as the year of the Initial Coin Offerings (ICOs); ICOs refer to a new form of investment vehicle that allows investors from all around the globe to crowdfund new blockchain projects.

A new record was set in 2017 on the amount of funding ever raised through this method, with ICOs raising more than 5.6 billion over the course of the year. Some of these ICOs have been huge successes while others have been epic failures. The sector has also had its fair share of scams, scandals, and hacks.

The very first ICO in history took place in 2013 on the Mastercoin blockchain, now referred to as Omnilayer.

This was an application built on top of the Bitcoin blockchain and it raised the equivalent of $500,000. Within a single year, the value of this investment had appreciated to about $5.5 million which validated its investment model and set the pace for future ICOs.

Fast forward to 2017 when almost 450 companies raised funds using ICOs. The competitive ICO environment is saturated with aggressive marketing campaigns designed to capture investor attention. Expert analysts offer a cautious perspective on ICO performance, with some predicting that nine out of ten of these projects fail. Market observers do add, however, that the experimentation that has been ongoing in this sector paves the way for a bright future.

In this article, we’ll proceed to take a look at some of the companies that have captured the most capital through initial coin offerings:

Bancor

Bancor

Raised: $153 Million

Promise: The Bancor Protocol allows tokens to be instantly convertible for one another at all times through a robust network of connected cryptocurrencies.

Current Standing: Over 100 token projects have announced integrations with the Bancor Network, while many of the industry’s most popular tokens, including EOS, DAI (MakerDao), OMG (OmiseGO) and WAX (OPSkins), are currently live and instantly convertible on the network.

Filecoin

Filecoin

Raised: $257 Million

Promise: To build a cloud storage network on the decentralized blockchain network.

Current Standing: The Filecoin team said they have been “heads down” turning their project into reality since their token crowd sale. One of their most immediate tasks is to build out their community of developers and users as the project’s Interplanetary File System (IFPS) continues to grow steadily, serving more extensive sets of users and more kinds of applications.

BitConnect

BitConnect

Raised: $2.3 Billion Market Cap

Promise: Users could “stake”, or loan their cryptocurrency to the company in exchange for guaranteed returns depending on the length of the investment period.

Current Standing: In early 2018 the lending and exchange platform, which was long suspected by many in the crypto community of being a Ponzi scheme, announced it was shutting down.

Tezos

Raised: $232 Million

Promise: To develop a distributed ledger that self-amends and allows for easy generation of smart contracts.

Current Standing: Contributors in the Tezos ICO are yet to receive any tokens as the project has been derailed by a battle between its founders and the president of a Swiss foundation that was set up to conduct the ICO. The foundation controls the funds, while the founders manage the project’s code.

Bancor, however, appears to set itself apart from the crowd. Here’s why.

The Bancor Differentiator

The Bancor Differentiator

There are a few differences between the Bancor project and other ICOs that have ended up in disappointment. One of the principal reasons for the success of Bancor is that it had a clear vision.

It identified a market loophole and offered a solution to cater to it. This clear objective and purpose justified the creation of a new token and implementation of the concept.

But in the case of BitConnect, the team’s efforts were focused on marketing from the get-go. Many observers familiar with pyramid schemes would be noted the semblance from the earliest days of the campaign.

The Tezos project also had some glaring issues from inception that created a contrast between its framework and that of Bancor. As a blockchain model, Bancor stuck to the technology’s inherent design that allows for decentralization but with a system of governance in place. Tezos said it would give all token-holders the right to make decisions.

The Tezos team, however, failed to address questions raised by the community as to the viability and execution of this option, providing no definite answer.

A crucial mark for a successful ICO is a clear plan that the team can justify and defend when queries arise.

Fortunately, Bancor’s team members have displayed through their actions how focused and determined they are to achieve their plans.

One of the most pertinent lessons from the “year of the ICO” is the fact that things are not always what they purport to be. But when we take care to study the finer details, it’s possible to develop a clear perspective on the viability of a project.

The end of 2017 might very well have dampened the hype surrounding ICOs due to skepticism, disappointment, and investor fatigue, but the industry appears to be maturing with the likes of Bancor leading the way for successful models. 2018 might be the year during which investors learn to separate truth from fiction and make better investment decisions in this speculative space.

Below is an in-depth analysis of each company’s ICO and subsequent performance, or failure.

The Bancor ICO

Raised $153 million in less than 3 hours

The Bancor ICO went on record as being one of the most successful ever. It raised approximately $153 million in less than three hours and has been delivering on its promises, as is evidenced in this article about Bancor on Forbes.

What made the Bancor protocol unique is that it promised to make Smart Tokens as liquid as legal tender — this was achieved through a Smart Token standard that could bring all cryptocurrencies together and connect them in a decentralized liquidity framework. The network incorporates a built-in price calculation mechanism that greatly simplifies the purchase process.

