Slump of Y tokens: why Yearn.finance (YFI)’s momentum is weakening—for now

Slump of Y tokens: why Yearn.finance (YFI)’s momentum is weakening—for now Slump of Y tokens: why Yearn.finance (YFI)’s momentum is weakening—for now

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

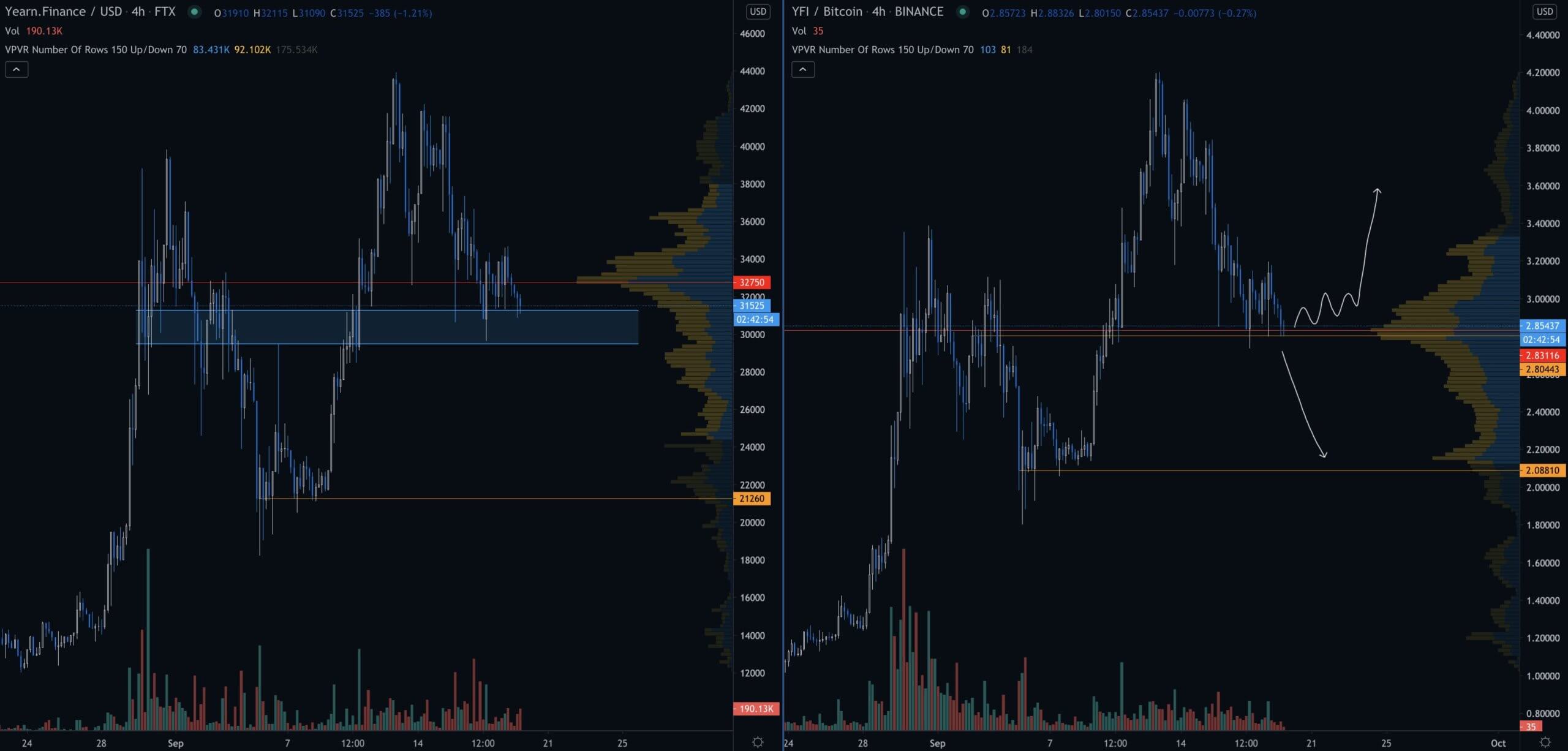

Since September 12, the price of Yearn.finance (YFI) dropped from $43,937 to as low as $26,222. YFI’s 40% decline within eight days caused other Y tokens and decentralized finance (DeFi) tokens to plummet.

DFI.Money (YFII), YFLink (YFL), YFValue (YFV), and other Y tokens dropped harder than YFI in the past two weeks.

DeFi market is taking a breather, what happens next to Yearn.finance?

The DeFi market is consolidating after months of seeing an explosive rally.

YFI, as an example, is down 40% since last week but has increased by 450% since mid-August.

As DeFi users and investors take profit from high yields sell various governance tokens, many DeFi tokens are pulling back.

Analysts say that the drop of YFI below the $31,525 support level leaves it vulnerable to a larger drop.

Nik Yaremchuk, an on-chain analyst, said:

“YFI is also included in the list of assets I watch, so I’ll periodically review Price Action. The analysis is quite simple, we’re consolidating here and continue to rise or fall to $20k.”

The $31,525 area was especially critical for YFI as it marked the 20-day moving average of the 1-day chart. Losing an MA on a high-time frame chart is considered short-term bearish in technical analysis.

While YFI could see weakness in the near term, investors say that its long-term prospect remains intact.

When asked about the longevity of “bluechip” DeFi tokens, Kelvin Koh at Spartan Group said it depends on three factors.

Koh, who operates a major Asia-based investment firm, pinpointed the mainstream users inflow, regulation, and market sentiment as key catalysts. He said:

“It depends on whether: 1. we get bubble conditions like in 2017; 2. DeFi can continue to innovate and build real products and bring in mainstream users; 3. Any regulatory headwinds. Given the subset of projects ATM, YFI would be considered a blue chip.”

YFI faces a larely technical pullback in the near term. But in the longer term, the pace of innovation and product launches of Yearn.finance remain optimistic.

Andre Cronje, the creator of YFI and the project’s lead developer, has continued to ship developments at a rapid rate.

For instance, Yearn.finance released the SyntheticRebaseDollar on September 17 as its latest product. It enables users to deposit a cryptocurrency, like Chainlink, that tracks its dollar value. The Yearn.finance team explained:

“Deposit $100 worth of LINK and you receive 100 srUSD. If the value of LINK increases by +50%, you will have 150 srUSD. There is no rebase trigger, this happens automatically every time the value of underlying collateral changes.”

The continuous introduction of new products and services on Yearn.finance would likely strengthen its survivability over the long run.

A whale accumulated around $1.3 million worth of YFI

On September 20, despite the sizable pullback of YFI, an unknown whale placed a 49 YFI buy order on Binance at $32,000.

The buy wall was eventually absorbed, and the whale purchased around $1.3 million worth of YFI.

49 #YFI (1,342,456 USD) transferred from #Binance to unknown wallet

— Whale Alert (@whale_alert) September 21, 2020

The accumulation of YFI by whales in spite of the correction across many DeFi tokens suggests some whales are confident in its long-term trajectory.