The Fed pumping the stock market might help Bitcoin, but not for the reason you expect

The Fed pumping the stock market might help Bitcoin, but not for the reason you expect The Fed pumping the stock market might help Bitcoin, but not for the reason you expect

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Despite cheering against central banks printing money and governments accumulating massive amounts of debt, these phenomena may be the very things that bolster Bitcoin’s price action in the months and years ahead.

Some people believe that a collapse of the current economic system would bolster assets like Bitcoin due to economic participants fleeing to “hard money,” but one analyst is now noting that there could be another reason why loose monetary policy provides BTC with a boost.

His analysis is primarily rooted in Bitcoin’s close correlation to the stock market, noting that the injection of freshly printed money into equities could create a tailwind that drives Bitcoin higher.

Bitcoin forms close correlation to S&P 500 as global uncertainty abounds

Throughout the past couple of months, Bitcoin has formed an incredibly close correlation to the global markets, with traders and investors generally treating it as a fully risk-on asset in the time following its decline from highs of $10,500 in late-February.

This decline came about in close tandem to that seen by the U.S. equities market, which plunged as investors began to grow aware of the implications of the rapidly spreading Coronavirus on the global economy.

Surprisingly, the market has been able to hold up relatively well with all things considered, as the S&P 500 is trading down under 15 percent from its yearly open while Bitcoin is trading down by a mere 4 percent.

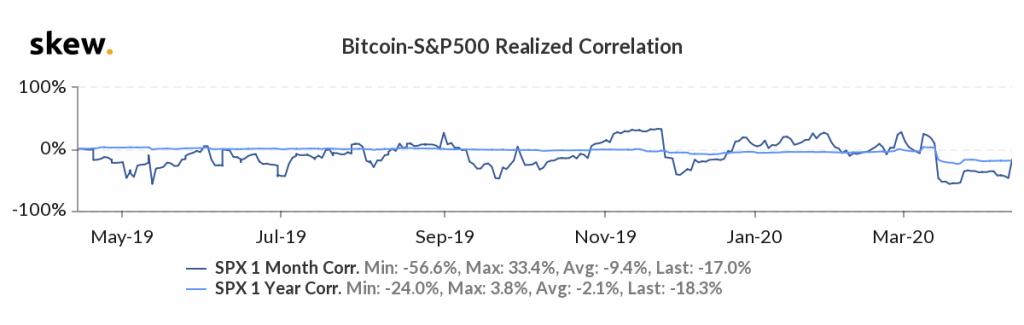

According to information from research and data platform Skew, Bitcoin and the S&P 500 have seen a close realized correlation to one another throughout the past couple of months, with this correlation growing incredibly tight throughout April.

Here’s why BTC’s correlation to the S&P 500 may boost its price

Because the Fed has been taking unprecedented actions to try to curb the economic impacts of the ongoing pandemic, the stock market has been boosted by massive monetary injections in the form of quantitative easing, repo operations, and more.

Josh Rager, a popular cryptocurrency analyst, explained that these monetary policies are likely to strengthen Bitcoin, apropos to the stock market climbing higher.

“If the FED continues to pump the stock market, Bitcoin will surely follow behind. Not going to counter trade the FED. Still think pullbacks will come but the market has been strong. This is a long game and will last for months to come. Trade the market you are given.”

As the pandemic continues to play out and the upcoming earnings season gives investors solid data into the depths of the economic impacts it has created, it will likely grow clearer as to whether or not Bitcoin will soon pump – or plummet – alongside the stock market.

Bitcoin Market Data

At the time of press 12:38 am UTC on Apr. 15, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.19% over the past 24 hours. Bitcoin has a market capitalization of $125.66 billion with a 24-hour trading volume of $34.21 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 12:38 am UTC on Apr. 15, 2020, the total crypto market is valued at at $195.89 billion with a 24-hour volume of $117.85 billion. Bitcoin dominance is currently at 64.16%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)