This new model would eliminate the need for exchange sites or third parties for the conversion of currencies. Different currencies would thus be able to trade with each other quickly and tokens would be able to hold other tokens in reserve. This would create a relationship between different currencies and allow for direct transfers using smart contracts.

The best part is that unlike most blockchain technologies, Bancor could work for any currency, be it fiat or virtual. It would also work for physical assets of all kinds, such as precious metals.

Some of the most outstanding features of this innovative network included the fact that the model provides continuous liquidity. This is because all purchases and sales are executed using smart contracts which means that the smart contract token would always remain liquid regardless of trading volumes.

Additionally, transactions would not attract any fees. The only requirement for smart tokens is gas, and this is usually pretty low. No token is discriminated against by this model; Bancor Smart Tokens are able to improve liquidity even for the lightest and smallest currencies available.

Pricing on the model would be achieved using algorithms, which means that both purchasing and liquidating would cost the same. There would be no spread. The use of smart tokens would also allow for the pre-calculations of expected slippage before transactions are executed.

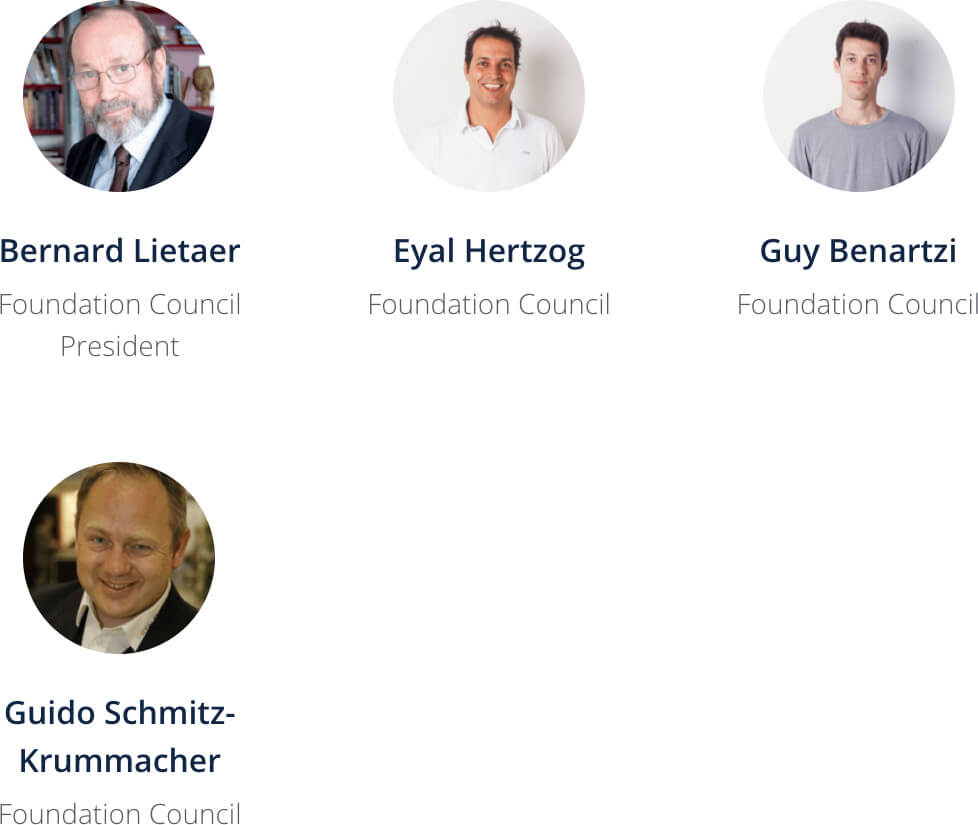

Exceptional team members

One of the primary drivers that attracted potential investors to the Bancor ICO was the Bancor team. They brought together more than 20 years of cumulative experience and had a strong network of advisers surrounding them.

One of the primary drivers that attracted potential investors to the Bancor ICO was the Bancor team. They brought together more than 20 years of cumulative experience and had a strong network of advisers surrounding them.

This was quite different from most other models and gave a reason for optimism right from the onset.

Six months on and the Bancor team is still on the right track, making strides towards their ultimate objective. In that brief time span, more than 50 different token projects have committed to come onboard to take advantage of the unique proposal in the network. There are many big blockchain names like SENSE, WAX token, Power Ledger and more that have integrated and are now working with Bancor Protocol.

Over 320 of the integrated token partners in the project have already made their tokens active. Users of the platform can make use of a variety of wallets, from the network’s own Bancor web wallet to Parity, Mist, and MetaMask, among others.

