Bitcoin ‘Fear and Greed Index’ reaches early pandemic levels of 2020

Bitcoin ‘Fear and Greed Index’ reaches early pandemic levels of 2020 Bitcoin ‘Fear and Greed Index’ reaches early pandemic levels of 2020

The crypto market has reached the fear level not seen since last April.

Photo by Benjamin Wedemeyer on Unsplash

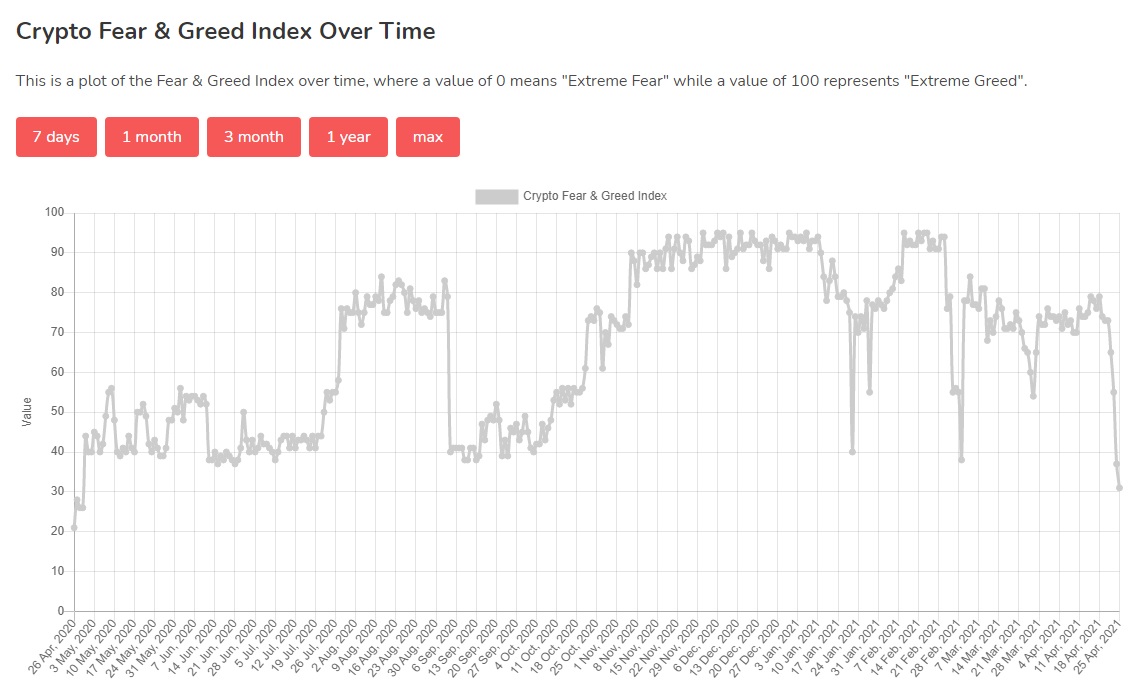

The “Crypto Fear and Greed Index,” a collective metric that measures current sentiments on the cryptocurrency market, swiftly swung from “Extreme Greed” (79 points) last week to “Fear” (31) today as most digital assets continue to wallow in the red zone.

Today's Cryptocurrency Fear And Greed Index: 31

Ranking: Fear#Crypto #Bitcoin #Ethereum

— Crypto Fear And Greed Bot (@FearAndGreedBot) April 25, 2021

The index takes into account various aspects such as volatility, the market’s momentum and trading volumes, social media sentiments, trends, and so on. The metric scales from 0 (maximum “Fear”) to 100 (ultimate “Greed”).

Essentially, the “Crypto Fear and Greed Index” reflects the attitude of the majority of crypto enthusiasts. When it goes into the “Fear” territory, this means that prices of digital assets are likely going down and users are selling their crypto en masse.

Similarly, a high “Greed” usually accompanies strong price rallies as demand for crypto outweighs supply, propelling its value up. While not conclusive in any sense, the index can nonetheless help traders to navigate the treacherous waters of cryptocurrency markets.

Biden’s tax scare

The latest fear cycle on the crypto market was caused by the ongoing price decline across the board following rumors about potential tax law amendments in the U.S. As CryptoSlate reported, sources close to the Biden administration reported on Thursday that policymakers are planning to increase taxes for wealthy investors to as much as 43.5% for gains above $1 million.

This resulted in massive sell-offs across stocks and commodity markets, followed by digital assets as well. At press time, most cryptocurrencies are still trading in the red zone. However, the market has somewhat stabilized over the past couple of days as Bitcoin hovers around $50,000 (down from about $57,500 on Monday).

Sunday Survey:

Where will #Bitcoin bottom before we see the ATH again?

— Jimmy Song (송재준) (@jimmysong) April 25, 2021

Meanwhile, according to the “Crypto Fear and Greed Index” website, such levels of fear around 30 points have not been seen since April 2020—soon after Bitcoin plunged to $5,000 from $10,000 amid the coronavirus outbreak.

Further fueling the panic, Scott Minerd, chief investment officer at Guggenheim Partners, said oт Friday that Bitcoin could see a 50% drop in the near term because it ran “too far, too fast.”

“I think we could pull back to $20,000 to $30,000 on Bitcoin, which would be a 50% decline, but the interesting thing about Bitcoin is we’ve seen these kinds of declines before,” Minerd explained, adding that this would be “the normal evolution in what is a longer-term bull market.”

Bitcoin Market Data

At the time of press 7:30 am UTC on Apr. 26, 2021, Bitcoin is ranked #1 by market cap and the price is up 5.58% over the past 24 hours. Bitcoin has a market capitalization of $984.68 billion with a 24-hour trading volume of $57.65 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 7:30 am UTC on Apr. 26, 2021, the total crypto market is valued at at $1.97 trillion with a 24-hour volume of $159.85 billion. Bitcoin dominance is currently at 50.09%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass