This crypto research firm’s new metric calculates “genuine” volume to tackle wash trading on Bitcoin and other digital assets

This crypto research firm’s new metric calculates “genuine” volume to tackle wash trading on Bitcoin and other digital assets This crypto research firm’s new metric calculates “genuine” volume to tackle wash trading on Bitcoin and other digital assets

Photo by Nathan Dumlao on Unsplash

Cryptocurrency markets are like none other — high leverage, massive volatility, and the introduction of products like options, swaps, and perpetual futures make the market ripe for traders looking to make quick profits.

But one metric has continually stuck out as a moot point, attracting questions from both critics and seasoned investors. In question here are exchange volumes and alleged wash trading on crypto exchanges, which some traders outright distrust.

Coinpaprika’s volume solution

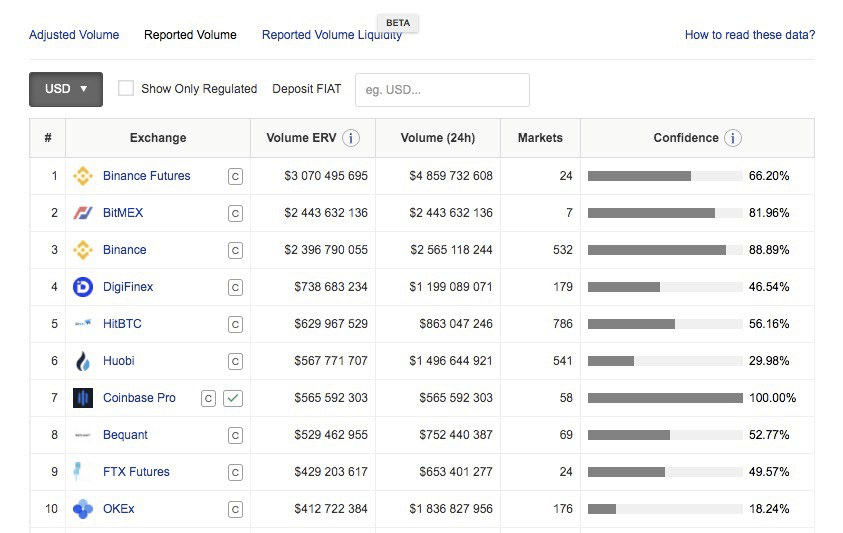

Tackling this issue is Coinpaprika, a research and markets analytics firm based in Poznan, Poland. The firm’s newly introduced metric, termed the Estimated Real Volume (ERV), uses previously-used data to present a realistic picture of trading volumes.

As told to CryptoSlate, the firm touts using “in-house” algorithms based on market liquidity to estimate “real” volumes. Coinpaprika hopes to stamp out “wash-trading” activity, and “preserve only legitimate volume.”

Coinpaprika says the feature will be rolled out to over 200 exchanges at launch, with more in the pipeline if they “have appropriate working API endpoints.”

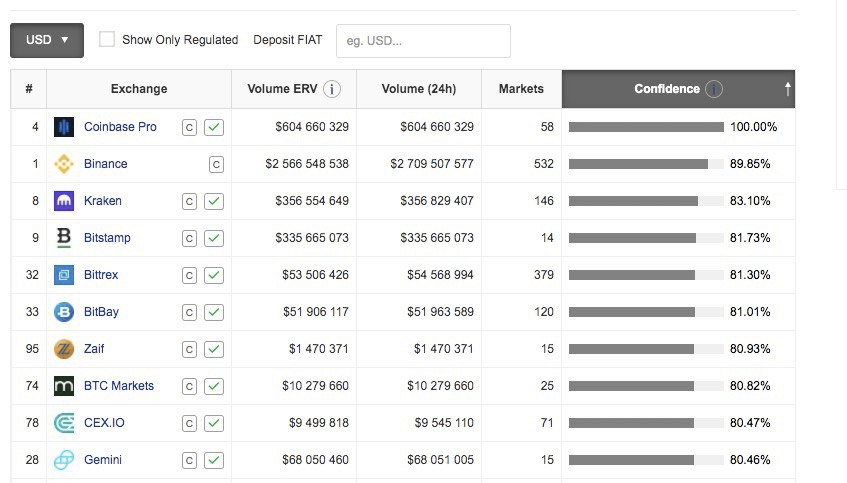

Another algorithm, the Confidence Score, evaluates exchanges on three parameters: liquidity with a 75 percentage weightage, web traffic with a 20 percent weightage, and “regulations” taking up the remaining 5 percent.

All values are then calculated into a “proper score.” Coinpaprika notes the ERV only eliminates wash-trading volumes, while the Confidence Score is a “holistic approach.” The latter provides data on web traffic and regulations, meaning a more all-round insight for traders.

Coinpaprika told CryptoSlate:

“(We) have compared results from ERV vs. a company that developed sophisticated algorithm detecting wash-trading using many more data endpoints (I don’t think I should mention the name, but they are liquidity providers – it’s very important for them to make a market on real volume exchanges)”

Battling wash-trading

The firm stated volumes calculated by the unnamed player on major exchanges, like OKEx, Binance, and Kraken showed a 100 percent agreement with Coinpaprika’s metrics. However, for “small and medium-sized exchanges,” the accuracy varied from 85 percent to 90 percent.

But the results are promising. Both Coinpaprika and the unnamed firm depend on providing wash-trading-free data, with the latter even running a proprietary trading unit based on the results.

Meanwhile, wash-trading remains a huge concern on crypto exchanges, even attracting coverage from mainstream media on the topic.

How can one believe ANY of these figures when 95 percent of all bitcoin transactions on a typical exchange are fake? Fake-coins, shit-coins, fake-transactions, fake-pricing. The only true thing in crypto space is manipulation, pump n dump, front-running, wash trading, etc… https://t.co/i43cPwjFX2

— Nouriel Roubini (@Nouriel) June 26, 2019

Trading volumes on Bitcoin, Ether, and other altcoins cross over $500 million to even $1 billion every day, as per data on CoinMarketCap. However, fundamentally speaking, the crypto market is not very popular among retail traders or institutions; raising question the validity of billion-dollar reported volumes each day.

Last year, asset management firm Bitwise told the U.S. SEC that as much as 95 percent of daily volume in cryptocurrency markets was “fake.”