This means that it is now possible to execute live conversions on the Bancor blockchain using the network’s web app. These tokens include the native BNT (Bancor Network Token), ETH, WISHh, GNO IQT, STX, IND, and BMC. More than $20 million has already been converted using the network’s smart contract function. The total value of BNT exchanged to date is approximately $532 million.

Triumphant Bancor bounty program

The Bancor bounty program is yet another success story from this network. Contributors to the project have so far received more than 462,000 BNT through the reward system. The number of people who have already benefited is more than 6,400, and its success has led to the announcement of a further $1 million worth of tokens to be distributed throughout 2018.

Expansion and further improvements for 2018

Bancor has a full schedule planned for 2018. One of the most immediate objectives of the network is to plan for expansion in order to accommodate the expected inflow of new tokens. The model will, therefore, focus on scaling initiatives and work on integrating these new currencies. This will help more users to enjoy the benefits of easy token exchange, automated pricing calculations, and low fees — or none at all.

Additionally, the network is also placing cross-blockchain support on its priority list. This will allow new users and developers to build their own tokens on the platform and launch them effectively.

Bancor is investigating the integration of features that allow the purchase of tokens using credit cards, as well as the possibility of a P2P online marketplace sometime in the near future. You can also expect to see more currencies like BTC, LTC, XRP and others available for conversion on the Bancor network. Long-term goals include creating native open -source apps for iOS and Android.

Filecoin

Filecoin

Biggest ICO ever

Filecoin holds the top position for the biggest completed ICO ever, having raised $257 million between August and September last year. This came after the company had already raised $52 million from a number of venture capital firms.

Adherence to new SEC rules

Filecoin’s vision was to build a cloud storage network on a decentralized blockchain network. This would use the InterPlanetary File System (IPFS) to create a P2P record of data. Unlike most other models, it adhered to the new SEC rules governing crowdfunding events which only allow accredited investors to participate in the token sales.

This was one of the primary reasons for the massive success of the ICO. It has been successful thus far, with reports showing the project slowly materializing.

The project already has “tens of thousands” of miners and early storage users at the moment. The team is working on getting developers on board as well. The IPFS protocol is taking shape as it is already serving large numbers of users and various applications. There is still a lot of work to be done on the project, but development thus far is extremely promising.

BitConnect

BitConnect

$2.6 billion market capitalization

The BitConnect ICO has made headlines for all the wrong reasons. The company made a grand entrance into the cryptocurrency industry with a successful ICO towards the end of December 2016. It quickly rose to become one of the best performers on CoinMarketCap with a market capitalization of more than $2.6 billion and topped the $400 mark in value.

Ponzi scheme

BitConnect’s model, however, raised a lot of eyebrows leading some to label it a Ponzi scheme. Investors were guaranteed earnings of as much as 40% every month, operating on four tiers based on investors’ initial deposits. In addition to this, BitConnect promised a 1% ROI every single day. This is what led many to term the project unsustainable. It used affiliate marketers to capture in more and more investors, in the likeness of a pyramid scheme. This drew in supporters in large numbers and the coin grew to the top 20 crypto tokens based on market share.

Cease and desist letter

Its rapid momentum soon attracted the attention of authorities, resulting in an investigation in November last year by the British Registrar of Companies. Media speculation ensued, with many news outlets predicting an impending shutdown.

BitConnect tried to downplay the matter, calling media reports “fake news”. Shortly after the investigation, the platform received a cease and desist letter from the Texas Securities Board ordering BitConnect to shut down and stop BitConnect token (BCC) distribution until it clarified its position.

Another cease and desist letter followed fast from North Carolina Securities Board. Sweeping matters under the rug was no longer going to work and after an extended server downtime period, the company announced its intention to shut down its platform. The BitConnect instantly plummeted in value by about 96%. In a surprising turn of events, there is a new ICO on the horizon related to the original platform, going under the name “BitConnectX”.

Tezos

Tezos

Second biggest ICO

The Tezos ICO project took place in July 2017 and raised $232 million in total. This placed it on record as being the second biggest ICO ever on record.

The concept behind the project was the development of a distributed ledger that self-amends and allows for easy generation of smart contracts. Token holders on this network would have the privilege of approving and funding updates to the system. This was highly appealing as it met the decentralization standard of the ideal blockchain platform.

Legal crisis

However, six months in, the project’s founders are still in a legal crisis due to a dispute between them and the foundation holding the funds raised through the ICO. At the moment, two lawsuits are pending in court and severe in-fighting among the project’s principals. It is quite unfortunate as that this would have been one of the most rewarding projects for investors.

Back in July when the ICO took place, the value of BTC was only $2,000 and ETH was worth a little over $200. Current values would have meant a sizeable net fortune for all who had faith in this project.

Farside Investors

Farside Investors

CoinGlass

CoinGlass