Op-ed: Binance’s reputation at risk as CFTC allegations raise concerns

Op-ed: Binance’s reputation at risk as CFTC allegations raise concerns Op-ed: Binance’s reputation at risk as CFTC allegations raise concerns

Trust is essential in the cryptocurrency market, and if Binance is seen as a bad actor that trades against its users, it could result in a loss of confidence from its clients and investors.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The following is a guest post from web3 investor Anndy Lian.

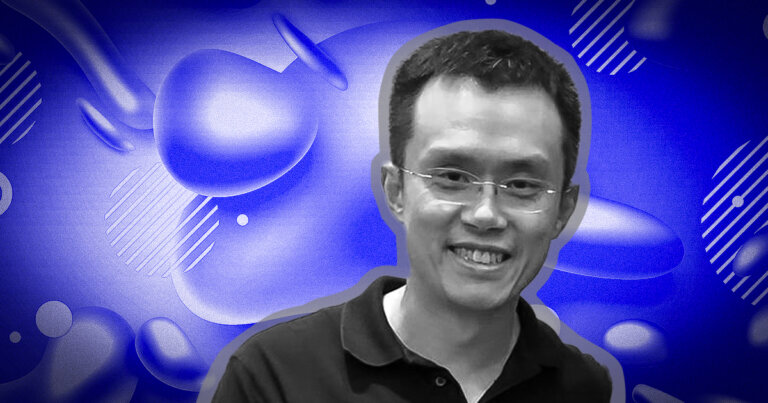

The U.S. Commodity Futures Trading Commission (CFTC) has sued Binance, the world’s largest cryptocurrency exchange, and its CEO, Changpeng Zhao (CZ), for allegedly violating federal law by allowing Americans to trade crypto derivatives on its platform.

The CFTC has been investigating Binance since 2021 on allegations that the exchange allowed U.S. residents to use its platform to buy and sell crypto derivatives, which require registration with the CFTC under current laws. The lawsuit alleges that Binance solicited U.S. users for millions in revenue, violating federal law. CFTC has also sued Binance for operating without being registered with the agency and without proper know-your-customer procedures.

The lawsuit also claims that Binance traded against its customers, taking advantage of inside information and manipulating markets to increase profits. Additionally, Binance’s former chief compliance officer, Samuel Lim, was charged with aiding and abetting the company’s violations. This is a severe breach of trust if this is true. The accusation of Binance trading against its users is particularly troubling. If true, this would be a betrayal of trust and a violation of the principles of fair trading.

Impact on Binance

As a cryptocurrency exchange, Binance should be a neutral platform that facilitates trading between buyers and sellers, not one that takes advantage of its users. If found guilty by the CFTC, it could face significant penalties and consequences. The CFTC can impose fines, seek injunctions, and even ban individuals or companies from participating in commodity markets. Binance could also face civil lawsuits from affected users or investors.

Additionally, Binance’s reputation could be severely impacted if found guilty of the CFTC’s charges. Trust is essential in the cryptocurrency market, and if Binance is seen as a bad actor that trades against its users, it could result in a loss of confidence from its clients and investors. It could affect Binance’s ability to operate in the U.S. and other regulated markets, limiting its growth potential.

Impact on industry

From a broader perspective, it could harm the entire cryptocurrency industry. Binance is currently the world’s largest cryptocurrency exchange and plays a significant role in the market. A loss of confidence in Binance could lead to a decrease in overall market trust and investment. It could increase regulatory scrutiny and stricter regulations for other cryptocurrency exchanges.

Rostin Behnam, CFTC Chairman, said in a statement:

“For years, Binance knew they were violating CFTC rules, working actively to both keep the money flowing and avoid compliance. This should be a warning to anyone in the digital asset world that the CFTC will not tolerate willful avoidance of U.S. law,”

If I am not wrong, this is the first time CFTC has gone against a crypto exchange. The allegations by the CFTC are not to be taken lightly, and Binance should address them with transparency and accountability. It is vital to remember that these are allegations, and Binance has not been found guilty of wrongdoing.

Therefore, we should reserve judgment until all the facts have been presented in court. The consequences of being found guilty by the CFTC could be severe for Binance and its operations. It remains to be seen what the outcome of the lawsuit will be, and Binance has denied any wrongdoing and vowed to fight the charges.

It is also important to note that Binance has been scrutinized by various regulators worldwide. This is not the first time the exchange has faced accusations of regulatory violations. This raises concerns about the exchange’s compliance procedures and willingness to follow regulatory requirements.

Binance has responded to the lawsuit, stating that its priority is to continue protecting its users while working with regulators to ensure compliance. Binance has denied the allegations, stating that they have always complied with U.S. regulations and that the CFTC’s claims are without merit.

CZ had also publicly clarified on his blog:

“We are collaborative with regulators and government agencies worldwide. While we are not perfect, we hold ourselves to a high standard, often higher than what existing regulations require. And above all, we believe in doing the right thing by our users at all times. In this journey towards freedom of money, we do not expect everything to be easy. We do not shy away from challenges.”

It remains to be seen how the case will play out. Still, the CFTC is taking a strong stance on regulating cryptocurrency trading — companies like Binance must ensure they comply with all relevant laws and regulations to avoid similar legal action in the future.

The outcome of the lawsuit remains to be seen, but companies like Binance must comply with all relevant laws and regulations to avoid similar legal action in the future. Ultimately, the importance of regulatory compliance and transparency cannot be overstated. Binance’s ability to clear its name and move forward in a transparent and accountable manner will be crucial for the entire industry’s health and growth.

CoinGlass

CoinGlass

Farside Investors

Farside Investors